UK Labor Market – No Lack of Slack

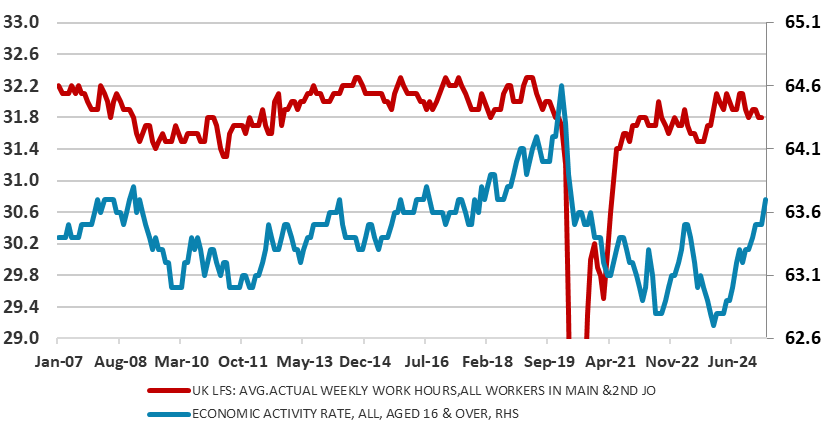

Even the BoE has acknowledged that the UK economy is developing slack in its labor market that we suggest is now not so much less tight but decidedly loose. Indeed, just days after BoE Governor Bailey suggested that signs of increasing labor market slack might prompt faster rate cuts, more such evidence accumulates. Earlier in the week, monthly survey compiled by Markit pointed to not only weaker pay pressures, falling job rolls and a steep rise in those looking for work, the latter very much associated with increased slack. But this is now reinforced both official and survey numbers. The latest ONS labor data showed a marked rise in activity and hours worked (Figure 1) amid more sign of job losses, lower pay growth and dwindling vacancies. But we would assert that the official data is still underplaying the extent of emerging labor market slack in contrast to the BoE’s own survey data which is consistent with increasing spare capacity, now well above pre-COVID levels.

Figure 1: Activity Rates and Hours Worked Rising

Source; ONS

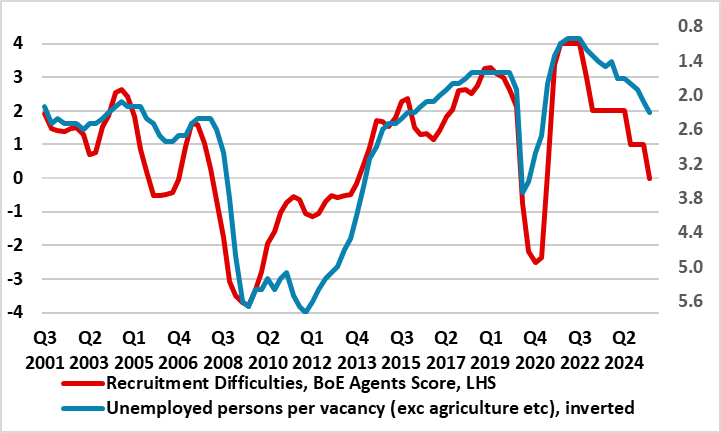

As a result, pay pressures seem to be receding and somewhat faster that BoE projections with private sector regular pay down to 5.0% on the official measure and could be down to nearer 4% in the next few months if the recent slower pace of growth persists. Indeed, alternative-sourced numbers from the HMRC suggest pay rates under 4.5%. The latter will depend mainly on employment but how this is faring is open to question given the data collection shortcomings in official data but where there is evidence that labor cost considerations are derailing employment is many sectors. Moreover, the continued strong but volatile gains in official data still look suspect as the BoE has repeatedly noted. But we think that the BoE is still too optimistic about the jobs backdrop, ignoring its own survey data (Figure 2). Admittedly, the official data suggest that vacancies are falling back appreciably. But as Figure 2 shows, however, these official measures still suggest a vacancy rate somewhat above previous and particularly pre-pandemic levels. But the BoE’s own survey data, cobbled from its monthly Agents Survey suggests the very opposite with a faster and sharper fall in labor market slack.

Figure 2: BoE Numbers Suggest Increasing and Above Average Slack

Source; ONS, BoE, CE

BoE Governor Bailey used an interview earlier this week to underscore the repeated BoE view that the path is downward for interest rates. But he said the MPC continues to use the words ‘gradual and careful’ because – as some people say - why are you cutting when inflation’s above target? However, If the MPC saw the slack opening up much more quickly, he said that would lead us to a different conclusion, albeit possibly with splits among committee members. An ever wider data backdrop is now very much suggesting slack is increasing even now from what may be far from authoritative ONS official numbers. The increase in effective UK labor supply will we assert weigh further on wage pressures, just as has been the case in the EZ of late!