UK GDP Preview (Feb 13): Weakness Continues, if not Deepens?

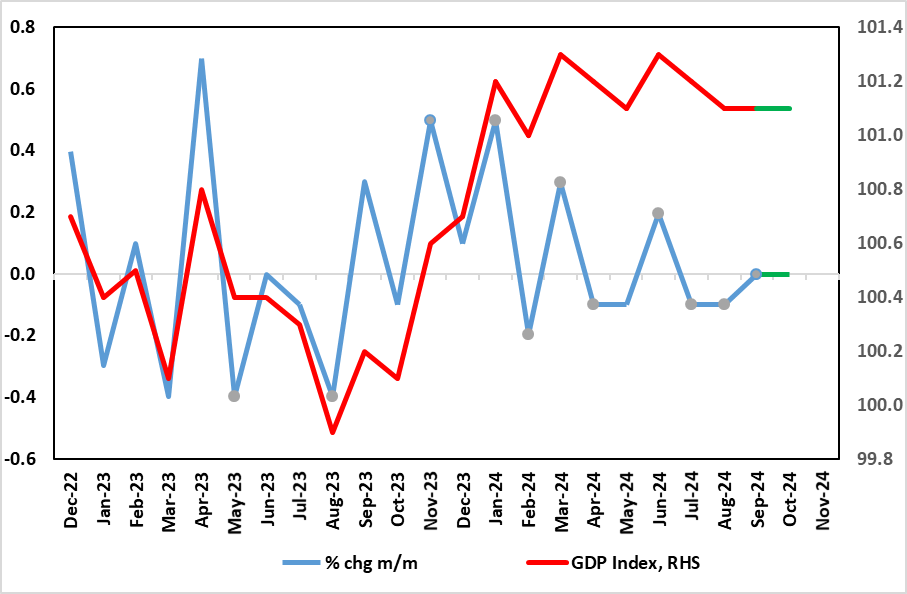

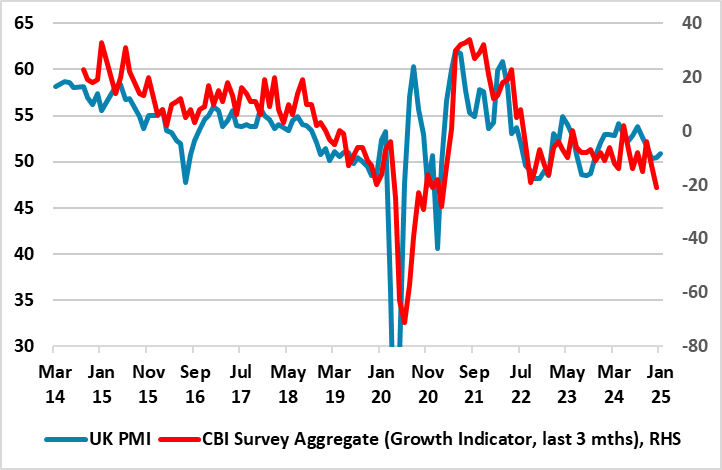

Recent data add to already-growing questions about the UK’s economy’s apparent solidity, if not strength, as seen in sizeable q/q gains in the first two quarters of the year. And those questions may be accentuated by the looming December GDP data where we see a flat m/m reading but, combined with drops in the two previous months (Figure 1), should mean that Q4 numbers (released alongside) see the first drop in five quarters at -0.1% q/q. Indeed, without revisions, December GDP needs to rise 0.2% m/m to avoid a Q4 fall but where mild, wet and stormy weather (which may already have caused a drop in December retailing) argue against any such a rise. Moreover, this poses the likelihood of the BoE GDP estimate being undershot for a second successive quarter adding to BoE growth concerns that are also being fanned by business survey data (Figure 3).

Figure 1: Momentum Ebbing?

Source: ONS

As we envisaged, November saw hardly any growth, this almost 0.1% rise came after October saw a second successive m/m drop of 0.1%, all below expectations, this adding to what have now been only three positive outcomes in the last eight months of data a period in which the economy has ‘shrunk’ a cumulative 0.1%. This backdrop included evidence that the economy actually fell again in terms of private sector activity in November. Thus the soft November must be seen in that weak and pared-back context and the likelihood remains that Q4 2024 may have seen a small q/q contraction.

This all the more notable as it suggests a weaker trend that dates back prior to the election of the new government let alone its October Budget and its mixed policy measures. Although most evident in a further drop in manufacturing, the data do also suggest weaker services of late. While monthly real gross domestic product is estimated to have grown by 0.1% in November 2024 largely because of modest rebound in services in which the latter output grew by 0.1% in November 2024, it showed no growth in the three months to November 2024. Otherwise, production output fell by 0.4% in November 2024, following an unrevised fall of 0.6% in October 2024; production fell by 0.7% in the three months to November 2024, driven by a decline in manufacturing. Construction output grew by 0.4% in November 2024, following a fall of 0.3% in October 2024 (revised up from a fall of 0.4% in our last release); construction also grew by 0.2% in the three months to November 2024. But the whole economy was boosted by the public sector – again!

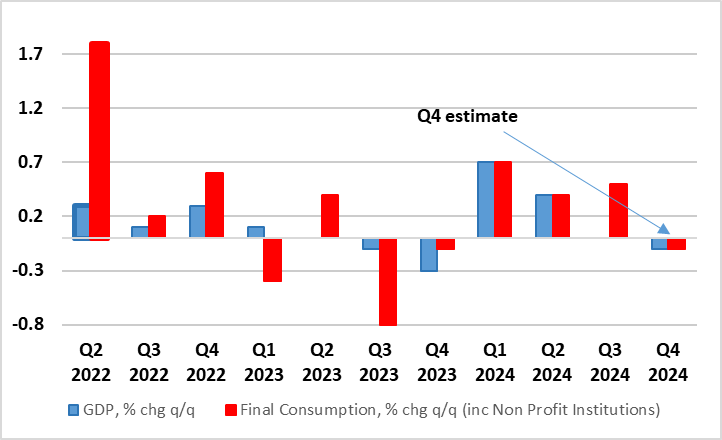

As for Q4, we see consumer spending dipping (Figure 2), thereby chiming with retail sales softness in the quarter. Other part of the Q4 breakdown are likely to remain weak too, the question being the extent to which some support to GDP maybe granted by weak domestic demand curtailing imports once again.

Regardless, and as suggested above, this weaker GDP backdrop is something that chimes more with labor market and public borrowing data and where HMRC payrolls paint a much softer backdrop and possible outlook. However, while the BoE may still look to a clear recovery into 2025, any further signs that Budget apprehension and what may now be damaged business and consumer confidence from actual fiscal measures may warrant a reassessment, especially given what looks to be a weak economic picture in neighboring Eurozone.

Figure 2: Consumer Faltering?

Source: ONS

Certainly business surveys are offering warning signs (Figure 3), these clearly suggesting momentum not just ebbing but possibly going into reverse. This is an important consideration for the likes of the BoE whose projections have had to be downgraded repeatedly of late; the MPC had projected a more upbeat 0.3% GDP rise for the last quarter, albeit that pared back to a zero projection in an update last month.

To the BoE, the weaker GDP backdrop has been something of a surprise, but critically any policy response depends on the extent to which softer activity reflects demand and/or supply factors. It does seem as if the BoE blames demand as the main culprit at least more recently, both as price pressures still seem to be receding and as its own models implies that demand shocks may have turned negative in Q3 of this year, having been more positive at the start of the year In addition, as trends in supply are particularly uncertain at the moment, it is difficult to identify where exactly a supply shock could be coming from, this view recently expressed by MPC member Breeden.

Figure 3: Surveys Suggest Downside Risks?

Source: Markit, CBI, % balances