UK: Tax Rises Looming?

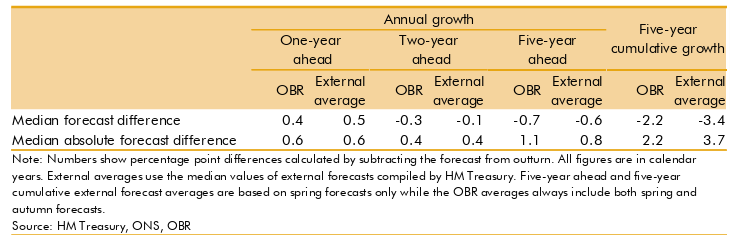

The politically damaging climb-down on welfare spending yesterday also saw the government face an additional fiscal hole after the fiscal watchdog (the Office for Budget Responsibility, OBR) hinted it has been repeatedly overestimating growth. Indeed, in its annual Forecast Evaluation Report, it suggested that it had been over-optimistic on GDP growth by an average of 0.7 ppt at the five-year horizon (Figure 1). Given the lack of welfare cuts, other spending commitments and a likely downgrade to the average 1.8% per year growth forecast the OBR has between 2026 and 2029, an overall fiscal hole of (well) over £ 10 bln now exists, this wiping out the budgetary leeway recently boosted in the government fiscal goal. Tax rises loom, the question is who may be the Chancellor carrying out such actions?

Figure 1: Average forecast differences: Real GDP growth – OBR vs Elsewhere

Source: OBR 2025 Forecast Evaluation Report

Yesterday the government managed to push through a spending bill, but one that was very much diluted in order to win support from its own sceptical backbenchers. As a result, the fiscal damage could be enough so that the government money may actually lose effective money after it was initially intended to generate net savings of £5 bln. This comes after the abolition of cutting winter fuel payments to pensioner may an additional £1.25 bln and the possibility of ending a welfare cap which could cost another £ 3.5 bln. Together these wipe out entirely the all of the £9.9 bln of headroom or leeway that Chancellor Reeves rebuilt to adhere to her fiscal rules in her Spring Statement in March. Although the OBR also noted it has been pessimistic on a shorter-term horizon (Figure 1), any upgrade to near term forecasts seems unlikely in its autumn forecast update. Meanwhile, the likely OBR longer-term GDP growth downgrade would only accentuate a likely fiscal overspend possibly by some sizeable amount, especially if this encompasses a downgrade to what many think is an optimistic OBR assumption about potential growth – this sees potential output growth falling from 1.5% in 2024 to 1.25 in 2025 but then picks up gradually to 1.8% so that potential output growth averages 1.6% in the four years from 2026 to 2029.

Obviously the choices are change the fiscal rules, more spending cuts, more borrowing or tax rises. As for the spending, a recent very tight three-year Spending Review has restricted everyday spending by government departments to only 1.3% in real terms from 2026 onwards and where some departments face real terms cuts. Borrowing more looks difficult given what seems to be congestion in the gilt market that has the BoE hinting it may rein its part if its QT program. Tinkering with fiscal rules that are only a year old may damage already damaged fiscal credibility. This leaves tax, but where changes to the main three revenue-raisers: income tax, VAT and employee National Insurance contributions – have been and remain ruled out. (Even) tighter fiscal policy beckons!