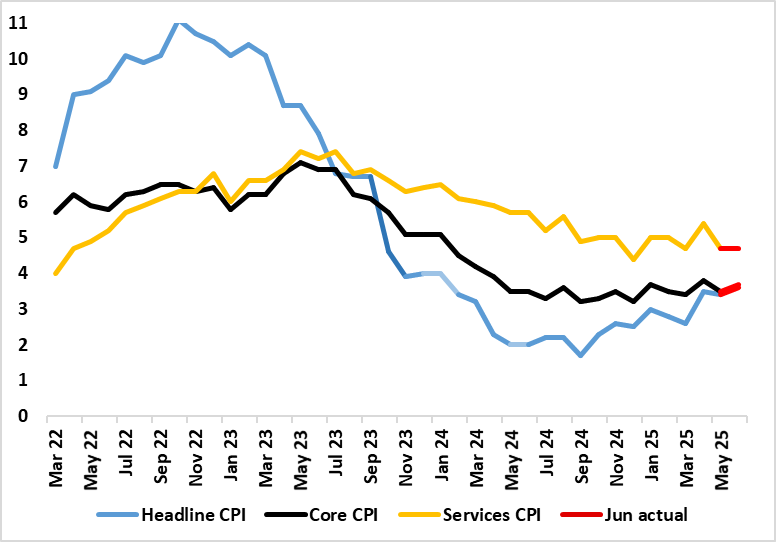

UK CPI Review: Services Inflation Fails to Fall Further as Headline Surprises on Upside?

Calendar effects have been accentuating swings in UK CPI data of late and these may have reoccurred in the June numbers partly explaining June numbers which surprised on the upside. Indeed, June saw the headline and core rise a further 0.2 ppt – the former to an 18-mth high of 3.6%. Moreover, services were steady as opposed to the expected slowing, this possibly an aberration in and around airfares that may reverse in the next set of data. Despite the June headline being some 0.3 ppt above BoE thinking, we do not think this will rule out a rate cut next month, albeit with a split MPC. This is unless tomorrow’s labor market data provides cause for concern, but where alternative insights to ONS data regarding the labor market are very pointing to rising spare capacity, a factor very much affecting BoE thinking!

Figure 1: June Inflation Surprises on the Upside and Broadly so

Source: ONS, Continuum Economics

Food price inflation which picked up to a 16-mth high of 4.5% may be a growing concern for the BoE both for its impact of spending power and on inflation. The question is whether this may be a poor UK harvest or shops passing on recent NIC hikes.

But real economy and labor market weakness, allied to fiscal concerns may be even bigger worries for the BoE. Admittedly, the slight increase in the headline rate into June 2025 reflected upward contributions from seven (of the 12) divisions, partially offset by downward contributions from three divisions. The largest upward contribution came from transport, particularly motor fuels. There were also upward effects from air fares, rail fares, and maintenance and repair of personal transport equipment.

Clothing and footwear prices rose by 0.5% y/y, compared with a fall of 0.3% in the 12 months to May. The 12-month rate has fluctuated between positive and negative during 2025 and has turned positive again following two consecutive negative readings – but we still think this weakness is consistent with a hesitant consumer and questions whether higher taxes are indeed, being passed on by shops. This is underscored by the further fall in restaurant/hotels inflation, this often seen as a harbinger of underlying inflation and very much driven by wages, in turn suggesting n a slowing in the latter.

Overall, the data does underscores some price resilience as far as UK inflation is concerned. But we still see the headline rate coming down to around 3% but probably not until year end and maybe with some further (temporary) pick-up in the interim.