UK Labor Market – A Tale of Two Labor Markets?

Policy-making is fraught with difficult decision making at the best of times. But at present in the UK, such decisions are made all the more problematic given inconsistencies, if not conflicts, in the data backdrop, thereby making any reading of the economy all the more subjective. Is employment and wage growth rising or falling, and if as we suggest it is the latter, then recent GDP strength looks all the more suspect. What does seem clear(er) is that it is no longer a case of the UK labor market merely getting less tight, but is at best neutral now that participation rates have risen back to their pre-pandemic average. But possibly in anticipation of looming labor costs rises, vacancies are clearly falling, this making the case for weaker employment and wage growth all the more compelling. The data clearly support the case for more BoE easing, even before the threat/reality of U.S. tariffs adds to the headwinds the economy is facing.

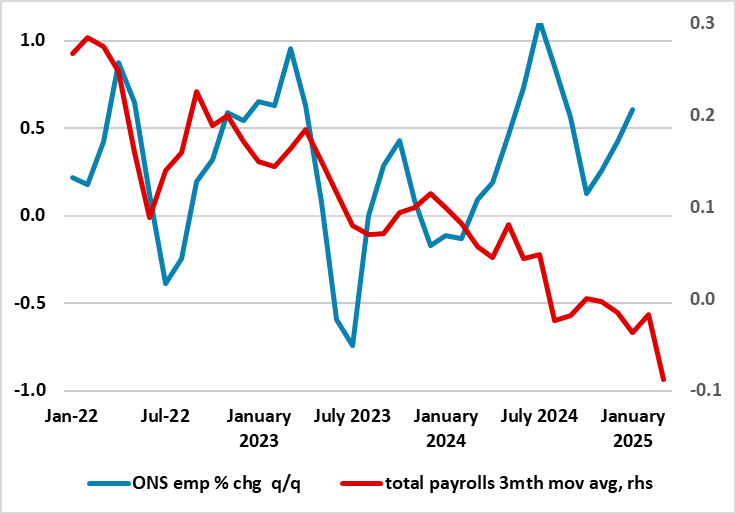

Figure 1: Sharp(er) Fall in Payrolls Contrast Increasingly with Still-Strong Official Jobs Messages

Source; ONS, HMRC

Amid continued reservations about the accuracy of official labor market data produced by the ONS, alternative and very clearly more authoritative data on payrolls suggest that employment is continuing to contract, and possibly much more clearly in these March numbers (Figure 1). Indeed, the payroll data produced by the HMRC, have now show seven m/m falls since the level of payrolls peaked ten months ago, this weakness also chiming with the sobering messages from business surveys. Admittedly, the drop in this ten-month period is only 0.3%, but this is a marked contrast to the 2.1% increase official data suggest has occurred in the last year. More notably, overall payrolls have been buttressed by sizeable public sector employment gains to a degree that private payrolls in the last five months are down almost a full ppt. Moreover, amid fiscal strains, non-health public sector jobs have now started to fall too, compounding what has been an ever clearer haemorrhaging of jobs in private services, thereby suggesting that cost pressures (now accentuated by the looming increase in employee National Insurance Contributions and the actual rise in the minimum wage) have already affected the labor market severely.

Moreover, this conflict in employment strength between official ONS) data and that from HMRC is also visible in wage data with the latest HMRC data showing somewhat softer wage pressures down to below 5% But there is even clearer contrast, if not conflicts, in the array of labor market data!

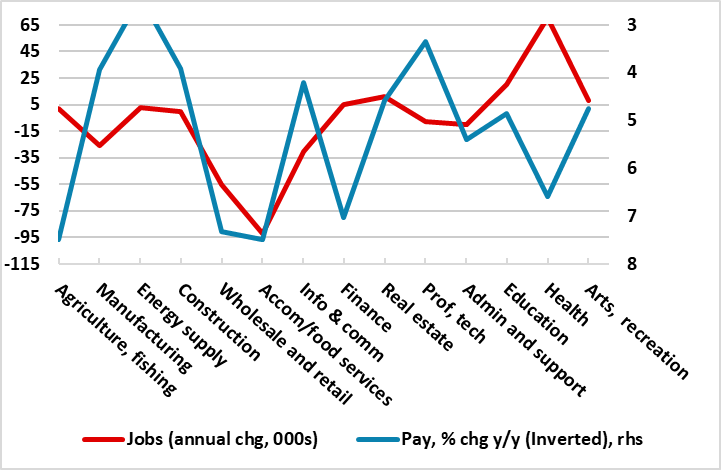

The National Insurance changes taking effect this month mirror similar moves seen of late (eg 2022, 2011 and 2003) what happened then is that Labour intensive sectors and other service-based sectors reduced both headcounts and vacancies either in anticipation or immediately after the change was effective. This already seems to be happening, but possibly as much to already rising pay bills as to the threat if even higher labor costs to come. Indeed, as Figure 2 illustrates, the labor market is working as it should do, with sectors where pay is the highest seeing falling payrolls as companies try to adjust to already high pay bills by curbing jobs to limit the rise in labor costs that otherwise would either/both hit profit margins and raise the prospect of higher consumer prices.

Figure 2: Sectors Facing Highest Pay Growth Seeing Clearest Job Shedding

Source; HMRC

This is one the main reasons why we think he BoE is too concerned about the overall inflation outlook as (to us) we see companies are already acting to rein in their labor cost bills for fear that raising prices may only serve to reduce demand. Indeed, as Figure 2 illustrates there is already a clear and inverse relationship between employment changes and pay growth, the exception being health where government spending initiatives are both trying to repair real pay and actual output in the sector, but where cost cutting looms here too. The UK is facing clear and probably increased headwinds that BoE rate cuts can help the economy to navigate through somewhat better.