BoE vs the (Weaker) Data

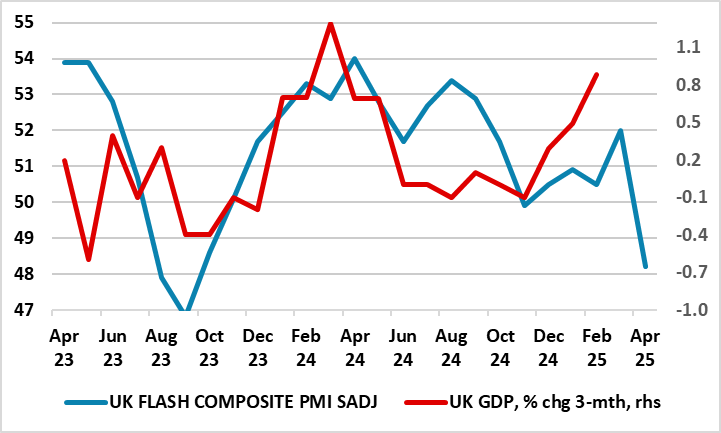

Amid what are now an ever broader array if indicators suggesting that the economy is stagnating, if not contracting the BoE has the opportunity to address this risks with three separate MPC speeches due later today. Chief Economist Pill, Governor Bailey and Deputy Breeden can address the extent to which apparent GDP resilience is either/both illusory or temporary given further signs challenging the solid monthly national account outcomes so far this year. Employment data for some time has presented a much weaker picture as do (weaker than expected) government revenue numbers in official figures out today showing a marked overshoot in borrowing. But most obvious is the PMI data today, not only because they show an even clearer conflict (Figure 1) but because they also suggest that domestic factors as well as global trade worries are hitting and hurting the UK economy, this chiming with the rationale the IMF gave in explaining its UK growth downgrade.

Figure 1: A Tale of Two Economies

Source: Markit ONS

As these include the array of cost and price rises that persuaded the BoE to raise its inflation forecasts, MPC members may now ask themselves, if these rises are as likely to hit activity and curtail pricing power as offering a threat of persistent inflation.