UK CPI Review (May 21): How Durable a Surge?

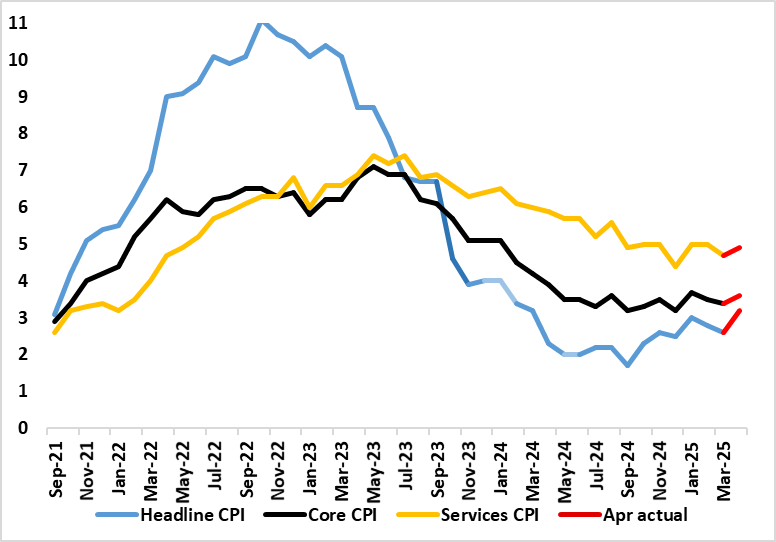

The UK and the rest of the DM world are now decoupling, at least in terms of inflation, where the UK is seeing a surge, (largely home-grown) just as W European sees their respective inflation fall back to, if not below, targets – although some measures if underling EZ inflation have started to edge back up. Regardless, as for the UK, the main near-term inflation story was (and remains) what would happen in the April data when a series of energy, utility, post office and some other regulated and service price rises are due, albeit now offset somewhat by a fall in petrol prices if the slump in energy prices persists. The result was a notch higher than the BoE expected with a jump to 3.5%, a rise dominated by a pick-up in services, some of which (ie airfares) may be temporary. The data may have persuaded the MC not to cut earlier this month but at the same time there is no clear fresh inflation spiral with six of 12 CPI components seeing softer pressures and where consumer sensitive clothing and household equipment actually turned negative, possible a sign of reined in pricing power.

Figure 1: April CPI Inflation Jump Broadly – Albeit Temporarily?

Source: ONS, Continuum Economics

We see inflation peaking at this April level albeit with some dip before the rate returns (briefly) to (around) 3.5% in September, this latter outcome some 0.2 ppt below BoE thinking. As for BoE rate cutting, we think upside surprises would have to dislodge the MPC from cutting at least twice more this year albeit it clear that the MPC will remain divided, if not more so, even against a backdrop where there is a general view that policy restriction needs to reduced, the difference being over how fast given worries about price persistence (see below).

As for recent trends, the April numbers were dominated by services. Airfare prices rose by 27.5% on the month, up from 6.5% a year ago. This was the second-highest monthly rise for an April since records began and very much reflects the timing of Easter which should mean airfares drop back in May. The rise in the headline rate reflected large upward effects from gas and electricity, which resulted from the raising of the Office of Gas and Electricity Markets energy price cap in April 2025. Prices of water and sewerage rose by 26.1% in the month to April 2025 compared with a rise of 8.1% a year ago. This is the largest rise since at least February 1988.

But there was a further downward contributions came from clothing fuels, household goods and restaurants and hotels, the latter often seen as a lead indicator for services inflation.

Notably, the high-profile added price pressures that hit the headline are hardly demand determined even though largely of domestic origin and may accentuate already weak growth, thereby further restraining company pricing power, but where the BoE will now be (or should be) shifting its concerns from alleged price persistence to assessing and minimising downside activity risks from the tariff (both direct and indirect).

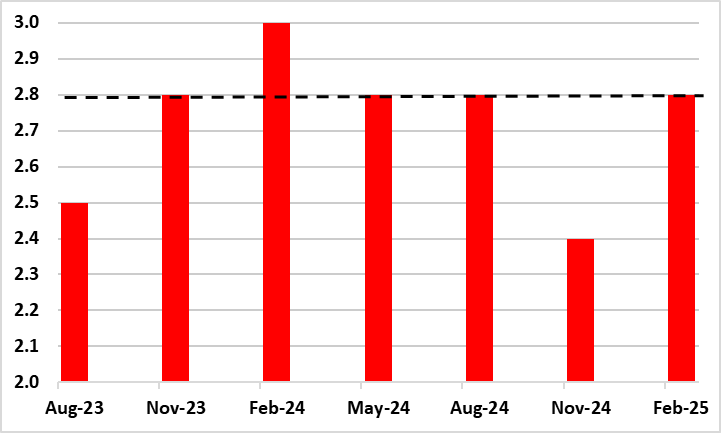

One reason for this still optimistic outlook is an alternative and more reassuring assessment of the labor market and cost pressures. To suggest that the UK labor market is merely getting less tight misses the point entirely. Amid continued reservations about the accuracy of official labor market data produced by the ONS, alternative and very clearly more authoritative data on payrolls suggest that employment is continuing to contract. Indeed, the payroll data produced by the HMRC, have now show six m/m falls since the level of payrolls peaked nine months ago. Admittedly, the drop in this five-month period is only 0.1%, but this is a marked contrast to the 1.4% increase official data suggest has occurred in the last year. More notably, overall payrolls have been buttressed by sizeable public sector employment gains to a degree that private payrolls in the last five months are down almost 100K (ie -0.5%). Moreover, amid fiscal strains, non-health public sector jobs have now started to fall too, compounding what has been an ever clearer haemorrhaging of jobs in private services, thereby suggesting that cost pressures (now accentuated by the looming increase in employee National Insurance Contributions and the actual rise in the minimum wage) have already affected the labor market severely. Notably, BoE Chief Economist Pill used a keynote speech to discuss his reservation about the current pace of BoE easing. He suggested higher than expected pay pressures were signs of price persistence. This is debateable, not least as overall CPI inflation has largely met BoE expectation (Figure 2 shows the last seven projections for Q125 from the last seven MPRs), raising questions about the broad thrust of the BoE inflation forecasts – has the MPC under-estimated non-wage cost and price pressures?

Figure 2: BoE Inflation Forecasts Largely Accurate Even if Wages Have Exceed its Thinking

Source; BoE, dashed line is Q125 actual outcome for CPI headline