BoE Review: Divided by Scenarios?

The widely expected 25 bp Bank Rate cut (to a 2-year low of 4.25%) came amid a less dovish rather than a more hawkish assessment than was envisaged beforehand. While the new Monetary Policy Report MPR) now sees inflation fall below target almost a year earlier than seen three months ago (Figure 1), this largely reflects weaker energy price assumptions alongside only a modestly larger negative output gap. Instead, a friendlier interest rate picture helps limit any damage to the GDP outlook, this in turn meaning that the envisaged drop in inflation while earlier, does not intensify further out. But that growth outlook has a clear downside risk tilt, partly reflecting the uncertainty aspect from the U.S. tariff threat. We still think the BoE is too optimistic regarding the growth outlook and not encompassing the ensuing disinflation risks. As a result, we continue to point to at least two more 25 bp cuts this year and probably three, with a full ppt on the cards for 2026, that still leaving the policy stance slightly restrictive.

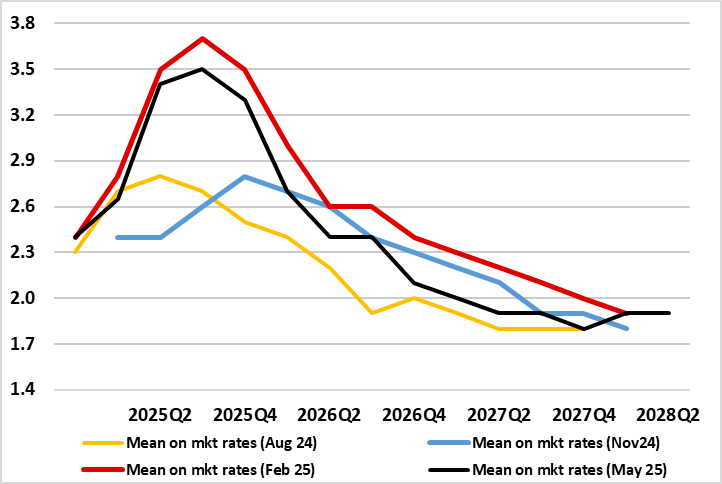

Figure 1: BoE Upgraded Inflation Outlook Still Too Gloomy!

Source: BoE

It remains clear that MPC divisions remain given the three-way manner in which this vote materialized. Such divisions have been enough for the BoE to have altered its rhetoric as far back as February to stress the need for policy to be framed carefully as well as gradually. This line f thinking continued to be the case this month, also repeating that monetary policy will need to continue to remain restrictive for sufficiently long. The fact that two MPC members voted for no cut at all this time around is possibly not as hawkish as it appears, not least as their rationale was partly based around what we think is flimsy evidence of a still tight labor market. But it is clear that the BoE overall is placing much more emphasis on a possibly weaker supply side of the economy (both at home and globally) than perhaps markets are, this explaining the lack of a clearer disinflationary outlook.

Indeed, while the MPR stressed there were growing risks from potential global trade arrangements depending on how trade policies unfolded, it alleges risks lie on both sides. As a result, the BoE contend that UK inflation could be affected by a wide range of factors such as shifts in trade patterns, supply chain disruptions in the UK and abroad, and movements in global exchange rates. On the one hand this meant that it was possible that the ultimate net effect of these developments could be materially more disinflationary for the UK than in the baseline forecast, but it was also possible that the effect could be slightly inflationary in the longer term due to supply factors. Overall, while it is too early to conclude over what period and to what degree different economic effects could materialise we think the disinflation alternative is both more likely and the more sizeable.

Scenario Building Backfiring?

It is clear that elevated uncertainty underscores the BoE thinking and projections but this does not explain the current MPC divisions. Instead they merely reflect the impact that scenario building is having with it seemingly the case that policy hawks’ thinking chimes with the inflation persistence alternative while the two members who opted for 50 bp put more emphasis on the downside risk. This envisages developments in global trade policy weighing on demand to a greater extent than in the baseline, the latter being the option that the MPC majority followed. The question then is the new policy framework in the after math of the Bernanke Review actually backfiring as the scenario building it is based around is merely exacerbating divisions among policy-makers. Perhaps the very opposite is the case as the Review was partly designed to deter group-think!