UK CPI Review: Inflation Respite Ahead of Likely Key April Surge?

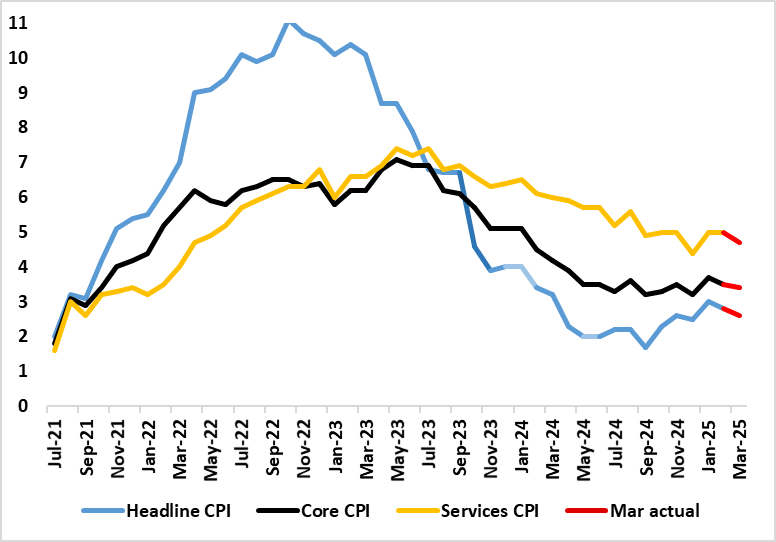

Although relegated by current market ructions and tariff threats, the main near-term inflation story was (and remains) what happens in the April data when a series of energy, utility, post office and some other regulated and service price rises are due, albeit now possibly offset somewhat by a fall in petrol prices if the slump in energy prices persists. All of which would have made the just released March data something of a side issue even though they did show headline CPI inflation retreating a little further. Indeed, the headline fell 0.2 ppt for a second successive month to 2.6%, a notch below both consensus and BoE thinking. Core inflation dropped a notch to 3.4%, while services retreated 0.3 ppt to 4.7%, this still nothing more than 3-mth low. The data do not argue against a BoE rate cut next month, the rationale for which stems more from real economy frailty..

Figure 1: March CPI Inflation to Slips Back Broadly – albeit Temporarily?

Source: ONS, Continuum Economics

There was no additional sign of softer clothing but rental inflation eased additionally, both still possible signs that weak consumers are starting to rein in pricing power. Regardless, the slowing in the headline rate into March 2025 reflected downward contributions from seven (out of 12) divisions, partially offset by upward contributions from two divisions. The largest downward contributions came from recreation and culture, housing and household services, transport, and restaurants and hotels.

Regardless, while overall inflation did drop back further in March we acknowledge that the headline will spike back higher in Q2 as a series of regulated prices (eg water bills) and energy costs take effect. Indeed, inflation may now average around 3% in Q3, some one ppt higher than previously thought but still well below the 3.7% rate that the BoE now projects but with downside risk given that current market turmoil could mean that petrol prices in April knock inflation back some 0.2-0.3 ppt, albeit where lower oil prices feeding though into retailing very slowly. But we think the BoE will regard the data as largely historic and instead place more attention on both the (seemingly weak) outlook and also a softer labor market backdrop and outlook.