UK GDP Review: Surprise Resilience

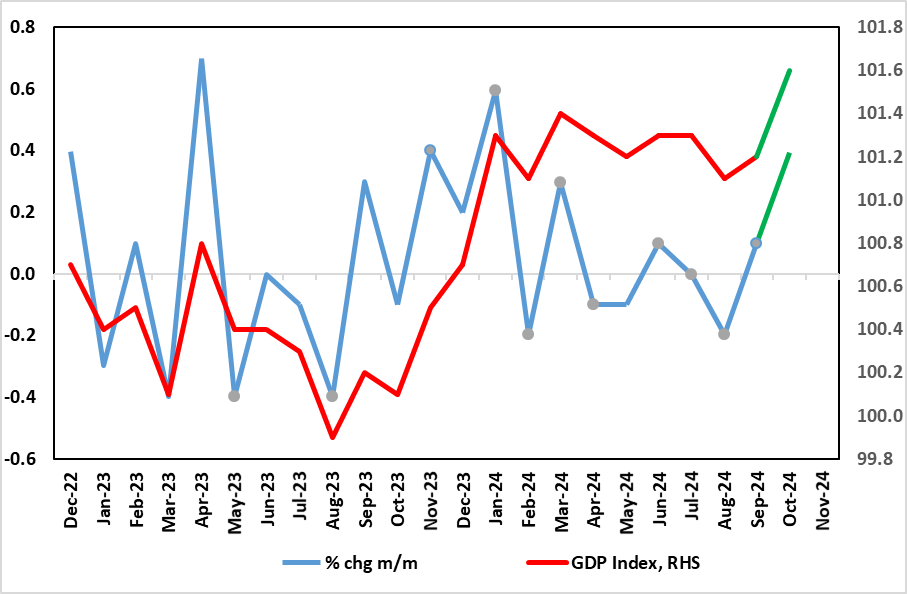

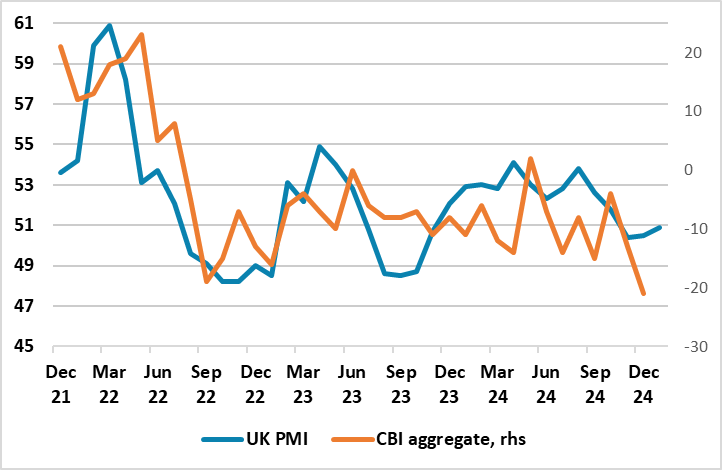

GDP data for the end of 2024 very much surprised on the upside albeit still failing to convey an impression of UK’s economy displaying solidity, if not strength. Admittedly GDP rose by 0.4% m/m in December, the largest such gain in 11 months (Figure 1) and enough to have allowed Q4 see growth of 0.1% as opposed to the largely expected same-sized fall. The data means the economy grew 0.9% in 2024 but amid what looks to be a possible involuntary rise in inventories that supported Q4 GDP and a suspect (ie survey conflicting) jump in manufacturing that boosted December numbers, we doubt that genuine fresh momentum has emerged – GDP per head actually fell. Indeed, we still see growth around 0.7-0.8% for the whole of this year, despite the looming fiscal boost that has persuaded some forecasters to upgrade their projection for the year. Instead we note the sobering message from business surveys (Figure 2) as well as from payroll data, all more consistent with tepid growth rather than the upbeat growth aspiration of the government.

Figure 1: Momentum Recovering Amid Continued Downside Risks?

Source: ONS

As we envisaged, November saw hardly any growth, this almost-0.1% rise came after October saw a second successive m/m drop of 0.1%, all below expectations. But the December rise changes this somewhat even though GDP has declines in half of the last eight months of data during which the economy has growth a mere 0.4%,

This all the more notable as it suggests a weaker trend that dates back prior to the election of the new government let alone its October Budget and its mixed policy measures. Indeed, the Q4 picture shows no growth in consumer spending and a fall in business investment and with the growth very much a result of a build in inventories, albeit this partly offset by a jump in imports.

Figure 2: Surveys Suggest Downside Risks?

Source: Markit, CBI

Regardless, and as suggested above, our relative weaker GDP outlook is something that chimes more with soft survey data (Figure 2) and public borrowing data and where HMRC payrolls paint a much softer backdrop and possible outlook. However, while the BoE may still look to a clear recovery later in 2025, any further signs that Budget apprehension and what may now be damaged business and consumer confidence from actual fiscal measures may warrant a reassessment, especially given what looks to be a weak economic picture in neighbouring Eurozone.