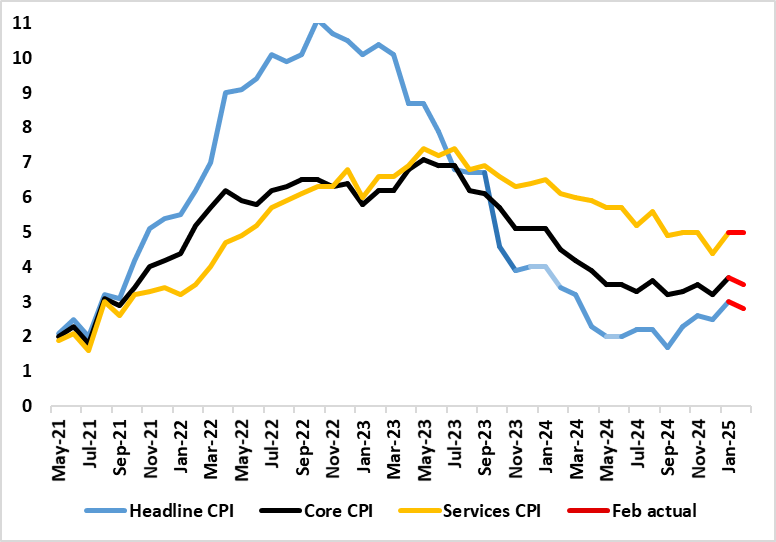

UK CPI Review: Inflation Slips Even as Services Fail to Soften?

Not surprisingly, February’s CPI data provided mixed signals. They may have undershot expectations, but actually tallied with our and BoE thinking, at least in terms of a 0.2 ppt drop for both the headline to 2.8% and for the core to 3.5%. This came in spite of higher alcohol duties and no drop in services, the latter pulled higher by mobile phone costs, with good inflation actually softening instead, based around clothing inflation turning negative for the first time since the midst of the pandemic in 2021 – possibly a fresh sign of consumer weakness? Also notable was the first clear drop in rent inflation in the current cycle – also possibly a sign of the economy weakness. But with price pressures falling in just three of the 12 CPI components, the data hardly will soften worries bout price resilience among some MPC members, especially core inflation has basically moved sideways in the last 6-9 months.

Figure 1: February Inflation Slips Back But Not Broadly?

Source: ONS, Continuum Economics

January’s CPI numbers showed a marked bounce back up, and with the 0.5 ppt rise taking it to a 10-month high of 3.0%, this being above consensus and BoE thinking. Notably services jumped from 4.4% to 5.0%, actually below expectations, having been driven higher by a swing in airfares and the rise in school fees, bit with further upward pressure evident in rents too. We think some of this services pressure was noise but it continues into February with airfares failing to fall back as expected.

The January CPI data added to worries about a fresh spike in price pressures having emerged, albeit with it unclear the extent to which pandemic-induced changes in seasonal price patterns have acted to make the CPI backdrop much more volatile. Certainly the data were not helped by an increase in the weighting of (currently high) services and a lower setting for (currently soft goods). Notably, these CPI data come after more apparently perturbing wage data, although we think that there are actually signs that companies are reacting to labor costs pressures by curbing jobs as a means of trying to raise prices. This explains our still optimistic outlook regarding prices. In this regard tentative evidence about softer clothing prices and a drop in rental inflation could be seen as signs current economic weakness taking a toll on price pressures and company pricing power

Regardless, while overall inflation may drop back further in the rest of the current quarter we acknowledge that the headline will spike back higher in Q2 as a series of regulated prices (water bills) and energy costs take effect. Indeed, inflation may now average around 3% in Q3, some one ppt higher than previously thought but still well below the 3.7% rate that the BoE now projects. These added price pressures are hardly demand determined and may accentuate already weak growth, thereby further restraining company pricing power. We therefore still see three more 25 bp Bank Rate cuts this year, as the BoE reacts to weaker core inflation and the added damage to demand ensuing from price spikes, with the impact of likely further fiscal tightening possibly become the main issue alongside the impact of likely U.S. tariffs.