UK: Risk Picture Rising and Broadening

The BoE’s latest message from its Financial Policy Committee notes that UK household and corporate borrowers remain resilient in aggregate while the UK banking system remains in a strong position even if economic, financial and business conditions became substantially worse than expected. But the latest record it has produced is understandably coy about the fiscal position, in contrast to the latest update from the Office for Budget Responsibility (OBR. Indeed, the OBR stressed that risks to the UK fiscal position are high and mounting. Of course, the BoE does not have its head in the sand, the FPC stressing that term premia globally have increased materially and remain elevated with the ensuing risk of sharp falls in risky asset prices, and pressures on sovereign debt markets are still elevated. The question is whether the BoE judges that it is part of the adverse narrative where its slow conventional easing and persistent unconventional tightening have accentuated risks to both the fiscal and financial side.

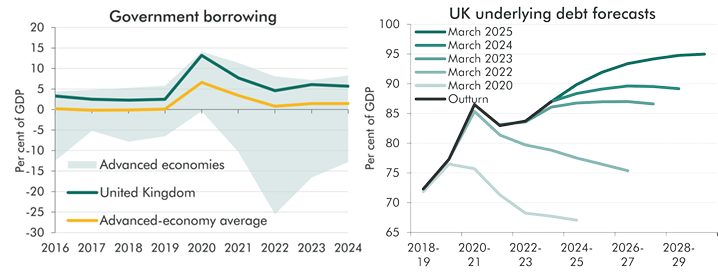

Figure 1: Fiscal Risks Reflect Rising Borrowing in Advanced economies, and Rising UK government debt

Source: OBR

Fiscal and financial risks may be discussed separately, but they are very much intertwined, both being at the whim of what can be swiftly changing sentiment in markets. As for the fiscal side, the OBR used its Fiscal Risks and Sustainability report to stress that efforts to put the UK’s public finances on a sustainable footing after a series of global shocks have met with only limited and temporary success in recent years, leaving the UK with the sixth-highest debt, fifth-highest deficit, and third-highest borrowing costs among 36 advanced economies and where the debt outlook has worsened repeatedly (Figure 1). Moreover, against this more vulnerable backdrop, the risks to the fiscal outlook are mounting and broadening, including: the sustainability of state and private pensions and the sector’s demand for government debt; risks to assets and liabilities on the public balance sheet and the Government’s new net financial liabilities target; and the combined costs of climate damage and the net zero transition.

Meanwhile, the latest BoE Financial Policy Committee meeting record is more open about the size and possible imminence of risks facing the UK. It notes that Risks and uncertainty associated with geopolitical tensions, global fragmentation of trade and financial markets, and pressures on sovereign debt markets are still elevated, this perhaps an acknowledgement of fiscal risks. Importantly, it notes that some geopolitical risks have indeed, crystallised. Related to this, material uncertainty around the global macroeconomic outlook persists and as an open economy with a large financial sector, these risks are particularly relevant to UK financial stability. The question is whether the BoE is going to remain an observer and commentator on such risks or help to alleviate them?