UK CPI Review: Services Inflation Falls Clearly

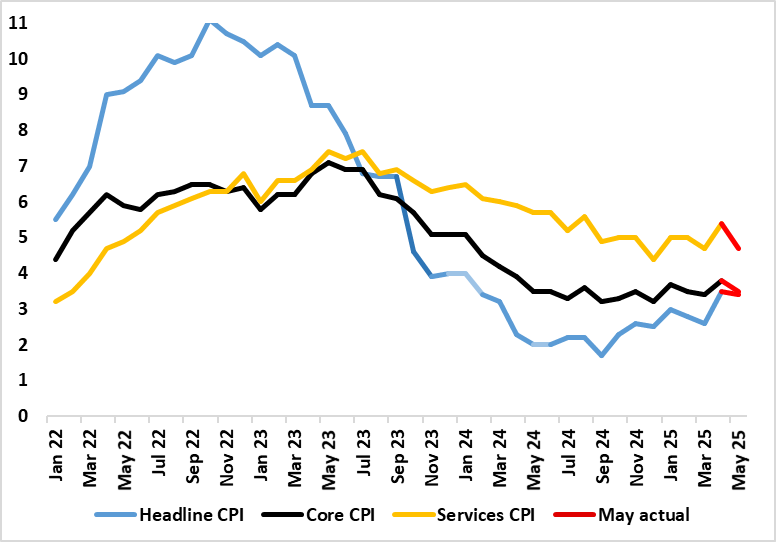

As for the UK, the main near-term inflation story was (and remains) what would happen after the April data when a series of energy, utility, post office and some other regulated and service price rises fell due, albeit now offset somewhat by a fall in petrol prices. The result was a notch higher than the BoE expected with a jump to 3.5%, albeit since revised back a notch to 3.4%, still a rise dominated by a pick-up in services, some of which (ie airfares) may be temporary. Indeed, the timing of Easter may have been a partial factor and this should unwind in the looming May CPI. This seems to have been the case, albeit only to some extent, where a distinct drop back in services and core rates failed to make the headline drop, which instead stayed at 3.4% in line with BoE thinking due to higher food and household goods prices.

Figure 1: April CPI Inflation Jumped Broadly and Stayed There in May

Source: ONS, Continuum Economics

The April data may have persuaded some of the MPC not to cut last month had they been aware of the full data. But at the same time there was no clear fresh inflation spiral with six of the 12 CPI components seeing softer pressures and where consumer sensitive clothing and household equipment actually turned negative, possible a sign of reined in pricing power. But these numbers made known in advance to the MPC meeting which gives its verdict tomorrow, may intensify divisions, with the hawks perturbed by the fact that over half the components saw a pick-up.

Albeit with some added upside risk from a likely rise back in fuel costs in July, we see inflation having largely peaked at this April/May level albeit with the rate returns (briefly) to (around) 3.5% in September, this latter outcome some 0.2 ppt below BoE thinking. As for BoE rate cutting, we still think upside surprises would have to dislodge the MPC from cutting at least twice more this year albeit it clear that the MPC will remain divided, if not more so, even against a backdrop where there is a general view that policy restriction needs to reduced, the difference being over how fast given worries about price persistence, and where recent looser labor market numbers may be more important in (re-)shaping policy thinking.