UK GDP Preview (Jun 12): GDP Still Overstating Activity?

After two successive monthly upside surprises, a correction back in GDP could be expected for the upcoming April data, especially as Q1 numbers may have been boosted by added production destined for the U.S in anticipation of tariffs. In addition, real estate activity seems to have slumped after the raising of effective stamp duty in April. But we already know that retail sales rose clearly in the month and it is hard to see GDP moving dramatically in the opposite direction as a result. Moreover, activity (at least outside of utilities) may have been boosted elsewhere by record sunshine and temperatures during April, this the likely reason behind the retail sales jump. Combining these factors, we see a flat m/m April GDP outcome, enough to pull the 3-mth rate t0 an 11-month high of 0.8% (Figure 1) and where it may be difficult for Q2 GDP to be negative. But we remain suspicious of any such strength, not least given anecdotal and survey evidence increasing to the contrary (Figure 2) which suggest an even weaker picture than the BoE acknowledges.

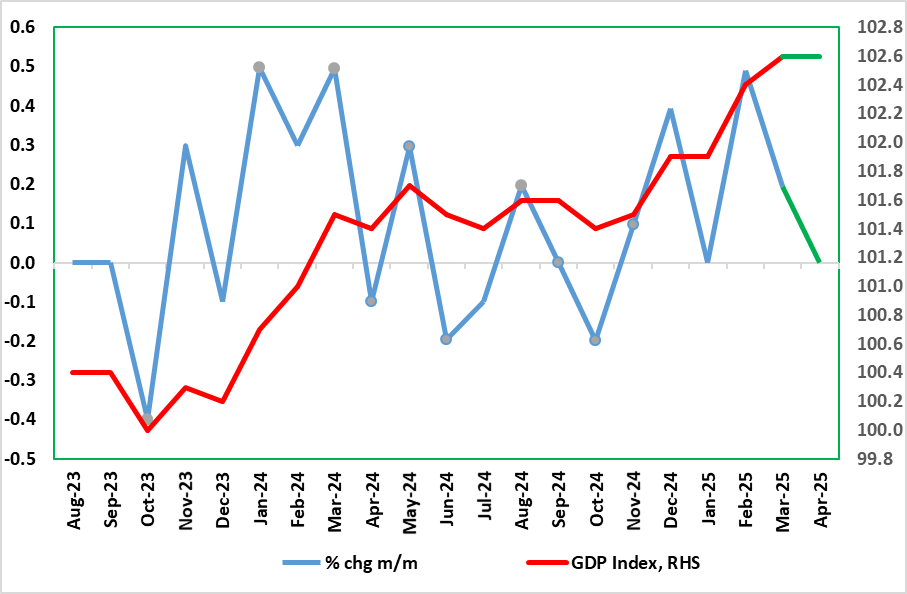

Figure 1: Actual GDP Looking Far Better into Early 2025 as in Early 2024

Source: ONS, green denotes latest outcome

First some recent perspective. National account data delivered yet another upside surprise both in terms of the latest monthly figure and also the associated Q1 update. Indeed, February GDP, rather than consolidating in the March GDP release with a flat m/m reading, instead grew by 0.2% (Figure 1), a fifth successive non-negative outcome, led this time by services. Partly as a result, Q1 GDP rose by 0.7%, boosted both by exports and business investment. Notably, consumer spending rose a tame 0.2%, possibly a result of higher household inflation in the quarter, this worrying given the more marked rise seen through this and the coming quarter in regard to price pressures. The data is unlikely to make any difference to BoE thinking which foresaw a 0.6% Q1 rise and one that still led to a marginal emergence of an output gap, this reflecting a (very justifiable) BoE view that the official data are overstating actual activity which is more likely to have been near zero last quarter with a similar, if not weaker, picture envisaged for the current quarter.

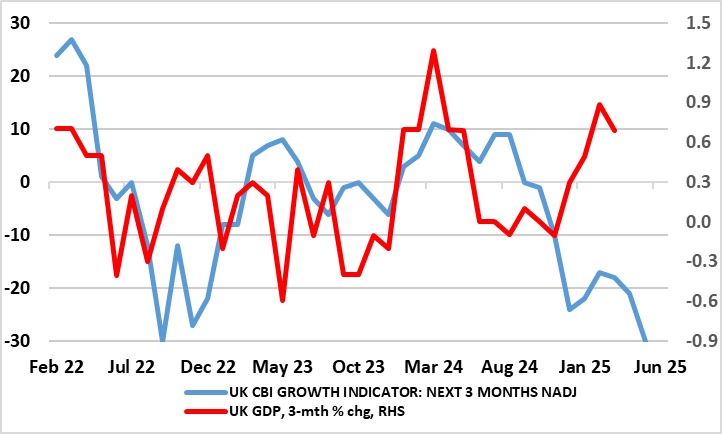

Figure 2: Official Data Momentum Contrasts with Downside Risks From Surveys?

Source: ONS, CBI Growth Indicator which combines results from three separate sector surveys

Perhaps more notably and something policy makers should bear in mind, the data volatility of late suggest what may be changing seasonal factors post pandemic which may mean the UK economy in early 2025 is seeing similar but short-lived strong growth as seen in in the same period of last year – thus any solid Q1 gain needs to be put into that perspective. But even amid a BoE view of near zero growth envisaged this year, we think the Bank is too optimistic about both the current state of the economy and the medium-term outlook, not least as it as its 1.5% average consumer spending n forecast for 2025-26 does not seem to have taken any toll from the higher inflation it has pointed to. And of course there is the global trade uncertainty which is going to hit continental Europe possible a protracted basis. Against this backdrop, it not surprising how negative business surveys are now flagging the activity outlook (Figure 2). Indeed, business survey data suggested an even weaker picture than the BoE, albeit PMI numbers less downbeat than numbers emanating from the CBI, whose survey numbers are somewhat more broad-based than the former’s high-profile composite index. But the PMI also tells a weaker story once its construction survey is included! With this in mind, we envisage zero Q2 GDP growth and only around 1% for the whole of 2025.