UK: Mixed Labor Market Signals – Yet Again

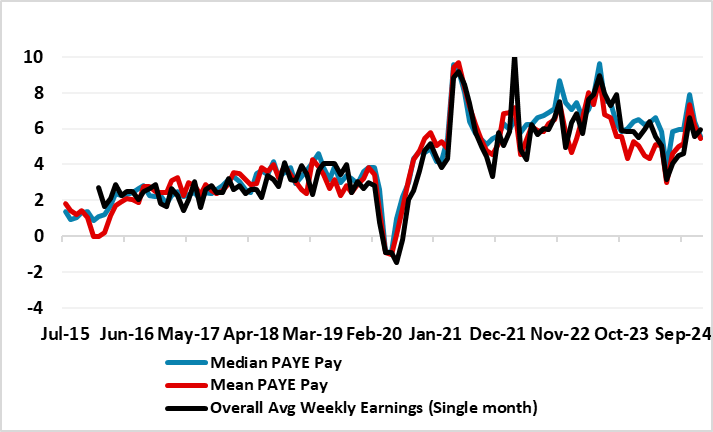

There is little in the latest UK labor market numbers that will ease any concerns of the BoE policy hawks. Admittedly, inactivity and vacancies fell, both suggesting some easing in the labor market, although the former is as suspect as the (still apparently rising) ONS employment numbers due to questions about their reliability. That may apply also to even the average earnings data, but these numbers are largely chiming with payroll numbers which many consider to be more accurate, both in terms of jobs and pay. They do show some easing has occurred but where the pace of growth still at under 6% would be considered too high. However, there are some signs of softer private sector pay. This may probably reflect the fact that the data show – certainly the payrolls – that activity may still be still falling at least outside of the public sector. There is little net policy significance from the numbers!

Figure 1: All Pay Measures Still High?

Source; ONS - PAYE= pay as you earn

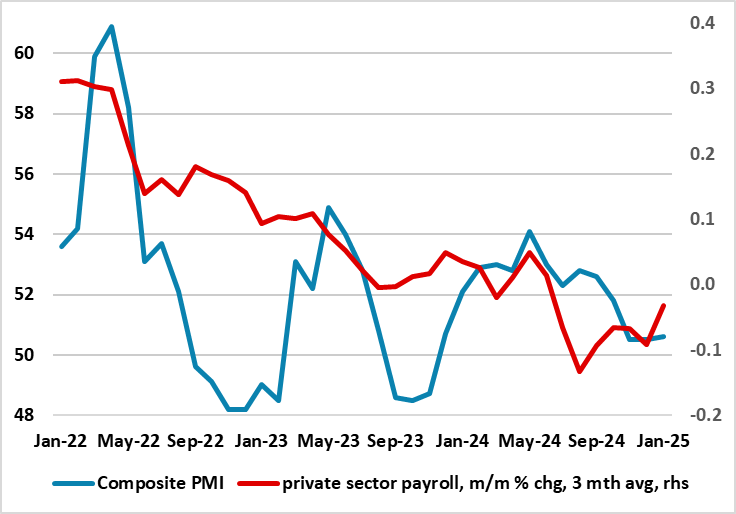

The question is the degree to which emerging public spending plans continue to bolster jobs, albeit where local authorities are flagging that looming rises in effective payroll taxes will inhibit jobs. The payroll data very echo recent business survey data which suggest a flat to softer backdrop, thereby refuting the possible more positive signs seen in the latest GDP numbers. Indeed, a flat real economy backdrop still seems to be the view that the BoE hold.

Figure 2: Private Sector Still Sliding?

Source; ONS, Markit