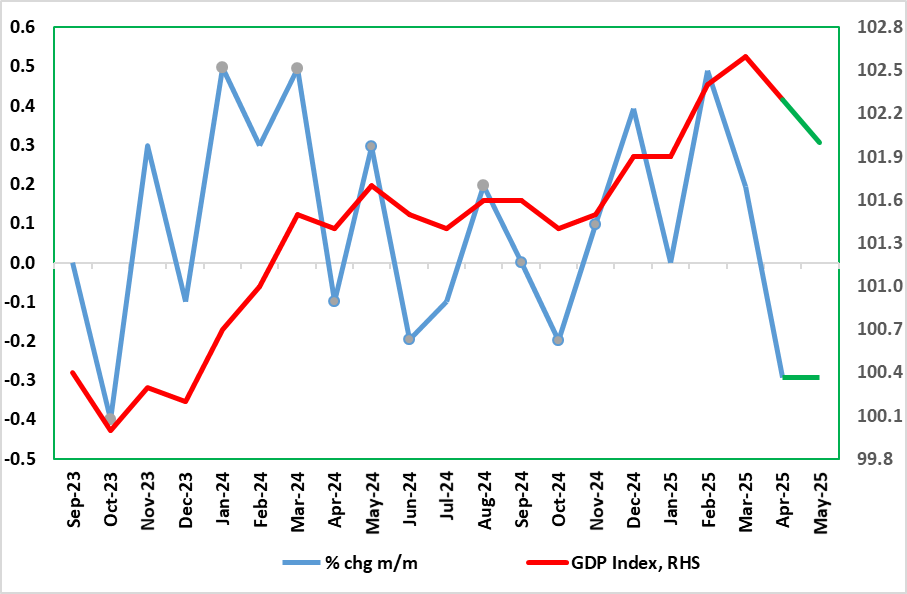

UK GDP Preview (Jul 11): Another Large Downside Surprise?

After two successive upside surprises, a correction back in monthly GDP was not entirely a wholesale surprise for April GDP. But we see that 0.3% m/m drop being repeated in the looming May numbers (Figure 1), thereby adding to a gloomier economic backdrop most recently highlighted by growing signs 0f labor market weakness. As a result, we think that Q2 GDP will fall 0.2% in q/q terms and may be almost as weak in Q3, the former undershooting BoE thinking of a rise of around 0.25%. The weakness we envisage chimes with business surveys (Figure 2), payrolls and tax outcomes. If this soft(er) pattern persists (let alone if it is even worse , then the BoE’s relative complacency regarding the economy is likely to shift and possibly rapidly so.

Figure 1: GDP to Fall Again?

Source: ONS, CE, projection in green

Indeed, there may even be downside risks to that projected 0.3% May drop, not least as the 3-mth rate would still be a positive 0.2%. This is especially as Q1 numbers may have been boosted by added production destined for the U.S in anticipation of tariffs, this evident in an industry reported slump in car production for the month of some 25% m/m (ie enough to knock GDP by 0.2 ppt itself. In addition, real estate activity seems to have dropped after the raising of effective stamp duty. Moreover, we already know that retail sales dropped clearly in May, this alone also potentially knocking m/m GDP down by over 0.2 ppt. Finally, utility output may drop afresh, it still being at elevated levels even after the April fall.

Perhaps more notably and something policy makers should bear in mind, the data volatility of late suggest what may be changing seasonal factors post pandemic which may mean the UK economy in early 2025 is seeing similar but short-lived strong growth as seen in in the same period of last year – thus any solid Q1 gain needs to be put into that perspective. But even amid a BoE view of near zero growth underlying envisaged this quarter, we think the Bank is too optimistic about both the current state of the economy and the medium-term outlook, not least as it as its 1.5% average consumer spending n forecast for 2025-26 does not seem to have taken any toll from the higher inflation it has pointed to. And of course there is the global trade uncertainty which is going to hit continental Europe possible a protracted basis.

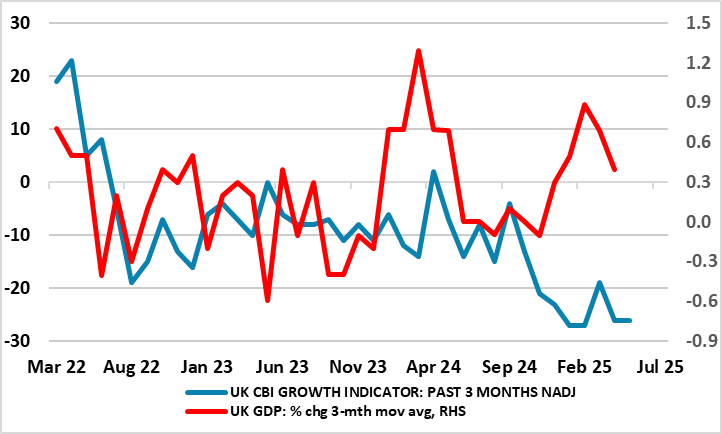

Against this backdrop, it not surprising how payroll and business surveys are now flagging a slumping activity outlook (Figure 2). Admittedly, PMI survey numbers are less downbeat than numbers emanating from the CBI, whose survey numbers are somewhat more broad-based than the former’s high-profile composite index. But the PMI also tell a weaker story once its construction survey is included! With this in mind, we envisage drops of between 0.1%-0.2% q/q in both Q2 and Q3 GDP and only around 0.8% for the whole of both 2025 and 2026. At this juncture, next year actually sees a better underlying tone but this could prove optimistic given likely fiscal tightening.

Figure 2: Official Data Momentum Contrasts with Downside Risks From Surveys?

Source: ONS, CBI Growth Indictor which combines results from three separate sector surveys

As suggested above, business surveys had continued to point to weak underlying GDP growth. But textual analysis of PMI responses by BoE staff suggested that global concerns had played a larger role in its weakness over recent months, relative to domestic factors. That may now be swinging the other way around but a key question being whether such developments in output also need to be considered in the wider context of the supply side of the economy, although with ever clearer slack in the labour market and within companies emerging, out weakness looks more demand determined. Regardless, if our May GDP projection proves anything like accurate, it is not a question of whether the BoE will ease next month but if it flags somewhat faster possible additional cuts, even if its updated forecast will not encompass the likely tighter fiscal outlook.