Bank of England

View:

August 20, 2025

UK CPI Review: Special Factors Pull Inflation Even Higher, but is that an Excuse?

August 20, 2025 6:47 AM UTC

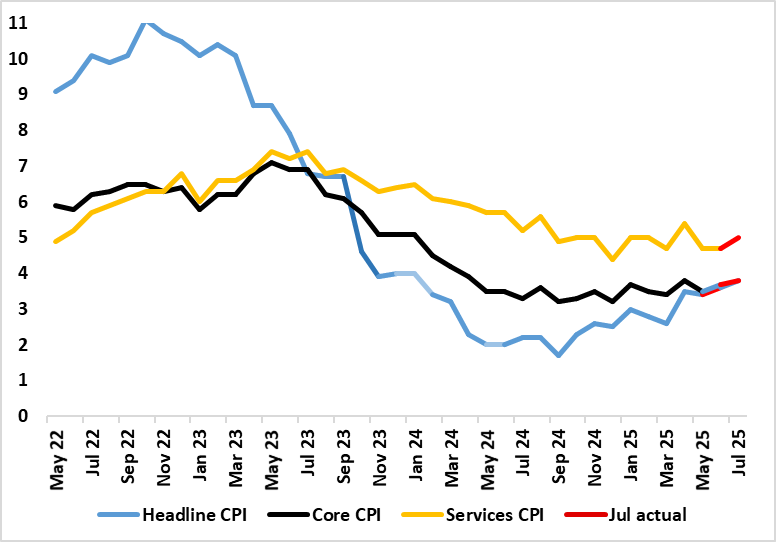

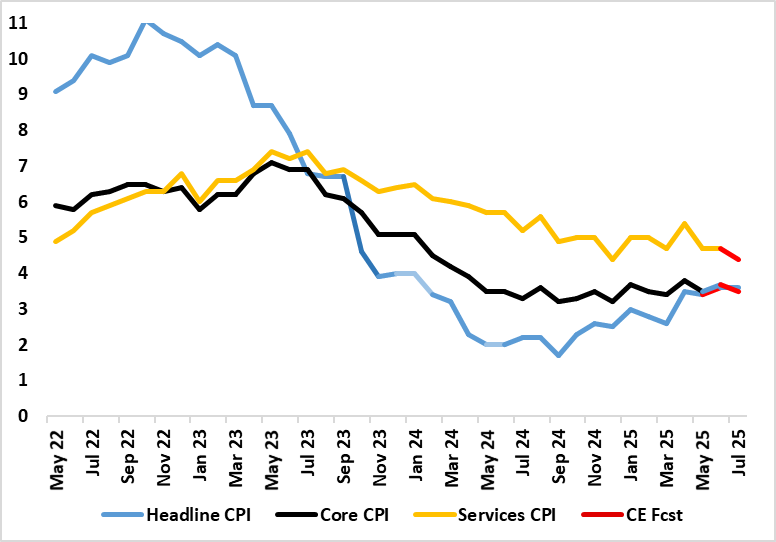

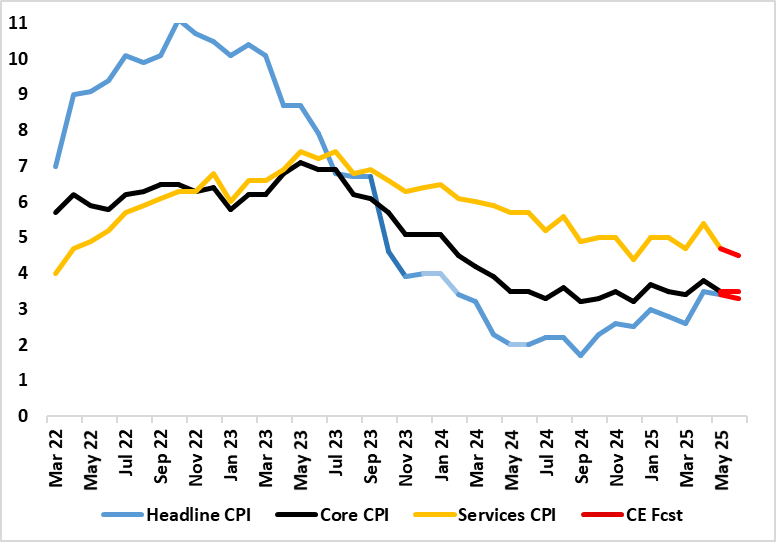

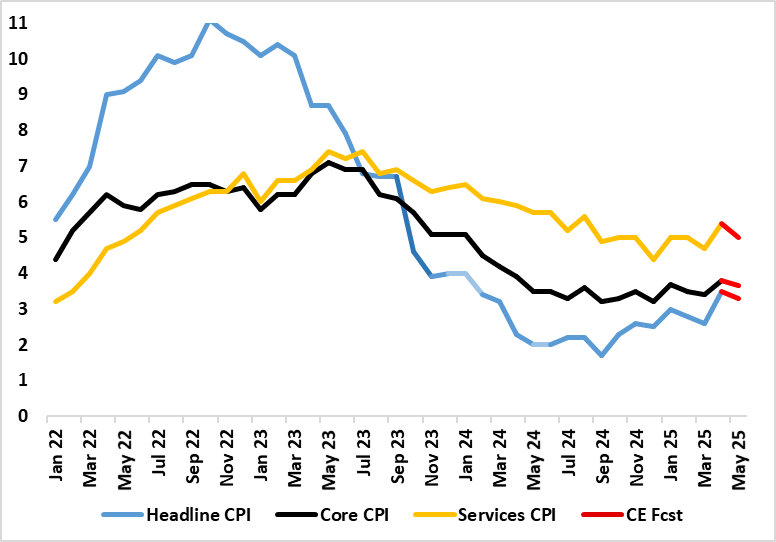

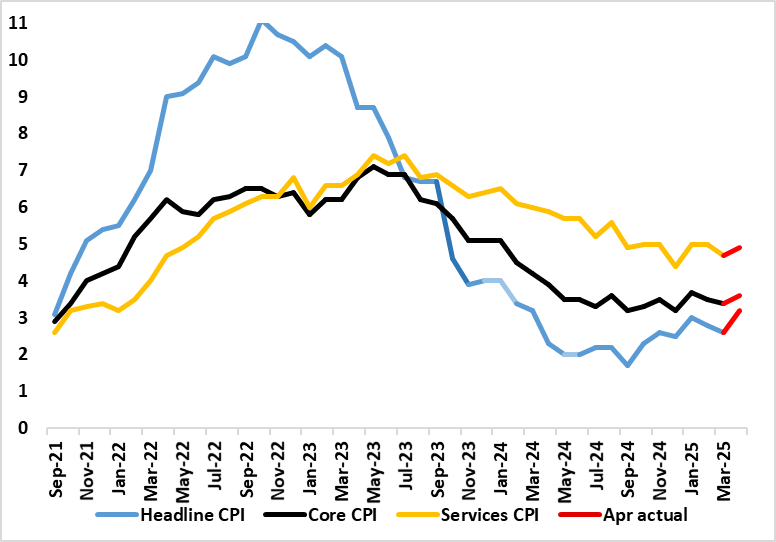

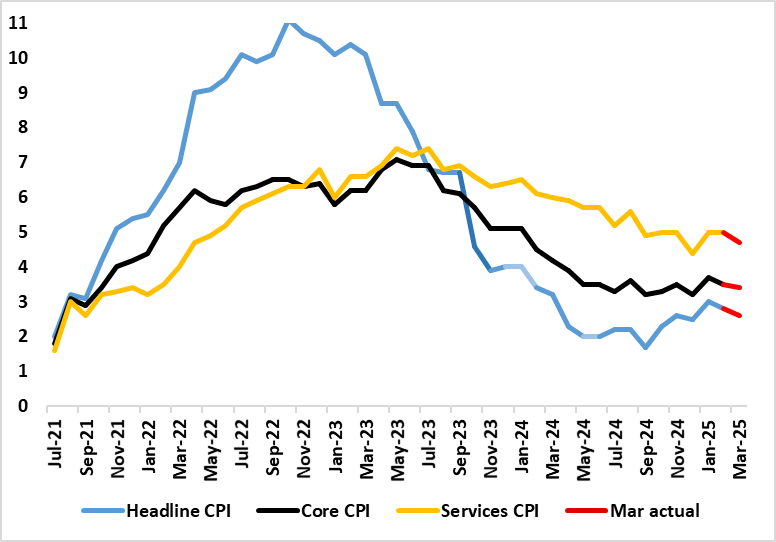

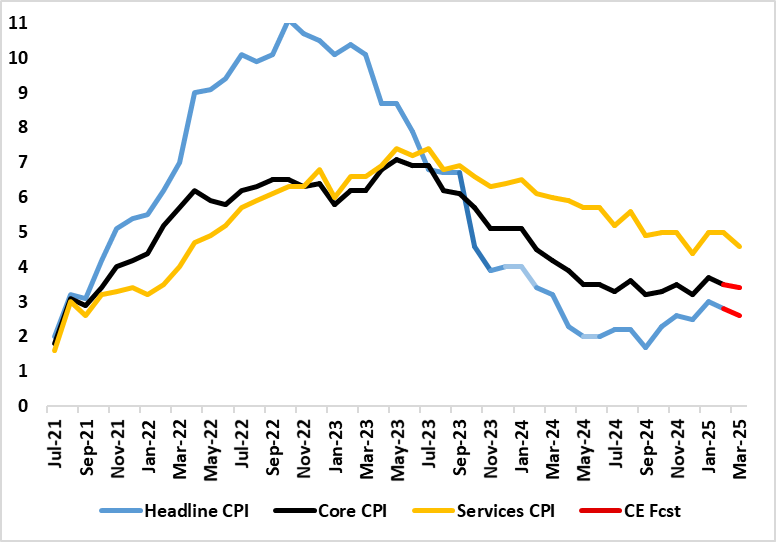

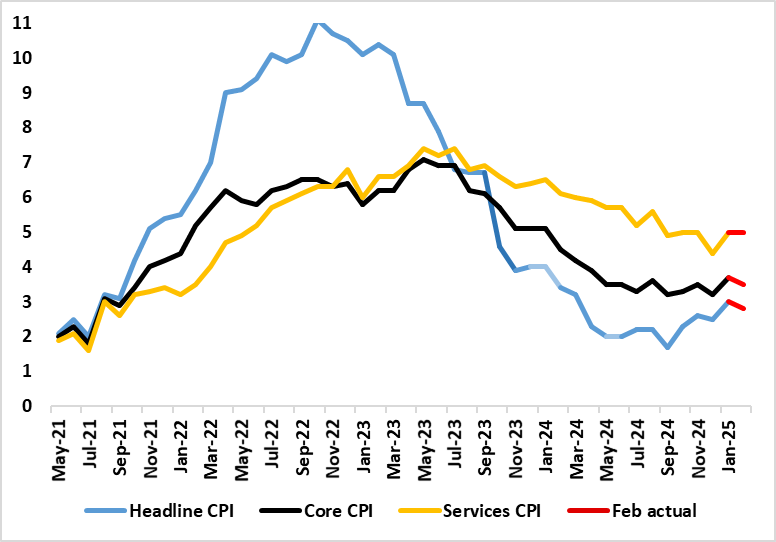

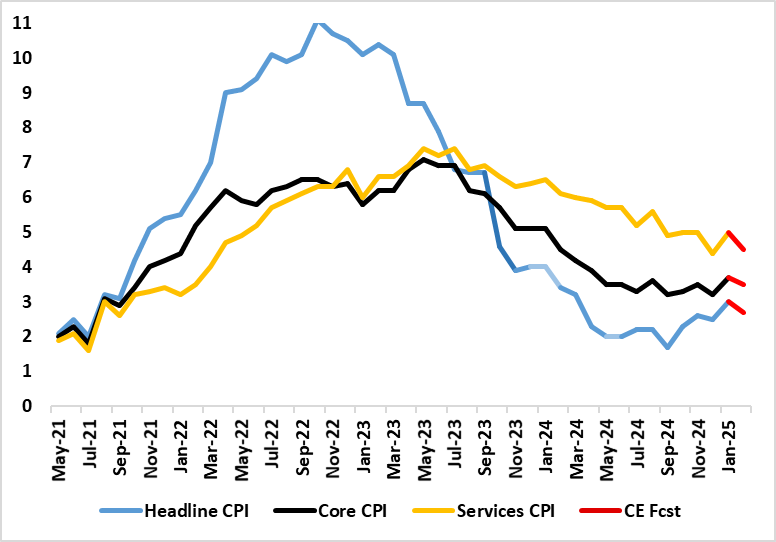

After the upside (and broad) June CPI surprise, CPI inflation rose further, up another 0.2 ppt to 3.8% in July, higher than the consensus but matching BoE thinking. And still the highest since January last year. The notable further 0.3 ppt rise in services inflation to 5.0% was also largely in lin

August 19, 2025

UK Labor Market: Is the BoE too Complacent?

August 19, 2025 10:10 AM UTC

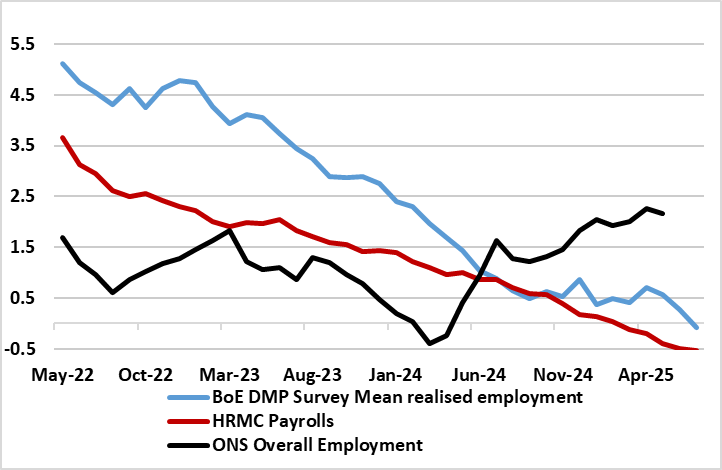

Unlike the Fed, which has dual mandate of curbing inflation and promoting employment, the BoE remit is purely the former. But it is clear that labour market considerations weigh heavily on the dovish contingent of the MPC and possibly increasingly so. However, we feel that the BOE is not fully e

August 14, 2025

UK GDP Review: Fresh Upside Growth Surprise But Partly Inventory Driven?

August 14, 2025 7:02 AM UTC

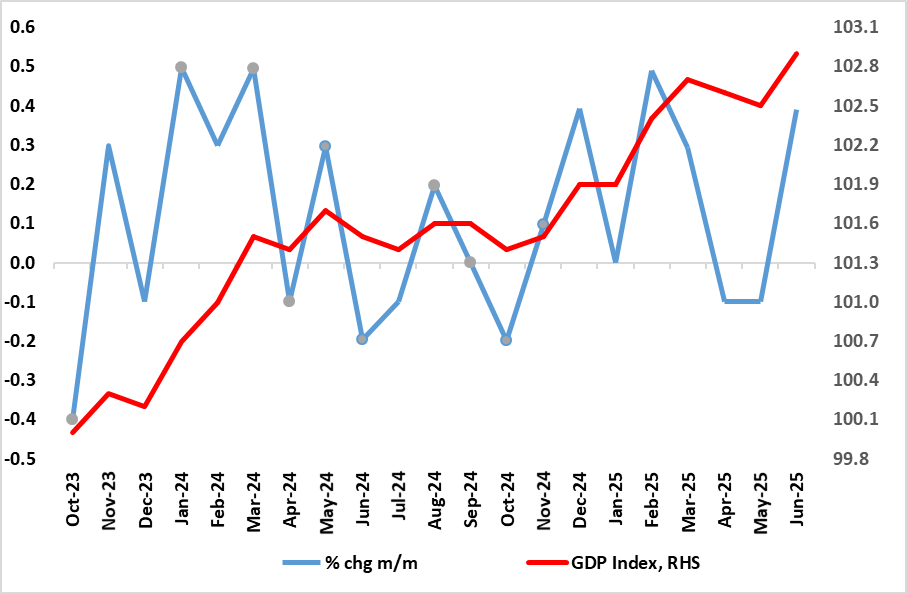

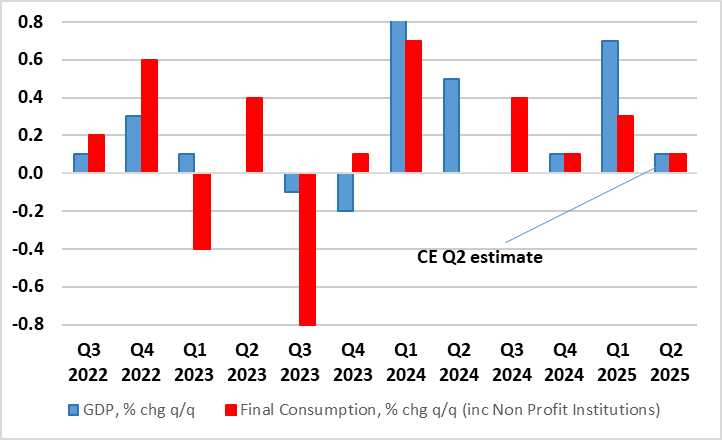

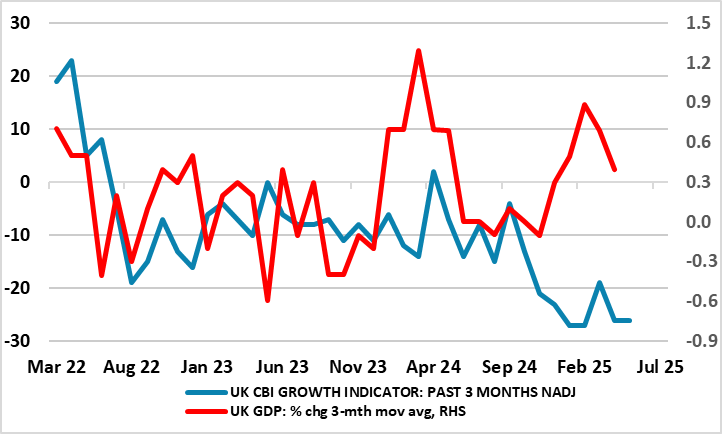

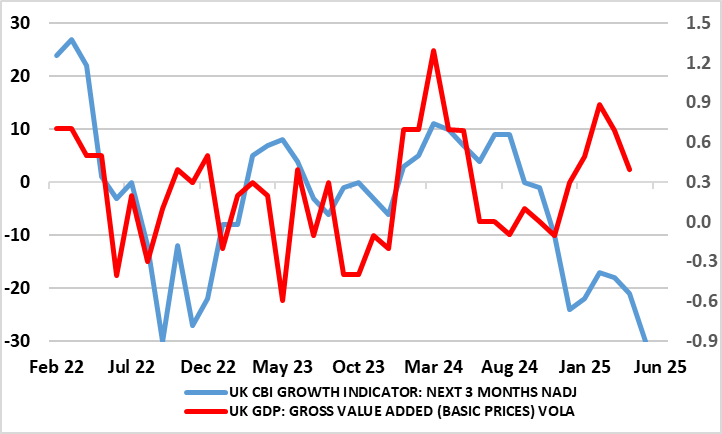

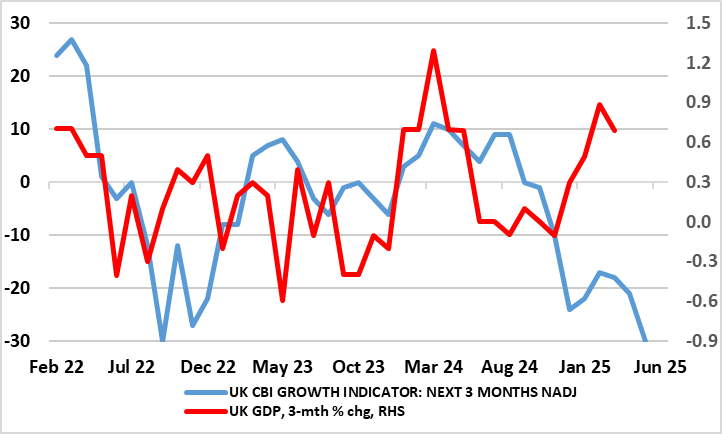

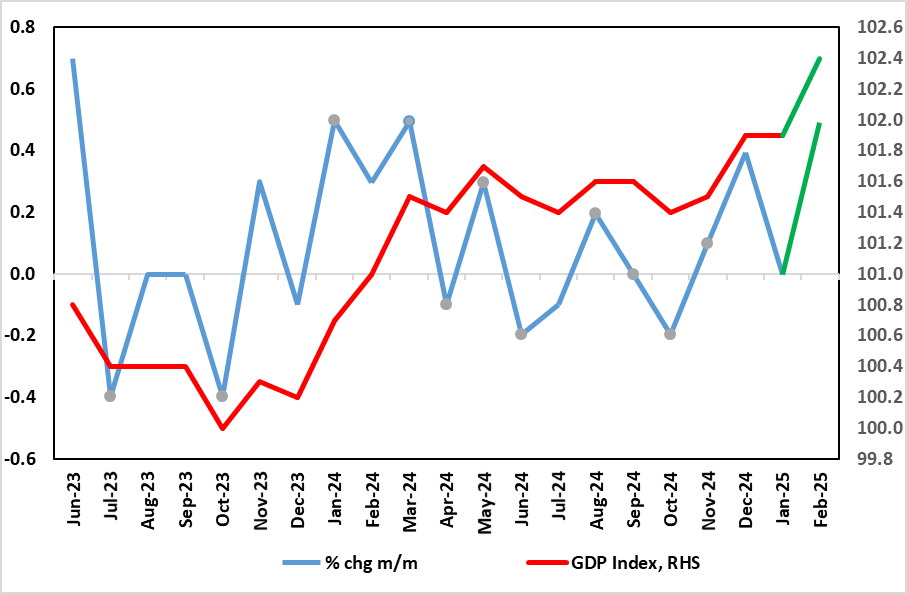

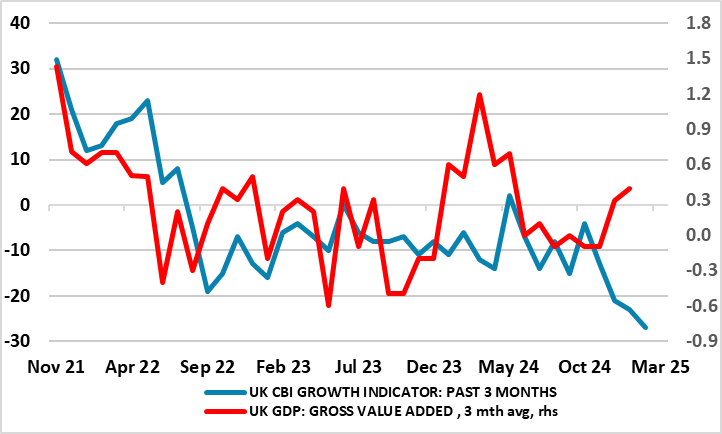

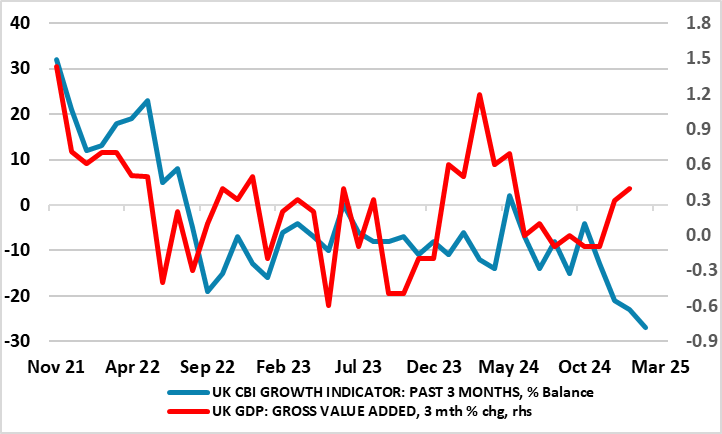

To what extent better in June GDP, not least it having been the warmest even such month in England, lay behind the fresh upside surprise that saw the economy grow 0.4%, twice generally expected and with the falls of the two previous months pared back so that a clearer uptrend has emerged (Figure 1).

August 11, 2025

UK CPI Preview (Aug 20): Services Inflation Fall Afresh r as Headline Stabilises?

August 11, 2025 2:24 PM UTC

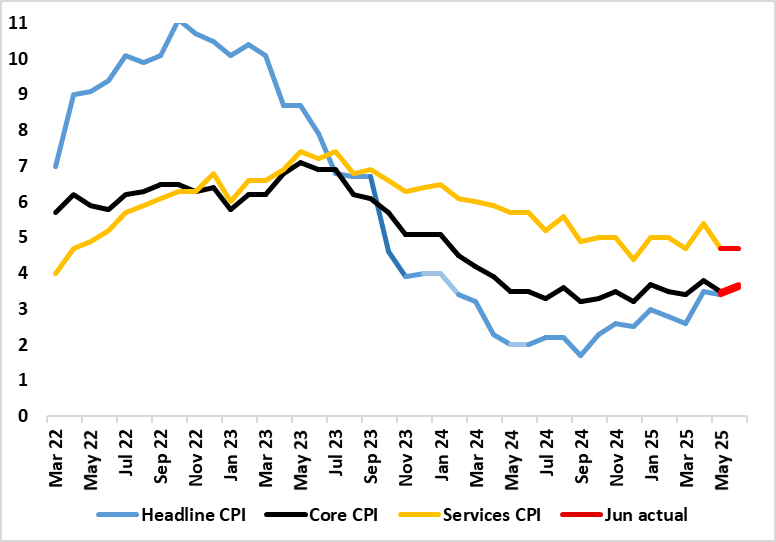

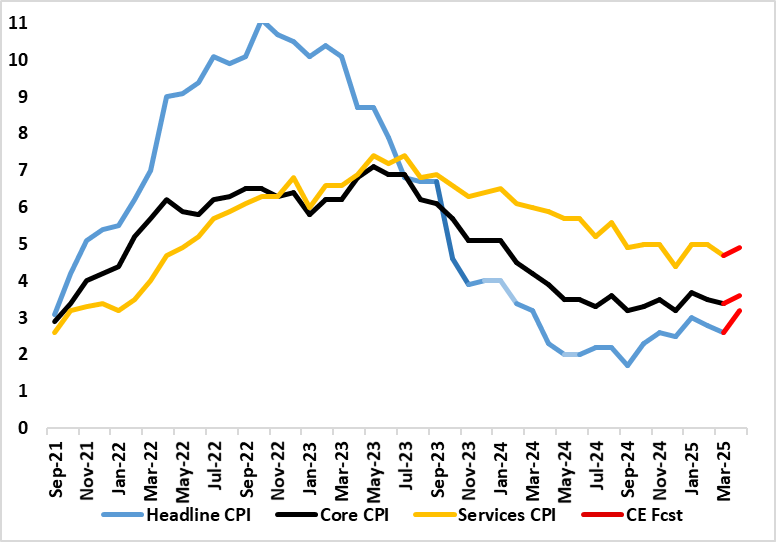

After the upside (and broad) June CPI surprise, we see CPI inflation steady at 3.6% in July, 0.2 ppt below BoE thinking. Our relatively lower estimate factors in lower services inflation (Figure 1) and a fall back in that for food, the former allowing the core rate to unwind the increase to 3.7% s

August 07, 2025

BoE Review: The (Fiscal) Elephant in the Room as the BoE Splits

August 7, 2025 12:48 PM UTC

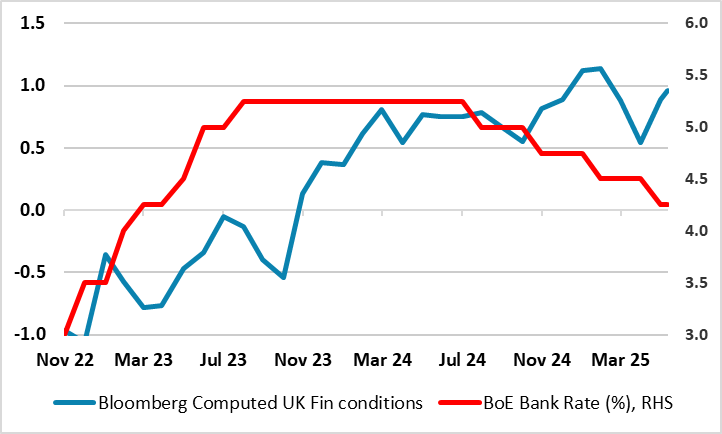

The widely expected 25 bp Bank Rate cut (to 4% and the fifth in the current cycle) duly arrived although the anticipated three-way split on the MPC was not quite as expected. It is puzzling how policy makers, faced obviously with both the same array of data and the same remit, can think so relativel

August 06, 2025

UK GDP Preview (Aug 14): Small GDP Rises Hardly Worth Shouting About?

August 6, 2025 2:48 PM UTC

There are some better signs as far as June GDP is concerned, not least it having been the warmest even such month in England. But we see only a 0.1% m/m rise (Figure 1), even with slightly better property and retail signals for the month. However, such an outcome, while a contrast to the two suc

July 31, 2025

BoE Preview (Aug 7): Labour Market Softness to Trigger Further Cut, But Fiscal Risks Loom

July 31, 2025 7:14 AM UTC

After what was widely considered to be a dovish hold at the last (June) MPC meeting (Bank Rate staying at 4.25%) which saw three dissents in favor of easing at that juncture, a 25 bp reduction is very much on the cards for the August decision. Likely to discuss its two alternative scenarios still,

July 30, 2025

DM Household Sluggish Borrowing

July 30, 2025 10:45 AM UTC

· Overall, restrained credit supply from banks; abundant employment/income or wealth for most households but restrained financial conditions for low income households could have restrained household lending growth to GDP. However, the surge in government debt and ensuing fear of fut

July 17, 2025

UK Labor Market – No Lack of Slack

July 17, 2025 6:58 AM UTC

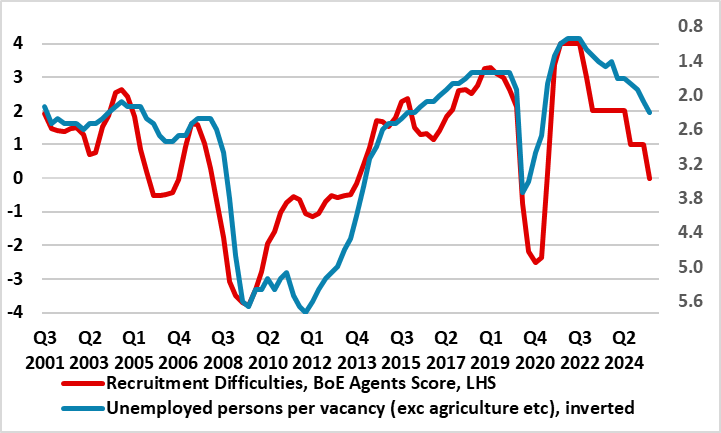

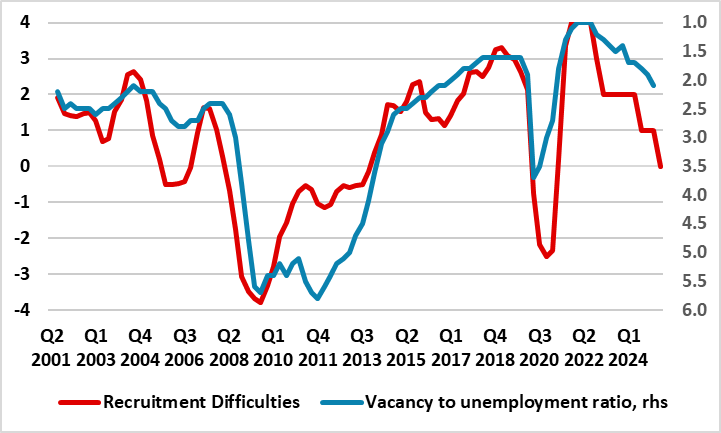

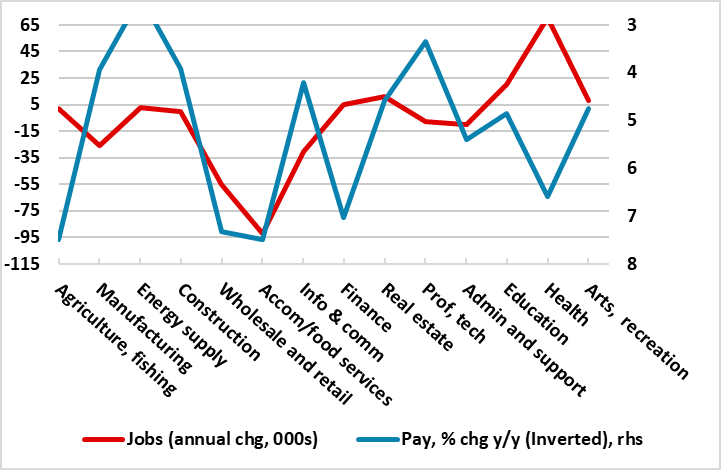

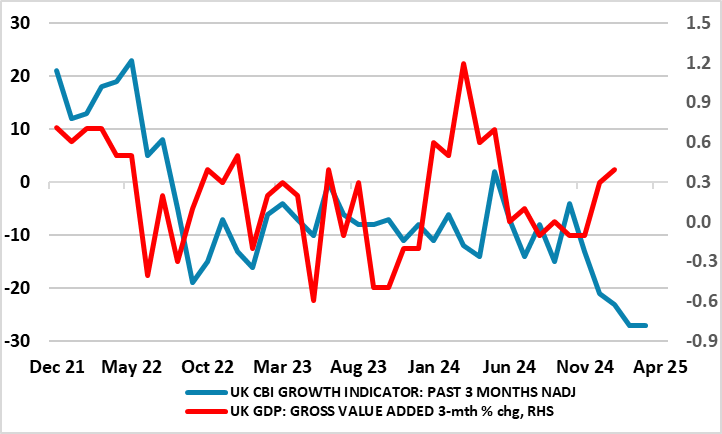

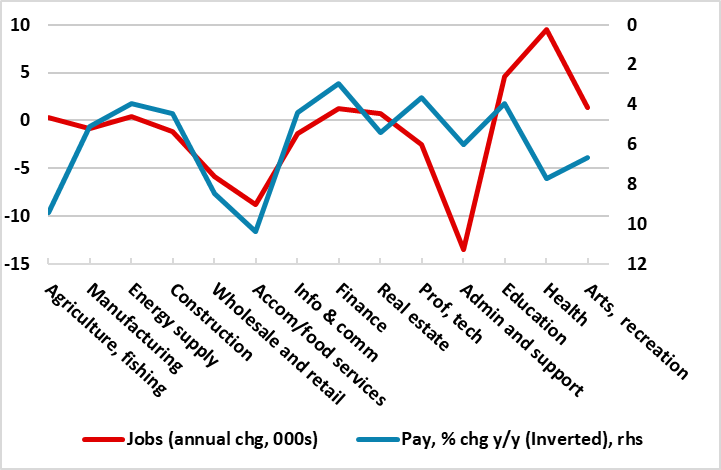

Even the BoE has acknowledged that the UK economy is developing slack in its labor market that we suggest is now not so much less tight but decidedly loose. Indeed, just days after BoE Governor Bailey suggested that signs of increasing labor market slack might prompt faster rate cuts, more such evid

July 16, 2025

UK CPI Review: Services Inflation Fails to Fall Further as Headline Surprises on Upside?

July 16, 2025 6:42 AM UTC

Calendar effects have been accentuating swings in UK CPI data of late and these may have reoccurred in the June numbers partly explaining June numbers which surprised on the upside. Indeed, June saw the headline and core rise a further 0.2 ppt – the former to an 18-mth high of 3.6%. Moreover, se

July 14, 2025

UK BoE Hints of Faster Easing Backed up by Survey Data?

July 14, 2025 8:38 AM UTC

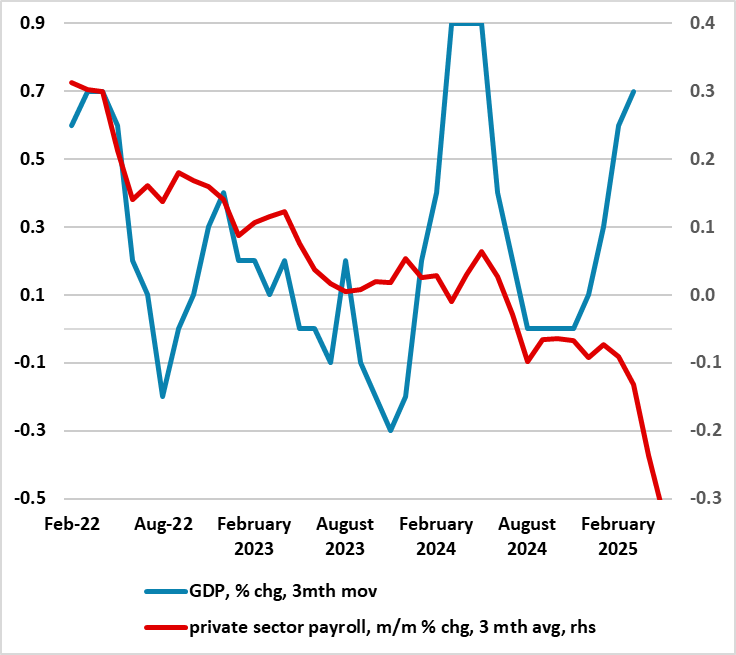

Somewhat ironically, just as BoE Governor Bailey suggested that signs of increasing labor market slack might prompt faster rate cuts, more such evidence accumulates. In fact, as monthly survey compiled by Markit pointed to not only weaker pay pressures, falling job rolls (Figure 1) and a steep ris

July 11, 2025

UK GDP Review: Another Downside Surprise

July 11, 2025 6:28 AM UTC

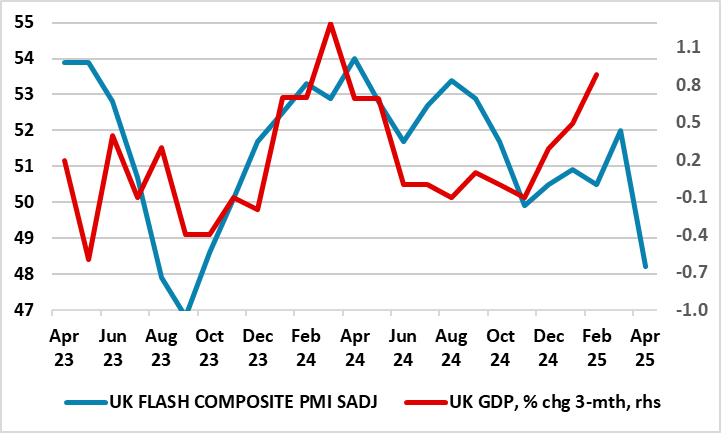

After two successive upside surprises, a correction back in monthly GDP was not entirely a wholesale surprise for April GDP. But that 0.3% m/m drop was almost repeated in the May numbers (Figure 1), where a further albeit smaller (ie 0.1%) fall occurred, but very much below consensus. Admittedly

July 09, 2025

UK CPI Preview (Jul 16): Services Inflation to Fall Further?

July 9, 2025 2:05 PM UTC

Calendar effects have been accentuating swings in UK CPI data of late. Indeed, the timing of Easter may have been a partial factor in the May CPI, where a distinct drop back in services and core rates failed to make the headline drop, which instead stayed at 3.4% in line with BoE thinking due to hig

UK: Risk Picture Rising and Broadening

July 9, 2025 12:35 PM UTC

The BoE’s latest message from its Financial Policy Committee notes that UK household and corporate borrowers remain resilient in aggregate while the UK banking system remains in a strong position even if economic, financial and business conditions became substantially worse than expected. But th

July 03, 2025

UK GDP Preview (Jul 11): Another Large Downside Surprise?

July 3, 2025 9:12 AM UTC

After two successive upside surprises, a correction back in monthly GDP was not entirely a wholesale surprise for April GDP. But we see that 0.3% m/m drop being repeated in the looming May numbers (Figure 1), thereby adding to a gloomier economic backdrop most recently highlighted by growing signs

July 02, 2025

UK: Tax Rises Looming?

July 2, 2025 8:34 AM UTC

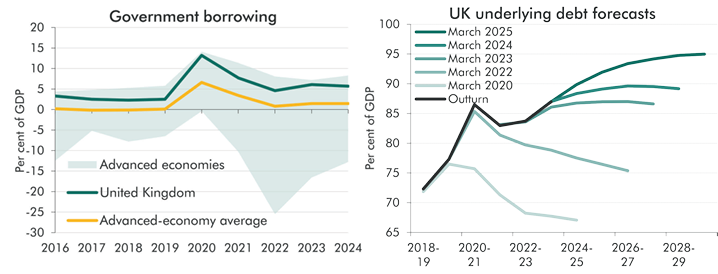

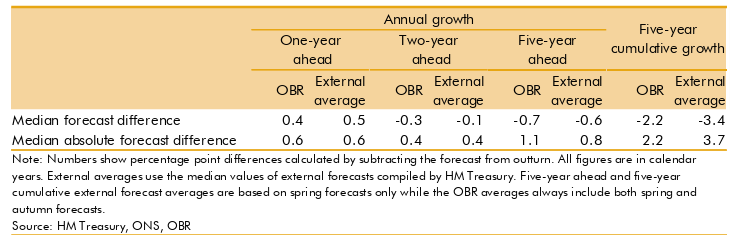

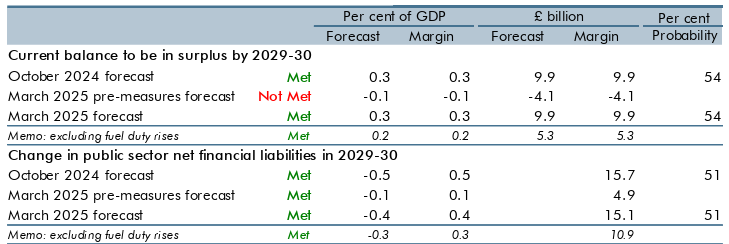

The politically damaging climb-down on welfare spending yesterday also saw the government face an additional fiscal hole after the fiscal watchdog (the Office for Budget Responsibility, OBR) hinted it has been repeatedly overestimating growth. Indeed, in its annual Forecast Evaluation Report, it s

DM Central Banks: Overlooking Lagged 2021-23 Tightening and QT?

July 2, 2025 8:30 AM UTC

We are concerned that DM central banks are underestimating the lagged impact of 2021-23 tightening and ongoing QT, which impacts the transmission mechanism of monetary policy. Central banks need to consider cyclical and structural issues, but also need a more rounded view of the stance and implica

June 27, 2025

UK Labor Market: Now not Less Tight but Genuinely Loose

June 27, 2025 8:30 AM UTC

It is clear(er) that the labor market is the key variable that the BoE is looking at to assess policy amid a backdrop where the official view is that current demand weakness may not be creating much, if any, slack as the supply side is equally anaemic. In this regard, it is also clear(er) that the

June 23, 2025

DM Rates Outlook: Yield Curve Steepening?

June 23, 2025 8:30 AM UTC

• We see the U.S. yield curve steepening in the next 6-18 months. 2yr U.S. Treasury yields can step down with cautious Fed easing on a modest/moderate growth slowdown and also if the Fed keeps an easing bias in H2 2026. 10yr U.S. Treasury yields face a tug of war between lower short-dated y

Western Europe Outlook: The First Shall be Last…

June 23, 2025 7:46 AM UTC

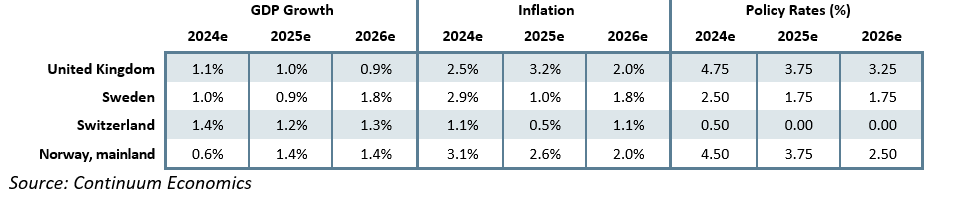

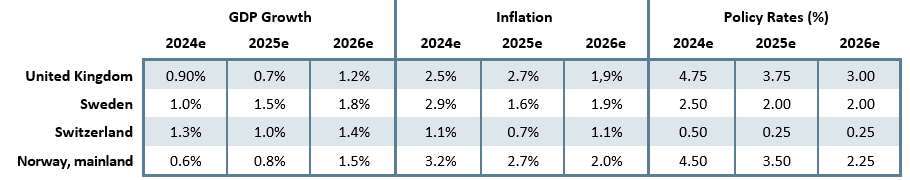

· In the UK, we have upgraded 2025 growth by 0.3 ppt back to 1.0%. But this is purely a result of the Q1 front-loading and instead masks what we think will be essentially a flat GDP profile into 2026. The BoE will likely ease further in H2 by at least 50 bp and maybe faster and then i

June 19, 2025

BoE Review : Labour Market Softness Triggers a Dovish Hold

June 19, 2025 11:51 AM UTC

A stable BoE policy decision was always the most likely (Bank Rate staying at 4.25%) as the MPC discussed its two alternative scenarios still, but possibly where hawks have been forced into diluting what were previous concerns about a ‘tight’ labor market. In fact, partly based on what was see

June 18, 2025

UK CPI Review: Services Inflation Falls Clearly

June 18, 2025 6:40 AM UTC

As for the UK, the main near-term inflation story was (and remains) what would happen after the April data when a series of energy, utility, post office and some other regulated and service price rises fell due, albeit now offset somewhat by a fall in petrol prices. The result was a notch higher t

June 13, 2025

BOE QT: Slowdown in September?

June 13, 2025 8:15 AM UTC

BOE QT is part of the reason behind both a steeper yield curve and subdued M4 and lending growth. The MPC in September will likely accept that to avoid impacting the monetary transmission mechanism that annual rundown of gilts needs to be slowed from GBP100bln pa to GBP75bln. Internal differences

June 12, 2025

BoE Preview (Jun 19): Splits to Continue?

June 12, 2025 12:57 PM UTC

A stable BoE policy decision next Thursday is most likely (Bank Rate staying at 4.25%) as the MPC discusses various scenarios still, possibly with any hawks diluting what were previous concerns about a ‘tight’ labor market. In fact, we see two dissents in favor of a 25 bp rate cut albeit where

UK GDP Review: GDP Overstating Activity Less Clearly But Looking Weaker?

June 12, 2025 6:54 AM UTC

After two successive upside surprises, a correction back in monthly GDP could be expected for the April data, especially as Q1 numbers may have been boosted by added production destined for the U.S in anticipation of tariffs. In addition, real estate activity seems to have dropped after the raisin

June 11, 2025

UK CPI Preview (Jun 18): Services Inflation to Fall Clearly?

June 11, 2025 7:03 AM UTC

The UK and the rest of the DM world have been decoupling, at least in terms of inflation, where the UK has undergone a surge, (largely home-grown) just as W European sees their respective inflation fall back to, if not below. Regardless, as for the UK, the main near-term inflation story was (and r

June 10, 2025

UK Labor Market – Slack and Divergences Widen

June 10, 2025 7:07 AM UTC

Even the BoE has acknowledged that the UK economy is developing slack and the continued trend rise in activity rates will only serve to reinforce the impression of a labor market that is not so much less tight but decidedly getting looser. As a result, pay pressures seem to be receding (Figure 1) an

June 04, 2025

UK GDP Preview (Jun 12): GDP Still Overstating Activity?

June 4, 2025 10:20 AM UTC

After two successive monthly upside surprises, a correction back in GDP could be expected for the upcoming April data, especially as Q1 numbers may have been boosted by added production destined for the U.S in anticipation of tariffs. In addition, real estate activity seems to have slumped after t

May 21, 2025

UK CPI Review (May 21): How Durable a Surge?

May 21, 2025 6:50 AM UTC

The UK and the rest of the DM world are now decoupling, at least in terms of inflation, where the UK is seeing a surge, (largely home-grown) just as W European sees their respective inflation fall back to, if not below, targets – although some measures if underling EZ inflation have started to edg

May 15, 2025

UK GDP Review: Q1 GDP Jumps But Erratic and Overstating Activity

May 15, 2025 7:17 AM UTC

National account data delivered yet another upside surprise both in terms of the latest monthly figure and also the associated Q1 update. Indeed, February GDP, rather than consolidating in the March GDP release with a flat m/m reading, instead grew by 0.2% (Figure 1), a fifth successive non-negati

May 13, 2025

UK Labor Market – How Much Slack?

May 13, 2025 9:57 AM UTC

Even the BoE has acknowledged that the UK economy is developing slack and the continued trend rise in activity rates will only serve to reinforce the impression of a labor market that is not so much less tight but decidedly getting looser. As a result, pay pressures seem to be receding (Figure 1) an

May 12, 2025

UK CPI Preview (May 21): How Big and Durable a Surge?

May 12, 2025 2:32 PM UTC

The UK and the rest of the DM world are about to decouple, at least in terms of inflation, where the UK faces a surge, (largely home-grown) just as W European sees their respective inflation fall back to, if not below, targets. Although relegated by current market ructions and tariff threats, the

May 09, 2025

UK GDP Preview (May 15): Q1 GDP Jumps But Underlying Picture Nearer Zero

May 9, 2025 9:32 AM UTC

We see the surprise and sizeable February GDP jump consolidating in the March GDP release with a flat m/m reading, this coming after that 0.5% jump (Figure 1). But there are downside risks given the possible (marked) correction back that may occur after what seems to be a very erratic February jum

May 08, 2025

BoE Review: Divided by Scenarios?

May 8, 2025 1:24 PM UTC

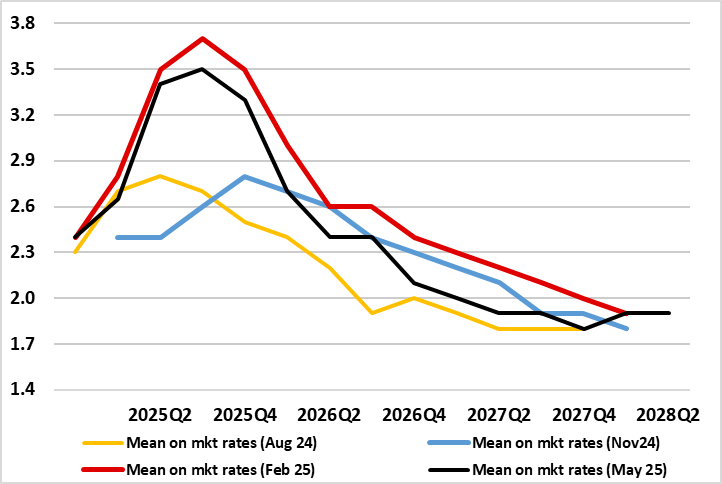

The widely expected 25 bp Bank Rate cut (to a 2-year low of 4.25%) came amid a less dovish rather than a more hawkish assessment than was envisaged beforehand. While the new Monetary Policy Report MPR) now sees inflation fall below target almost a year earlier than seen three months ago (Figure 1)

May 01, 2025

BoE Preview (May 8): Being A Little Less Careful Amid Data Conflicts

May 1, 2025 2:52 PM UTC

It has been relatively clear that MPC divisions have been enough for the BoE to have altered its rhetoric as far back as February to stress the need for policy to be framed carefully as well as gradually. Indeed, this shift very much pointed to the MPC majority envisaging rate cuts no faster than

April 23, 2025

BoE vs the (Weaker) Data

April 23, 2025 9:56 AM UTC

Amid what are now an ever broader array if indicators suggesting that the economy is stagnating, if not contracting the BoE has the opportunity to address this risks with three separate MPC speeches due later today. Chief Economist Pill, Governor Bailey and Deputy Breeden can address the extent to

April 16, 2025

UK CPI Review: Inflation Respite Ahead of Likely Key April Surge?

April 16, 2025 6:28 AM UTC

Although relegated by current market ructions and tariff threats, the main near-term inflation story was (and remains) what happens in the April data when a series of energy, utility, post office and some other regulated and service price rises are due, albeit now possibly offset somewhat by a fall

April 15, 2025

UK Labor Market – A Tale of Two Labor Markets?

April 15, 2025 9:45 AM UTC

Policy-making is fraught with difficult decision making at the best of times. But at present in the UK, such decisions are made all the more problematic given inconsistencies, if not conflicts, in the data backdrop, thereby making any reading of the economy all the more subjective. Is employment

April 11, 2025

UK GDP Review (Apr 11): Marked Strength in Spite of Soft(er) Surveys

April 11, 2025 6:40 AM UTC

UK data can be erratic, but the hugely unexpected surge in February GDP numbers (Figure 1) looks hard to fathom. A 0.5% m/m jump suggests the economy grew by an annualized 6%-plus in the month. This is hard to square against the message from surveys and other data such as that for the labor mark

April 08, 2025

UK CPI Preview (Apr 16): Inflation to Slip Further Ahead of Likely Key April Surge?

April 8, 2025 2:03 PM UTC

Not surprisingly, February’s CPI data provided mixed signals, albeit reversing some of the upside surprises seen in January data. The numbers may have undershot expectations, but actually tallied with our and BoE thinking, at least in terms of a 0.2 ppt drop for both the headline to 2.8% and for

April 04, 2025

UK GDP Preview (Apr 11): Resilience in Spite of Soft(er) Surveys

April 4, 2025 9:13 AM UTC

UK GDP Preview: Resilience in Spite of Soft(er) Surveys

Despite a fresh downside surprise for January numbers, the odds are increasing that current quarter GDP will be decidedly positive as opposed to the weak(ish) picture we perceive. This is all the more likely given the 0.1% m/m ‘recovery’ w

March 26, 2025

UK Spring Fiscal Statement – A Patch-up Not a Repair Job?

March 26, 2025 1:39 PM UTC

Chancellor Reeves never wanted a fiscal event at this juncture. But market pressure and economic weakness have forced her into a series of government spending cuts designed to shore up her recently revised fiscal goals via this so-call spring statement. The problem here is twofold. Firstly, the

UK CPI Review: Inflation Slips Even as Services Fail to Soften?

March 26, 2025 7:48 AM UTC

Not surprisingly, February’s CPI data provided mixed signals. They may have undershot expectations, but actually tallied with our and BoE thinking, at least in terms of a 0.2 ppt drop for both the headline to 2.8% and for the core to 3.5%. This came in spite of higher alcohol duties and no dro

March 25, 2025

Western Europe Outlook: Price Pressures - Puzzling or Possibly Persistent!

March 25, 2025 10:47 AM UTC

· In the UK, we continue to retain our below-consensus GDP picture for this year, with growth actually downgraded and with downside risks that may actually be both increasing and materializing. The BoE will likely ease further through 2025 by at least 75 bp and maybe faster and into 202

DM Rates Outlook: Policy Divergence

March 25, 2025 9:30 AM UTC

• 2yr U.S. Treasury yields can step down with cautious Fed easing on a modest/moderate growth slowdown and also if the Fed keeps an easing bias. 10yr U.S. Treasury yields can be helped by this easing and see a move down through 2025. However, the budget deficit will likely be 6.5-7.0%

March 20, 2025

BoE Review: Being Careful Amid Data Conflicts

March 20, 2025 12:45 PM UTC

Even amid a BoE rate cut last month that was delivered with a clear(er) degree of action, all MPC members opting for easier policy. Even so, it was clear there were still MPC divisions that probably reflected increased uncertainty enough for the BoE to have altered its rhetoric somewhat to stress

UK Labor Market – Private Payrolls Stay Soft Amid Cost Pressures?

March 20, 2025 7:57 AM UTC

To suggest that the UK labor market is merely getting less tight misses the point entirely even given more signs of higher participation. Amid continued reservations about the accuracy of official labor market data produced by the ONS, alternative and very clearly more authoritative data on payrol

March 19, 2025

UK CPI Preview (Mar 26): Inflation Slips as Services Soften?

March 19, 2025 7:31 AM UTC

January’s CPI numbers showed a marked bounce back up, and with the 0.5 ppt rise taking it to a 10-month high of 3.0%, this being above consensus and BoE thinking. Notably services jumped from 4.4% to 5.0%, actually below expectations, having been driven higher by a swing in airfares and the rise

March 14, 2025

UK GDP Review: Previous Resilience Gives Way to Softer Surveys

March 14, 2025 7:39 AM UTC

Despite a fresh downside surprise for January numbers, the odds are increasing that current quarter GDP will be decidedly positive as opposed to the weak(ish) picture we perceive. The upside surprises in December contrasts with a much softer impression from surveys (Figure 1), the latter now showi

March 11, 2025

BoE Preview (Mar 20): Being Careful the New Watchword

March 11, 2025 4:37 PM UTC

Having so far cut a modest 75 bp, the BoE rate cut last month was delivered with a clear(er) degree of action, by at least the MPC majority. But those implied MPC divisions probably reflected increased uncertainty enough for the BoE to have altered its rhetoric somewhat to stress the need for poli