UK GDP Review: Q1 GDP Jumps But Erratic and Overstating Activity

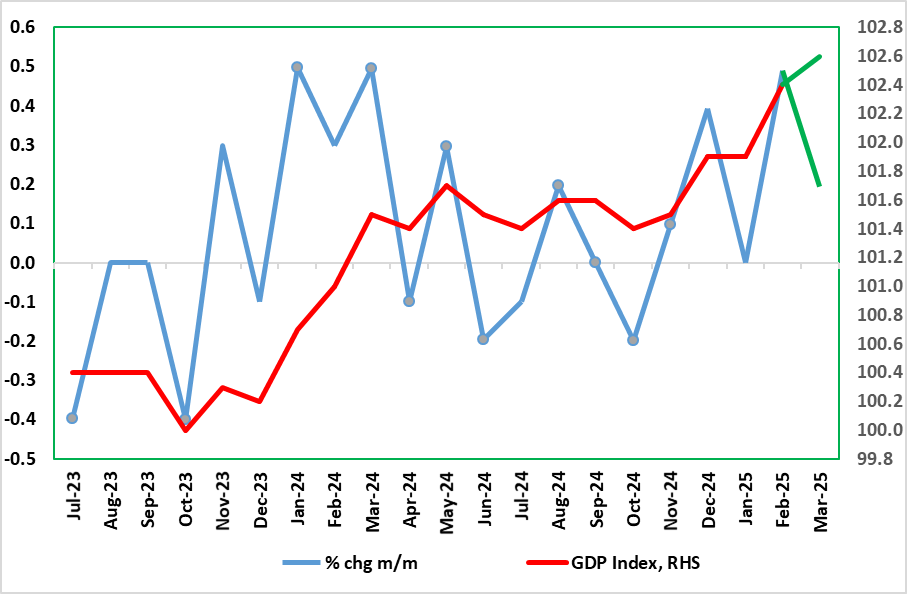

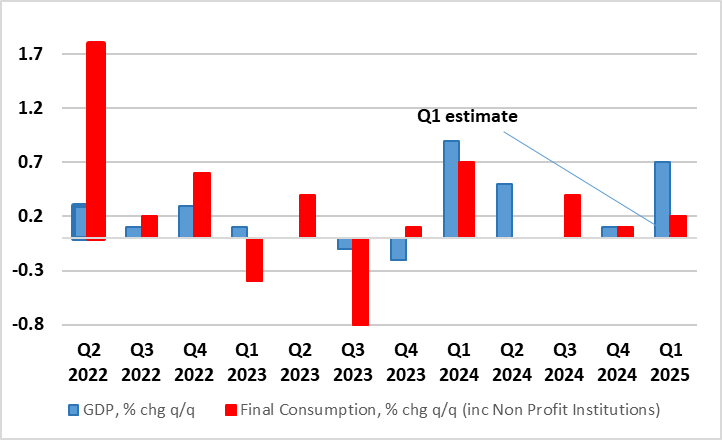

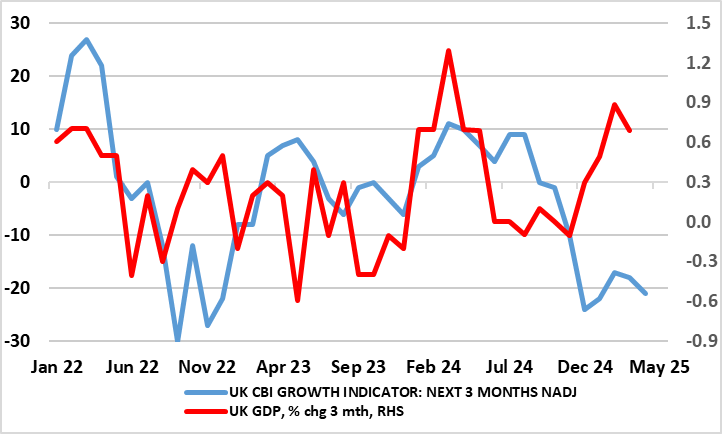

National account data delivered yet another upside surprise both in terms of the latest monthly figure and also the associated Q1 update. Indeed, February GDP, rather than consolidating in the March GDP release with a flat m/m reading, instead grew by 0.2% (Figure 1), a fifth successive non-negative outcome, led this time by services. Partly as a result, Q1 GDP rose by 0.7%, boosted both by exports and business investment. Notably, consumer spending rose a tame 0.2% (Figure 2), possibly a result of higher household inflation in the quarter, this worrying given the more marked rise seen this quarter in regard to price pressures. The data is unlikely to make any difference to BoE thinking which foresaw a 0.6% Q1 rise and one that still led to a marginal emergence of an output gap, this reflecting a (very justifiable) view that the official data are overstating actual activity (Figure 3) which is more likely to have been near zero last quarter with a similar, if not weaker, picture envisaged for the current quarter, still leaving sub-1% overall GDP growth this year.

Figure 1: Actual GDP Looking Far Better into Early 2025 as in Early 2024

Source: ONS, green denotes latest outcome

UK data can be erratic, but the hugely unexpected surge in February GDP numbers looked hard to fathom when the data surfaced and still seems puzzling. That unrevised 0.5% m/m jump suggested the economy grew by an annualized 6%-plus in the month. This is hard to square against the message from surveys and other data. More notable the February rise was based around a surge in manufacturing, also hard to assess given that this sector is where surveys suggest weakness is most paramount - there was a correction in March output. As for the March further rise, this was very much based around consumer services, very probably related to unseasonably warm weather, but not a degree that it propelled consumer spending much over Q1. Indeed, the latter laboured at 0.2% (Figure 2), possibly pressurized by a rise in the deflator, an ominous rise in the deflator (to 3.5%), a worrying feature given the more marked rise seen this quarter in regard to consumer price pressures – the BoE does not seem to regard that the emerging rise in inflation will take a toll on spending. Otherwise, the Q1 data was dominated by a rise in business investment and (net) exports, the former largely driven by aircraft imports which limited the latter although with export volumes pushed higher on the Non-EU side, presumably a reflection of bringing forward sales to the U.S. The data, does suggest a better productivity backdrop, especially on the basis of non official data which point to flat to falling employment.

But it is the outlook that will be dominating BoE thinking not least with tariffs coming in and where business worries were already fermenting given the weakness in surveys. And these surveys are used by the likes of the BoE to estimate underlying growth backdrop. On this basis, the BoE estimates that underlying growth in Q1 was around zero and where this lack of core momentum suggests that headline GDP growth will slow sharply in Q2, to 0.1%, with risks to the downside

Figure 2: Consumer Not Recovering?

Source: ONS, CE

Perhaps more notably and something policy makers should bear in mind, the data volatility of late suggest what may be changing seasonal factors post pandemic which may mean the UK economy in early 2025 sees similar but short-lived strong growth as seen in in the same period of last year – thus any solid Q1 gain needs to be put into that perspective. But even amid a BoE view of near zero growth envisaged this year, we think the Bank is too optimistic about both the current state of the economy and the medium-term outlook, not least as it as its 1.5% average consumer spending forecast for 2025-26 does not seem to have taken any toll from the higher inflation it has pointed to. And of course there is the global trade uncertainty which is going to hit continental Europe possible a protracted basis this accentuated by domestic fiscal worries. Against this backdrop, it not surprising how negative business surveys are now flagging the activity outlook (Figure 3) and where we see (still) sub 1% GDP growth this year and little better next.

Figure 3: Momentum Contrasts with Downside Risks From Surveys?

Source: ONS, CBI Growth Indictor which combines results from three separate sector surveys