BoE Review : Labour Market Softness Triggers a Dovish Hold

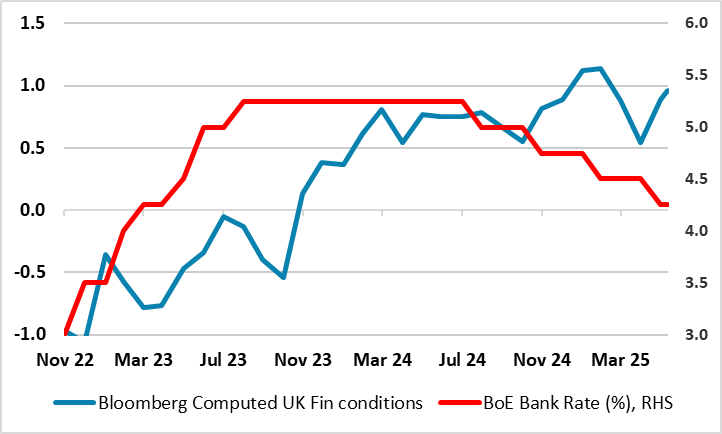

A stable BoE policy decision was always the most likely (Bank Rate staying at 4.25%) as the MPC discussed its two alternative scenarios still, but possibly where hawks have been forced into diluting what were previous concerns about a ‘tight’ labor market. In fact, partly based on what was seen as a ‘material further loosening in labour market conditions’, Dep Governor Ramsden (as he did twice in 2024) dissented in favor of a 25 bp rate cut, thereby adding to the more longstanding such demands from his colleagues Taylor and Dhingra. Regardless, the Monetary Policy Statement still repeated the need for policy to be framed carefully as well as gradually, also repeating that monetary policy will need to continue to remain restrictive for sufficiently long – the question being whether the dissenters also reject this line of thinking. But the issue of what constitutes restriction is also important (Figure 1 shows the policy rate diverging from financial conditions) as it should help determine how much further and when the BoE eases.

Figure 1: BoE Rate Cuts To Date Have Not Stopped Financial Conditions Tightening

Source: BoE, CE, Bloomberg

We think that with the BoE regarding neutral policy rate as being well above 3%, two further 25 bp moves this year will be followed by another 50 bp in H1 2026. But we think the risks are for deeper and possibly faster cuts as we think the BoE is both over optimistic about growth prospects and over-estimating policy neutrality. One question here is if the BoE slows its QT program will this have any bearing on conventional policy; NB – we think that the MPC in September will likely accept that to avoid impacting the monetary transmission mechanism that annual rundown of gilts needs to be slowed from GBP 100bln pa to GBP 75bln. Internal differences within the MPC argue against a more aggressive slowing.

While BoE research seems to have reduced the tariff risk at least to the UK, it is clear that other global considerations have come to the fore instead. Indeed, the BoE was clear that global uncertainty remains elevated, and that energy prices have risen owing to an escalation of the conflict in the Middle East, but some on the MPC may regard higher oil prices ultimately to be disinflationary given the damage they would wreak to spending power. Regardless, the MPC also noted its sensitivity to heightened unpredictability in the economic and geopolitical environment, and will continue to update its assessment of risks to the economy, the question here being what does sensitive actually imply. This is even more so given that the MPC regards the steer from surveys over recent months to have remained consistent with a zero to slightly positive pace of underlying growth currently. But such surveys needed to be considered in the wider context of the supply side of the economy, and the opening up of slack in the labour market and within companies.

But it this latter factor that is perhaps the key swing consideration for the MPC this time around where the overall weakening in these early-stage indicators of the tightness of the labour market suggested that some modest deterioration in late-stage indicators, such as the unemployment rate and the redundancy rate, should be expected over the coming months and to degree where the BoE assertion of currently near flat underlying employment growth may prove to be very optimistic given the message from payroll and PMI data.

Scenario Building Backfiring?

It is clear that elevated uncertainty underscores the BoE thinking and projections but this does not explain the current MPC divisions that led to the three-way vote last time around. Instead they merely reflect the impact that scenario building is having with it seemingly the case that policy hawks’ thinking chimes with the inflation persistence alternative while the two members who opted for 50 bp put more emphasis on the downside risk. This envisages developments in global trade policy weighing on demand to a greater extent than in the baseline, the latter being the option that the MPC majority followed. The question then is the new policy framework in the aftermath of the Bernanke Review actually backfiring as the scenario building it is based around is merely exacerbating divisions among policy-makers. Perhaps the very opposite is the case as the Review was partly designed to deter the kind of group-think that is far less prevalent presently! If so, it may make consistent and swift policy decision all the harder to come by – this adding to the case that making policy verdict outside of the four per year MPC meetings with updated forecasts less likely.