SARB MPC Review: Fall in Inflation Sparked Easing Cycle to Continue on November 21

Bottom line: South African Reserve Bank (SARB) cut the key rate by 25 bps to 7.75% at its final meeting of the year on November 21 given power cuts (loadshedding) are suspended, inflation expectations decelerated, and CPI softened further to 2.8% YoY in October due to falling fuel prices and slowing food prices. We expect data driven and cautious SARB to continue its easing cycle in 2025 considering lower inflation, more positive sentiment on the country and its credit rating, while the regulator will have to closely follow riskier global economic environment with a possibility of weaker ZAR and higher oil prices.

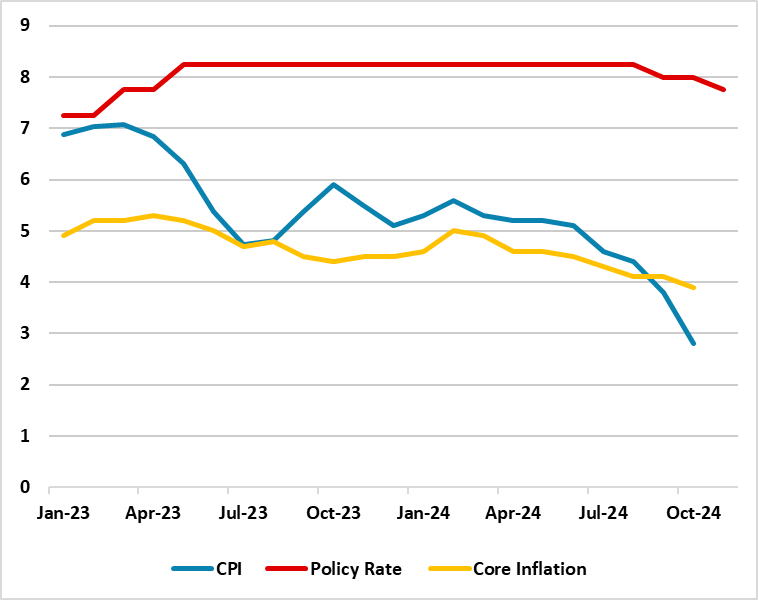

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2023 – November 2024

Source: Continuum Economics

After SARB announced its interest-rate decision on September 19 and cut the policy rate by 25 bps from 8.25% to 8.0% for the first time since its Covid-19 response over four years ago, SARB continued its easing cycle by reducing the policy rate by 25 bps to 7.75% at its final meeting of the year on November 21 amid muted growth and price pressures. We think recent fall in inflation, coupled with suspended power cuts and deceleration in inflation expectations in Q3 have relieved SARB.

After inflation decreased to 3.8% YoY in September, the downward trend continued fast in October and CPI hit 2.8% YoY due to falling fuel prices and slowing food prices. "Petrol and diesel prices declined by 5.3% between September and October," said Statistics South Africa. October's reading was the lowest inflation has been since June 2020. On a monthly basis, consumer prices decreased by 0.1% in October, and annual core inflation cooled off to 3.9% after September’s 4.1% which marked the lowest reading since May 2022.

On the power cuts front, South Africa’s national electricity utility company, Eskom, announced on November 15 that load shedding remained suspended for 233 consecutive days, reflecting structural generation improvements and new investments. Eskom also highlighted that investments in the generation recovery plan continue to pay off, driving efficiencies and supporting economic growth as diesel savings reached 15.6 billion ZAR YoY.

The inflation expectations continued to decline in Q3, as shown by the BER’s latest survey released on September 12. The average inflation expectations of analysts, business people and trade unions demonstrated that they now expect headline inflation to be 5.1% this year, before subsiding to 4.8% in both 2025 and 2026. In Q2, they still expected consumer inflation to register 5.3% this year and fall to 4.9% in 2026. (Note: This was one of the key data points as SARB governor Kganyago repeatedly said the regulator is paying full attention to the inflation expectations).

Following the rate cut decision on November 21, Kganyago said “We continue to see headline inflation stabilising near our midpoint objective over the forecast horizon. In this context, we anticipate inflation expectations will moderate further,” he added. Speaking about the rate path in 2025, Kganyago underscored that “(…) decisions will continue to be outlook dependent, responsive to data developments, and sensitive to the balance of risks to the forecast.”

It is worth noting that SARB was likely relieved by the Fed and ECB’s rate cut decisions, as both banks continue their cutting cycles, loosen global financial conditions and potentially ease pressure on the ZAR. Despite continued DM easing cycles, the result of recent U.S. presidential elections caused ZAR to face a difficult time against a resurgent USD as investors ponder to what extent president Trump is likely deliver tariffs across the world. (Note: ZAR depreciated from 17.6 to 18.3 against the USD between November 1 and 15).

We expect data driven and cautious SARB to continue its easing cycle in 2025 as inflationary pressures seem to be currently under control. Despite positive developments such as lower inflation, more positive sentiment on the country and its credit rating, SARB will have to closely follow and pay attention to riskier global economic environment with the possibility of weaker ZAR and higher oil prices, which could change the outlook in 2025.