UK CPI Preview (May 21): How Big and Durable a Surge?

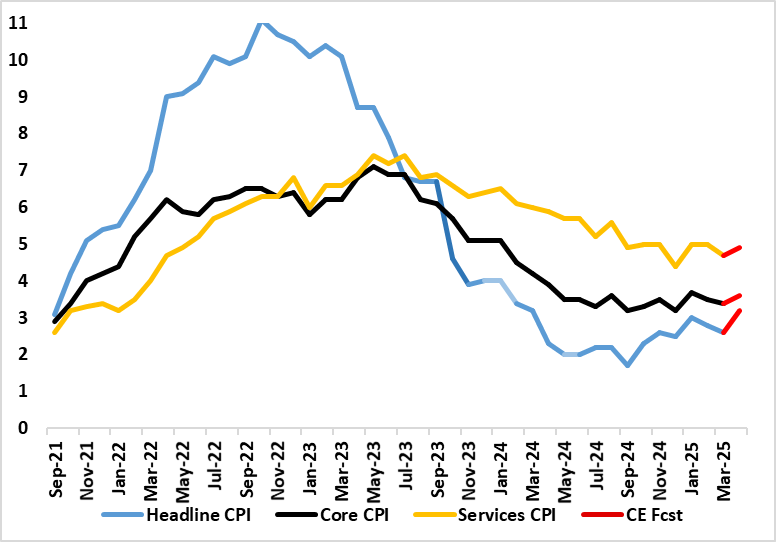

The UK and the rest of the DM world are about to decouple, at least in terms of inflation, where the UK faces a surge, (largely home-grown) just as W European sees their respective inflation fall back to, if not below, targets. Although relegated by current market ructions and tariff threats, the main near-term inflation story was (and remains) what happens in the April data when a series of energy, utility, post office and some other regulated and service price rises are due, albeit now offset somewhat by a fall in petrol prices if the slump in energy prices persists. Indeed, this array of rises, all domestically generated, should see headline CPI inflation rise from 2.6% to 3.2%, with the BoE opting for a larger rise to 3.4%.

Figure 1: April CPI Inflation to Jump Broadly – albeit Temporarily?

Source: ONS, Continuum Economics

We see inflation peaking at this April level albeit with some dip before the rate returns (briefly) to 3.2% in September, this latter outcome some 0.5 ppt below BoE thinking. As for BoE rate cutting, we think upside surprises would have to dislodge the MPC from cutting at least twice more this year.

As for recent trends, the March data was something of a side issue even though they did show headline CPI inflation retreating a little further. Indeed, the headline fell 0.2 ppt for a second successive month to 2.6%, a notch below both consensus and BoE thinking. Core inflation dropped a notch to 3.4%, while services retreated 0.3 ppt to 4.7%, this still nothing more than 3-mth low. There was no additional sign of softer clothing but rental inflation eased additionally, both still possible signs that weak consumers are starting to rein in pricing power. Regardless, the slowing in the headline rate into March 2025 reflected downward contributions from seven (out of 12) divisions, partially offset by upward contributions from two divisions. The largest downward contributions came from recreation and culture, housing and household services, transport, and restaurants and hotels.

Regardless, while overall inflation did drop back further in March we acknowledge that the headline will spike back higher in April as a series of regulated and services prices (eg water and phone bills) and energy costs take effect. Indeed, inflation may now average around 3% in both Q2 and Q3, some one ppt higher than previously thought but still well below the 3.7% rate that the BoE now projects but with downside risk given that recent market turmoil could mean that petrol prices in April knock inflation back some 0.3 ppt, albeit where lower oil prices feeding though into retailing very slowly. But higher utility bills will push up services and core inflation – at least temporarily.

Notably, these added price pressures are hardly demand determined even though largely of domestic origin and may accentuate already weak growth, thereby further restraining company pricing power, but where the BoE will now be (or should be) shifting its concerns from alleged price persistence to assessing and minimising downside activity risks from the tariff (both direct and indirect).