UK CPI Preview (Feb 19): Inflation Drop to Target Deferred

After the surprisingly soft December data, we think January’s CPI numbers will show some bounce back up, albeit the 0.2 ppt rise we envisage to 2.7% being notch below BoE thinking. This will largely reflect more ‘noise’ in volatile services and higher energy inflation both due to fuel price rises (including a rise in the energy price cap) and base effects. More notably, while overall inflation may drop back in the rest fi the current quarter we acknowledge that the headline will spike higher in Q2 as a series of regulated prices (water bills) and energy costs (mainly gas) take effect. Indeed, inflation may now rise to a high of around 2.8% in Q3, some 0.8 ppt higher than previously thought but still well below the 3.7% rate that the BoE now projects. This added price pressures are not demand determined and may accentuate already weak growth, thereby further restraining company pricing power. We therefore still see 3-4 more 25 bp Bank Rate cuts this year, as the BoE reacts to weaker core inflation.

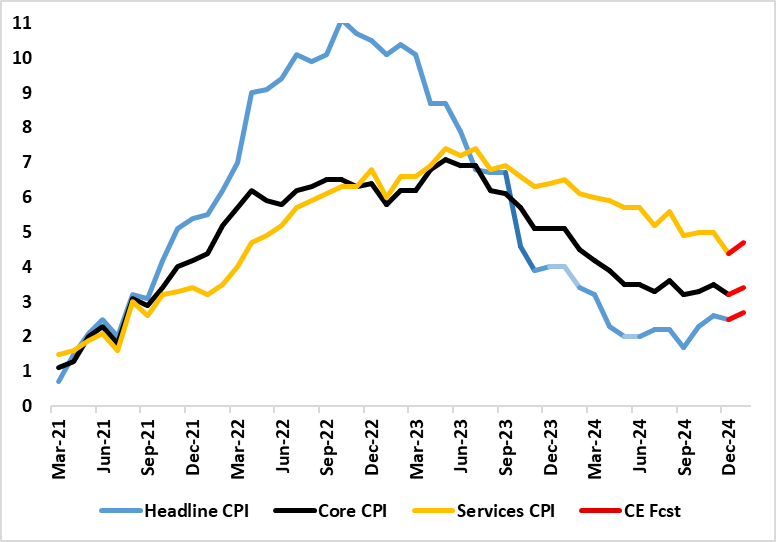

Figure 1: January Inflation to Spike Higher?

Source: ONS, Continuum Economics

Some have been suggesting stagflation pressure are now confronting the UK. Admittedly, the December UK CPI data did help dispel some of those concerns. Indeed, with markets looking for the headline rate to have stayed at November’s 2.6% outcome, the actual outcome instead dropped a notch and encompassed a drop in both the core and services inflation of 0.3 ppt and 0.6% respectively (Figure 1). Indeed, the almost three–year low of 4.4% in services thereby provided a much more reassuring message, especially as it reflected a drop in restaurant inflation, often considered to be a key indicator of inflation persistence. Moreover, looking at the CPI details, adjusted data also painted a much softer picture than base-effected y/y numbers, adding to downside surprises that the BoE have admitted to. However, the overall economy figures do sit more easily with the ‘stag’ part of a stagflation picture as do the most recent business survey numbers and as looming Q4 GDP figures may suggest. Indeed, it is clear is that the economy is stagnating, and that this predates the Budget, very much asking to what degree it is BoE policy that is hindering activity principally.

Inflation Rise Looming

But stagflation worries are likely to resurface in coming months as price rises loom. January inflation may see a bounce back in volatile services as well as higher energy inflation, the latter reflecting a rise in the OFGEM price cap and higher fuel costs. More notably, and as the BoE this month highlighted, a whole series of price rises are in the offing. But rather than being a reflection of demand pressures these price rises are more likely to weigh on already-weak demand. This is because they are either energy related (largely a result of supply conditions in the European gas market causing a further rise in the OFGEM energy price cap in April) and a reflection of regulated prices. The latter is mainly higher water bills aimed to provide funds to address deteriorating infrastructure although there are other pressures partly fiscally induced such as an end to a cap on bus fares and VAT being added to private school fees.

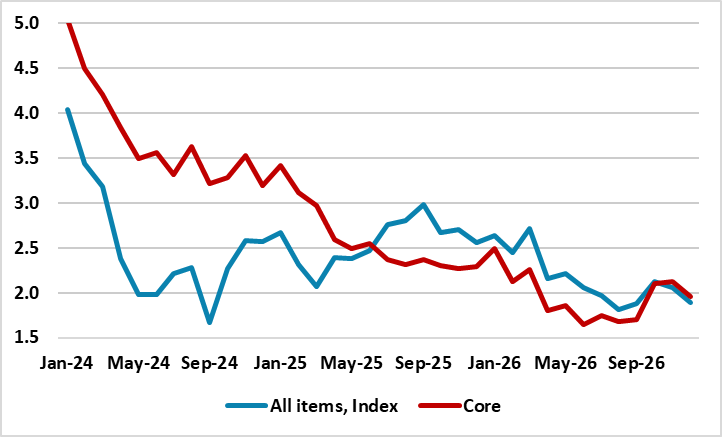

Figure 2: Headline Inflation to Rise Through 2025 While Core Drops

Source: ONS, Continuum Economics

Inflation Dynamics Shifting

As a result, April headline inflation will rise clearly after what we think will be a softening in the latter part of the current quarter and with some of this causing a rise in the core rate due to the regulated price increases. Indeed, headline inflation may approach 3% in Q3, albeit a rise far less than the 3.7% rate the BoE now envisages, albeit some 0.7 ppt higher than we previously proijected. The question is whether the BoE will be overly alarmed by the rise or instead reassured if we are right in that the inflation rise will be much lower than the MPC (at least a majority) assume. Reassurance may be the more likely as we see that in spite of the rise in regulated prices, core inflation will still fall and should fall below the headline by around mid-year (Figure 2). In addition, and as suggested above, the rise in prices will sap already weak demand - we have pared back our 2025 GDP projection a little further to a very much below consensus 0.6%, enough to convince the BoE hawks that weak growth is far from a purely supply phenomenon – the latest Monetary Policy Report suggested that weak H2 2024 was not a reflection of demand weakness!

Softer Inflation Factors Also Beckon

Moreover, there are also likely softer price pressures that the BoE may have to take into account, these being factored into our inflation picture somewhat. These include possible dumping of goods into the UK as tariff threats turn into a reality, this possibly explaining the fall in freight costs that is seemingly emerging at the moment. In addition, we think the BoE is overly cautious about the labor market as we see clear falls in payrolls data (an alternative to the ONS labor force numbers) that also suggest as relatively softer wage backdrop. Overall while exogenous factors now suggest that the drop towards (if not below) target will not occur in H2 this year (as we previously envisaged), it is still likely that CPI inflation will fall to target around-mid 2026, well over a year earlier than recently revised BoE thinking.