CBRT Continued to Keep Key Rate Stable at 50%

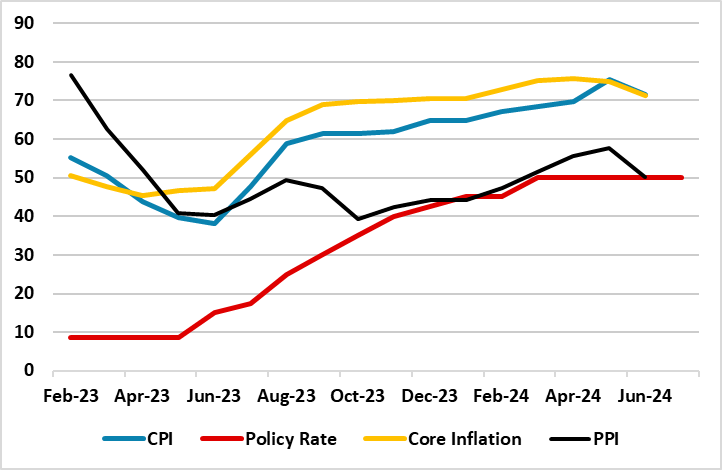

Bottom Line: As predictions were centred around no change, Central Bank of Turkiye (CBRT) kept the policy rate stable at 50% on July 23. CBRT said in a statement that tight monetary stance will be maintained until a significant and sustained decline in the underlying trend of monthly inflation is observed, and reiterated that it remains highly attentive to inflation risks. We expect a slight rise in the inflation in July due to adjustments in administered prices and taxes while a fall is envisaged after July particularly due to favourable base effects, lagged impacts of tightening cycle and additional quantitative steps. We foresee that the policy rate will be held unchanged at 50% in the next MPC meeting scheduled for August 20 as inflation continues to stay high.

Figure 1: CPI, PPI, Core Inflation (YoY, % Change) and Policy Rate (%), February 2023 – July 2024

Source: Continuum Economics

As expected, the CBRT decided to hold the key rate stable at 50% on July 23 MPC meeting taking into account that inflation remains the core economic problem.

According to the Bank’s assessment on July 23, stickiness in services inflation, inflation expectations, geopolitical risks, and food prices have kept inflationary pressures alive. MPC report highlighted that the domestic demand, albeit still at inflationary levels, continued to slow down. CBRT also announced that tight monetary stance will be maintained until a significant and sustained decline in the underlying trend of monthly inflation is observed while monetary policy stance will be tightened in case a significant and persistent deterioration in inflation is foreseen.

Concerning the course of inflation, CBRT highlighted that it expects a temporary rise in July due to adjustments in administered prices and taxes besides supply-side factors in unprocessed food prices. (Note: Turkiye’s CPI cooled to 71.6% annually and 1.6% monthly in June partly supported by the ease in energy and food prices in June compared to a month earlier).

Despite Minister of Labor Vedat Isikhan emphasized in June that there will not be an interim increase in the minimum monthly payments in July citing policy tightening and savings plans meant to curb soaring inflation, Turkish Grand National Assembly (TBMM) is now expected to implement a new proposal on income tax and raise the lowest pension to 12,500 TRY (USD 379) from 10,000 TRY, as the inflation continues to bite Turkish citizens. The same package of regulations will also raise the fee for the Turkish citizens traveling abroad must pay from 150 TRY to 500 TRY and includes new savings plans aiming to strengthen fair taxation, including a minimum corporate tax. (Note: The proposals are expected to be approved by TBMM on July 24 and presented to the Presidency for final approval).

Above mentioned spiral continues to be a major concern for Turkish government as the government remains stuck between choosing to hike the pensions and the salaries under soaring inflationary conditions or keeping them stable to help curb inflation.

According to a survey by the CBRT released on July 22, annual inflation rate is projected to drop to 42.95% by the end of 2024, down from the earlier estimate that stood at 43.52%. Our forecast for the annual average inflation is 58.8% and 35.3% in 2024 and 2025, respectively.

Taking into account that inflation readings could put pressure on CBRT to resume tightening cycle in the upcoming months, we foresee CBRT to hold the key rate constant at 50% through the end of 2024. Despite aggressive monetary tightening, we still think the road to bringing inflation back down to single-digit levels will be very bumpy, and the inflation getting there before 2027 remains very unlikely.