BoE Preview (Jun 19): Splits to Continue?

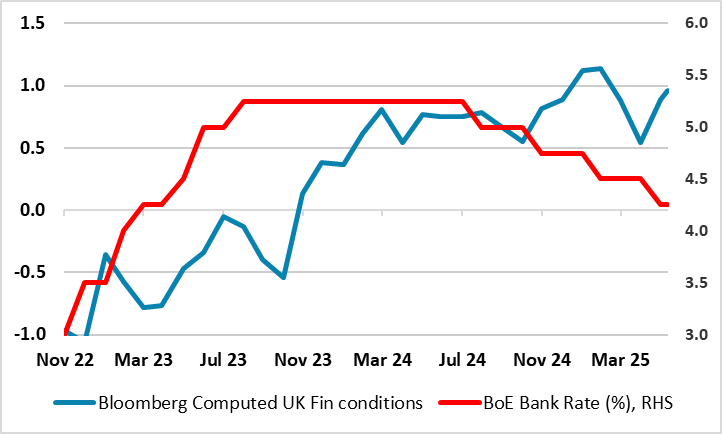

A stable BoE policy decision next Thursday is most likely (Bank Rate staying at 4.25%) as the MPC discusses various scenarios still, possibly with any hawks diluting what were previous concerns about a ‘tight’ labor market. In fact, we see two dissents in favor of a 25 bp rate cut albeit where the statement is likely to repeat the need for policy to be framed carefully as well as gradually, also repeating that monetary policy will need to continue to remain restrictive for sufficiently long. But the issue of what constitutes restriction is important (Figure 1 shows the policy rate diverging from financial conditions) as it should help determine how much further and when the BoE eases. We think that with the BoE regarding neutral policy rate as being well above 3%, two further 25 bp moves this year will be followed by another 50 bp in H1 2026. But we think the risks are for deeper and possibly faster cuts as we think the BoE is both over optimistic about growth prospects and over-estimating policy neutrality.

Figure 1: BoE Rate Cuts Not Stopping Financial Conditions Tightening

Source: BoE, CE, Bloomberg

BoE Optimism on Growth?

As for recent policy, early May saw the widely expected 25 bp Bank Rate cut (to a 2-year low of 4.25%) but which came amid a less dovish rather than a more hawkish assessment than was envisaged beforehand. While the updated Monetary Policy Report MPR) envisaged inflation falling below target almost a year earlier than seen three months earlier, this largely reflects weaker energy price assumptions alongside only a modestly larger negative output gap. Instead, a friendlier interest rate picture helped limit any damage to the BoE’s GDP outlook, this in turn meaning that the envisaged drop in inflation while earlier, does not intensify further out. Partly this reflects a BoE overall view which places much more emphasis on a possibly weaker supply side of the economy (both at home and globally) than perhaps markets have discounted, this explaining the lack of a clearer disinflationary outlook.

Financial Conditions Tightening

But to us that growth outlook has a clear downside risks, partly reflecting the uncertainty aspect from the U.S. tariff threat, something already evident in an array of data, not east payrolls and business survey numbers and also where fiscal policy will become contractionary next fiscal year. In addition, we think policy is biting harder than the BoE assumes. In fact, we think that the BoE is starting to think this way and we see that the annual rundown of gilts is likely to be slowed from £ 100 bln to £ 75bln – we will be releasing an article on this shortly. Indeed, this reflects emerging BoE thinking that its balance sheet reduction program has (and still is) having adverse economic consequences, partly on credit growth and where its bond portfolio reduction is accentuating higher gilt yields to a degree that is hampering, if not undermining, the monetary policy transmission mechanism - Figure 1 possibly illustrates this by showing how the BoE policy rate is still diverging from financial conditions. If so, such thinking could make the BoE revisit and pare back its neutral policy rate assumption as it is clear that the transmission mechanism is biting across the whole yield curve and not just around a short-term rate

Scenario Building Backfiring?

It is clear that elevated uncertainty underscores the BoE thinking and projections but this does not explain the current MPC divisions that led to the three-way vote last time around. Instead they merely reflect the impact that scenario building is having with it seemingly the case that policy hawks’ thinking chimes with the inflation persistence alternative while the two members who opted for 50 bp put more emphasis on the downside risk. This envisages developments in global trade policy weighing on demand to a greater extent than in the baseline, the latter being the option that the MPC majority followed. The question then is the new policy framework in the aftermath of the Bernanke Review actually backfiring as the scenario building it is based around is merely exacerbating divisions among policy-makers. Perhaps the very opposite is the case as the Review was partly designed to deter the kind of group-think that is far less prevalent presently! If so, it may make consistent and swift policy decision all the harder to come by – this adding to the case that making policy verdict outside of the four per year MPC meetings with updated forecasts less likely.