UK Labor Market: Now not Less Tight but Genuinely Loose

It is clear(er) that the labor market is the key variable that the BoE is looking at to assess policy amid a backdrop where the official view is that current demand weakness may not be creating much, if any, slack as the supply side is equally anaemic. In this regard, it is also clear(er) that the BoE conclusion is that the labor market is loosening. However, we would underscore that rather than a loosening meaning the labor market is less tight, the data now suggest that the labor market is actually loose and therefore characteristic of genuine slack in the economy. Of course there is an array of other factors shaping MPC thinking, not least trade matters and BoE balance sheet considerations. But with genuine slack emerging earlier and more sizeably that existing BoE thinking, this points to the BoE easing further in H2 by at least 50 bp and maybe faster and then into 2026 too.

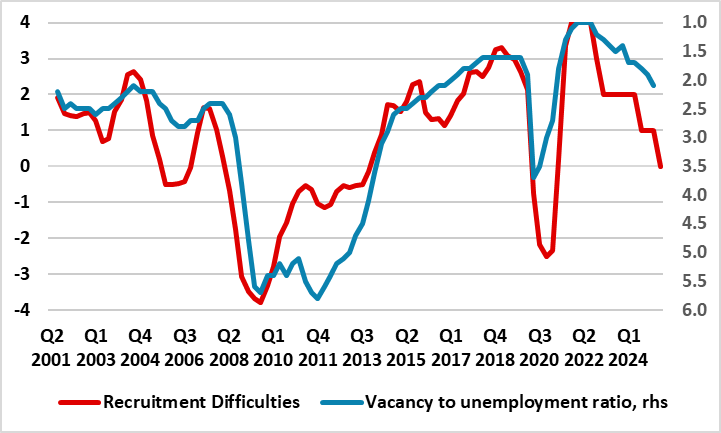

Figure 1: Alternative Measures of Labor Market Slack Suggest Looseness

Source: ONS, BoE Agents Survey

This month’s stable BoE policy decision was always the most likely (Bank Rate staying at 4.25%) as the MPC discussed its two alternative scenarios still, but possibly where hawks have been forced into diluting what were previous concerns about a ‘tight’ labor market. In fact, partly based on what was seen as a ‘material further loosening in labour market conditions’, Dep Governor Ramsden added to dissents and has since used a keynote speech to emphasize his focus on the labour market, since, notwithstanding all the global events, that is where he judges the most material developments have been in recent months.

Of course, any labor market analysis is complicated by well-advertised shortcomings with much of official labor market data. This does mean that the emphasis that the BoE has started to place on one key variable (ie the ratio of vacancies to unemployment – the v/u ratio) will also have questions about its accuracy, albeit where vacancy data is considered to be more reliable given its much higher survey response rate (ie around 75%). What the data does show is that amid what have been a marked fall in vacancies – the estimated number of vacancies in the UK fell by 7.9% q/q in March to May 2025, a 35th consecutive quarterly decline – market conditions have clearly loosened. But these v/u numbers are not that up-to-date, partly as they are based on three-month moving averages and where they are also partly compromised by the possibly spurious unemployment figures.

However, there are alternative data insights, many of which the BoE follow and highlight but seemingly do not prioritise, even if they also seem to be more topical. There are more anecdotal indicators; a potential leading indicator of swings in the labor market ahead is the clear rise in Google searches for redundancy now very much evident. But among the BoE’s own compiled data is the Banks Agents survey data which provides judgement-based scores (of 5/-5) on a series of economic conditions, reflecting the Agents’ conversations with businesses. One variable is asking companies about recruitment difficulties and as the BoE itself notes that this has been a pretty reliable leading indicator of the v/u ratio historically (Figure 1) and is more up-to-data the last observation being for May. But this long-standing survey variable is now saying three important things. Firstly, recruitment difficulties have fallen to levels both prior to the pandemic and to below its long-term average. Secondly, they have fallen appreciably of late, adding to signs of a weaker labor market from other sources such as actual payrolls. Thirdly, they have fallen to a degree faster and more sizeable that the official v/u ratio has. All of which suggest that labor market is not just less tight as the BoE seems to contend still but is actually now loose and thus symptomatic of genuine slack.