BoE Preview (Feb 6): Clearer Dovish Message to Markets?

Back in early December, BoE Governor Bailey suggested very openly in an FT interview that highlighted that the market path in the November forecast was conditioned on four rate cuts this year, this largely a result of inflation having come down “faster than we thought it would.” And while the BoE kept policy on hold later last month, there were three dissents in favor of cutting at that juncture. Since when other members of the MPC have suggested policy restrictiveness needs to be eased, making a further 25 bp move at the February 6 verdict very much a done-deal. But with weaker real economy and inflation data coming alongside market rate expectations still some half a ppt higher than in the previous projection it does seem likely as if the updated Monetary Policy Report (MPR) will be consistent with a series of cuts this year at least as large as in the last MPR – we think that five moves from the current 4.5% are on cards.

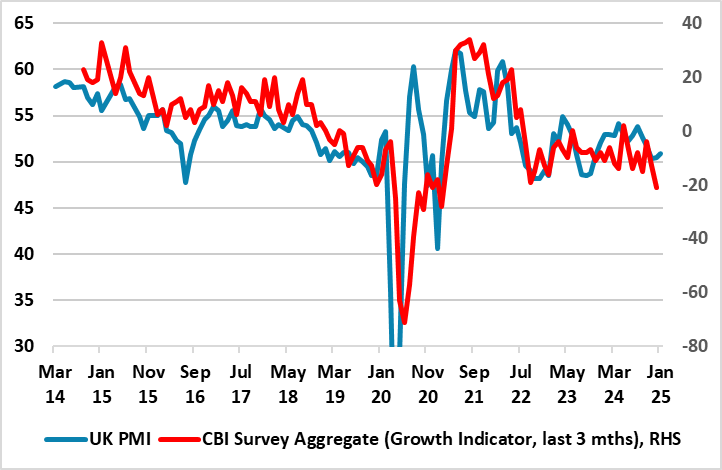

Figure 1: Surveys Pointing Down - Clearly

Source: Markit, CBI, Continuum Economics

A Softer Inflation Outlook?

The last MPR’s main inflation projection suggested a headline rate based on market discounting Bank Rate falling to 3.7% two years hence and this delivered a drop below target by mid-2027. Since when market rates have shot up albeit gyrated wildly but remain consistent with BoE rates being some 30 bp higher than assumed in the November MPR. Moreover, the economy has been weaker, not only with H2 2024 GDP likely to be some 0.5 ppt lower that the BoE projected three months ago, but where the outlook for this year looks to be much gloomier too given the manner in which private sector payrolls and now increasingly business survey data have fallen (Figure 1). Indeed, we think that GDP growth this year may be almost half the 1.5% the BoE currently estimates, largely as the recent Budget may not be anywhere near as stimulative as the MPC initially thought and where the impact of still very restrictive monetary policy is biting harder than the BoE believes – and where risks from abroad (weak EZ, soft China, trade war threat) add to downside risks. All of which would seem to point to a larger and/or earlier undershoot of the inflation target that seen in November.

Softer Services Emerging

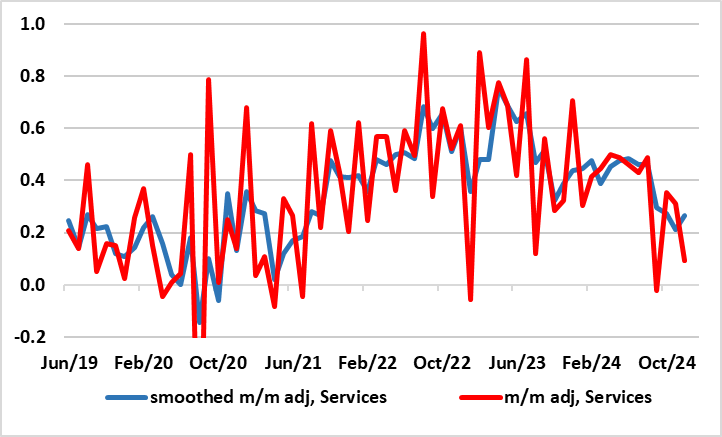

Admittedly, the hawkish view on the MPC is that recent real activity weakness it as much, if not more, on the supply side of the economy – notably the February MPR will conduct the annual review of the economy’s supply side and is likely to retain an on-going assumption that trend growth is little more than 1%. Moreover, it is likely very much to suggest that the labor market has loosened, if not being back below neutral. This may seem at odds with what seem to be still high average earnings data, but we think these numbers are in accurate, affected by survey responses and compositional factors. Alternative data based on payrolls suggest a somewhat softer pay backdrop, this possibly explaining what we think are emerging signs of a softening in hitherto resilient services inflation. Indeed, seasonally adjusted m/m data for services are already painting much more reassuring picture, thereby suggesting that the surprise drop in the y/y figure for services in the December CPI was not a mere aberration.

Figure 2: Softer Services Inflation Picture?

Source: ONS, Continuum Economics

Offering Messages

Against this backdrop, we think that the BoE will not only meet expectations by cutting rates afresh next week, but will encourage markets to think that that there will be more than the 2-3 cuts currently priced in. This may be done by maintaining an outlook still based on posturing several scenarios but with a clearer emphasis on one consistent with easing policy. The question perhaps is if the incentive to do is that persistently high market rates may not only damage the economy directly but could have second-round impact by forcing a tightening in fiscal policy as current budget targets would otherwise be in danger of being missed! But the policy outlook will still be clouded somewhat by uncertainty as to what constitutes a neutral and/or terminal rate - we think this is not that much different to the 2% level that many at the ECB think is applicable to the EZ.