SA MPC Review: SARB Cuts Key Rate to 7.25% on May 29 Given Subdued Inflation

Bottom Line: South African Reserve Bank (SARB) reduced the policy rate to 7.25% during the MPC on May 29 highlighting that annual inflation remained below SARB’s target range of 3%-6% hitting 2.8% YoY in April coupled with eased core inflation in April and a stronger Rand. We think the recent withdrawal of the (inflationary) VAT increase and relief in global oil prices also encouraged SARB to continue easing cycle. SARB governor Kganyago said on May 29 that the inflation target should be dropped to 3%, rather than the 3% to 6% range as is currently the situation. SARB also revised its end-year inflation forecast for 2025 from 3.6% YoY to 3.2% YoY, and downgraded its expectation for 2025 economic growth to 1.2% YoY from 1.7% YoY. Our end-year key rate prediction remains 7.0% for 2025.

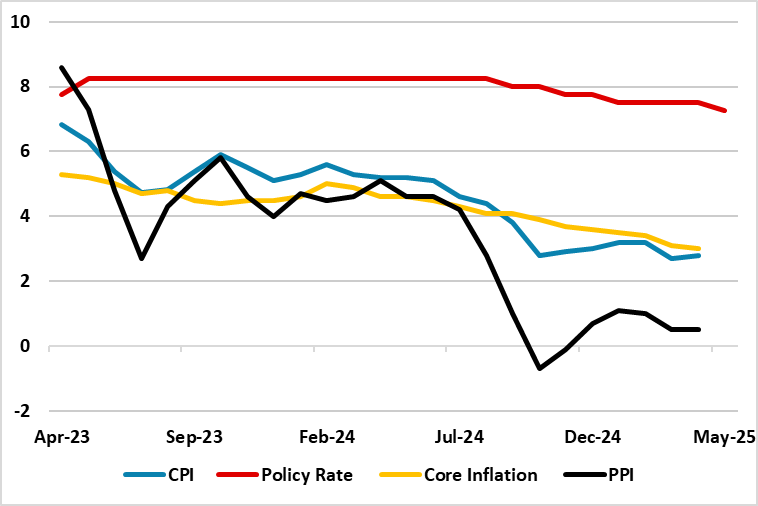

Figure 1: Policy Rate (%), CPI, PPI and Core Inflation (YoY, % Change), April 2023 – May 2025

Source: Continuum Economics

SARB’s MPC convened on May 29, and announced the third key rate decision of 2025 and continued its easing cycle after a break. SARB reduced the policy rate from 7.5% to 7.25% highlighting that annual inflation remained below SARB’s target range of 3%-6% hitting 2.8% YoY in April coupled with eased core inflation in April and a stronger Rand. We think the recent withdrawal of the (inflationary) VAT increase and relief in global oil prices also encouraged SARB to continue easing cycle.

SARB governor Kganyago indicated during the press conference that “Inflation target undershoot (2.8% YoY in April) reflects falling fuel costs, although underlying inflation is also well contained. Core inflation came in at 3% YoY, at the bottom of the target range.” Accordingly, SARB revised down its inflation forecasts, as confirmed by the governor that the MPC now considers a 3% scenario for inflation targeting more attractive than the 4.5% baseline, which will be objective at future meetings. Kganyago added that “Our previous forecasts included VAT increases, which have been cancelled.” (Note: National Treasury issued a press statement on April 24 indicating that the proposed 1% increase in VAT over the next two years will not be implemented as the Minister of Finance withdrew Budget 2.0). SARB also revised its end-year inflation forecast for 2025 from 3.6% YoY to 3.2% YoY. The SARB signaled that it expects that a stronger rand and lower world oil prices will offset pressure on fuel costs from the higher fuel levy announced in National Budget 3.0.

In addition to this, SARB decided to downgrade its GDP growth forecast for 2025 from 1.7% YoY to 1.2% YoY, which is lower than Finance Minister Godongwana’s anticipated 1.4% YoY, which he made earlier this month during the third iteration of the National Budget.

Despite positive developments mentioned above, we think there are still some upside risks to the inflation. First, the return of the power cuts (loadshedding) could ignite inflation in the upcoming months. Eskom announced on May 13 that Stage 2 loadshedding would be implemented following a Stage 2 loadshedding on April 24, which suggested serious issues. Energy experts warn that the recent power cuts reminded that rolling blackouts are still a threat. Additionally, unexpected global outlook could pressurize South Africa linked with increasing global trade risks following the additional tariff decisions by the Trump administration, which could be critical if the U.S. implements tariffs on imports from South Africa following the 90-day pause.

We think new inflation rate target could likely mean fewer rate cuts in the future. Our end year prediction remains 7.0% for 2025.