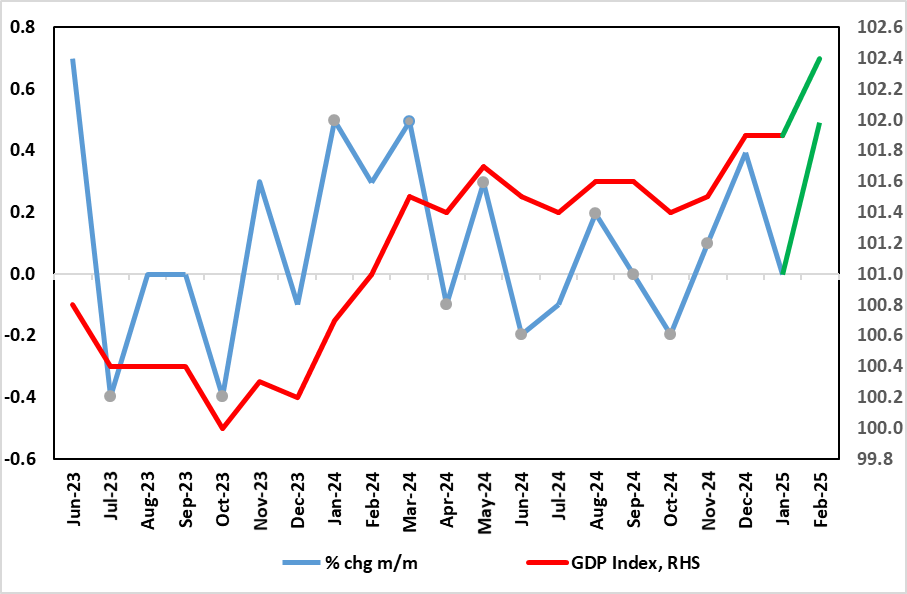

UK GDP Review (Apr 11): Marked Strength in Spite of Soft(er) Surveys

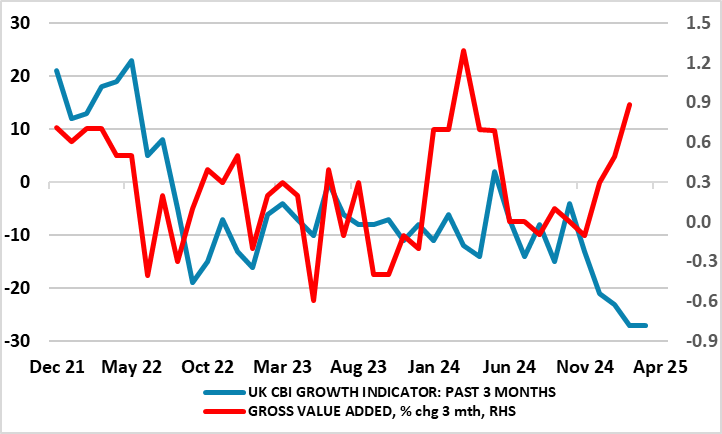

UK data can be erratic, but the hugely unexpected surge in February GDP numbers (Figure 1) looks hard to fathom. A 0.5% m/m jump suggests the economy grew by an annualized 6%-plus in the month. This is hard to square against the message from surveys and other data such as that for the labor market and government borrowing. More notably, the February rise was based around a surge in manufacturing, also hard to assess given that this sector is where surveys suggest weakness is most paramount. The overall February figure is well above any estimates, albeit where (some) upside risks were evident from higher property transactions (ahead of stamp duty rises) and already released solid retail sales and where warm weather actually boosted utility output. Even with a likely March correction, the latest data would mean that our and the BoE estimate for Q2 (0.25%) would be most likely be very much overshot by at least twofold. But it is the outlook that will be dominating BoE thinking not least with tariffs coming in higher and wider than expected and where business worries were already fermenting given the weakness in surveys (Figure 2).

Figure 1: Actual GDP Looking Far Better into Early 2025

Source: ONS, green denotes latest outcome

Indeed, the upside surprises in December and now for February contrasts with a much softer impression from surveys, the latter now showing weakness spreading into hitherto strong construction. Indeed, the PMI for the latter suggested the sharpest pace of job shedding in the sector since October 2020, with REC survey data adding to signs of a softer labor market more generally.

At the moment, our envisaged growth of 0.2 q/q for the last quarter, looks far too timid with a jump of over 0,5% more likely. The question is what markets and the BoE prioritizes in assessing the policy outlook – weak survey data (Figure 2) or apparently resilient official numbers. Perhaps more notably and something g policy makers should bear in mind, the data volatility of late suggest what may be changing seasonal factors post pandemic which may mean the UK economy in early 2025 sees similar but short-lived strong growth as seen in in the same period of last year – thus any solid Q1 gain needs to be put into that perspective

Figure 2 Momentum Contrasts with Downside Risks From Surveys?

Source: ONS, CBI Growth Indictor which combines results from three separate sector surveys