BoE Preview (May 8): Being A Little Less Careful Amid Data Conflicts

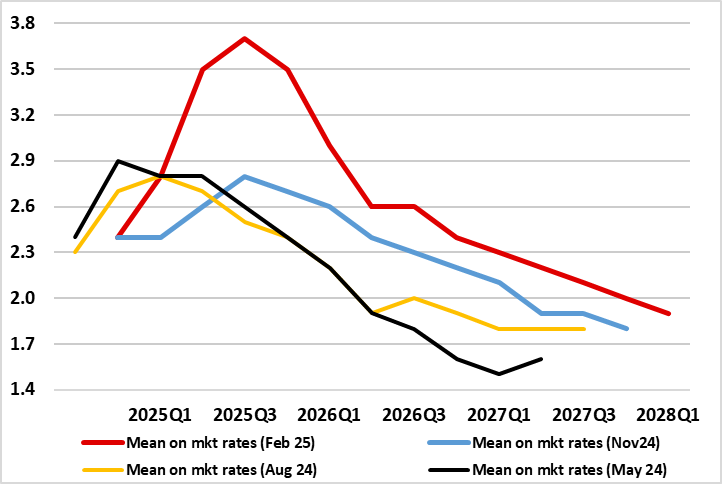

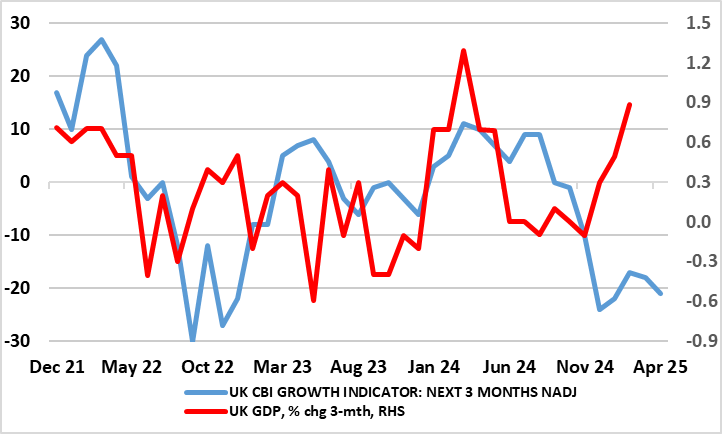

It has been relatively clear that MPC divisions have been enough for the BoE to have altered its rhetoric as far back as February to stress the need for policy to be framed carefully as well as gradually. Indeed, this shift very much pointed to the MPC majority envisaging rate cuts no faster than every quarter this year and a little further into 2026 but with no pre-set path being considered – at least openly. This would be consistent with a 25 bp cut (to a 2-year low of 4.25% when the next BoE decision arrives on May 8, this even more likely given the added downside risks that the UK is increasingly facing over and beyond that from a global trade flare-up. What will be (more) important is how the updated Monetary Policy Report (MPR) pares back its inflation surge for this year (Figure 1) both due to lower energy prices and these added downside risks paring back growth ahead (Figure 2), even given what seems to be some resilience evident in official activity data in early 2025.

Figure 1: BoE Upgraded Inflation Outlook Too Gloomy!

Source: BoE

How Much Restriction?

Whatever its likely reassessment, the BoE is still likely to believe that policy needs to remain restrictive, with the appropriate degree of restrictiveness to be decided at each meeting. The question being whether it can remove some current clear restriction earlier than previously envisaged. In this regard, and as has been the case with most European central bank meetings of late, it is less a case of what policy move is made this time around, rather how and if communication about future policy changes.

How Much Slack?

In this regard, the last set of BoE forecasts in the February MPR were notable for one possibly major thing – an assumption that underlying growth has fallen, possible to under 1%, much to do with the labor market. This does not explain all of the higher inflation profile which it pointed to that now only delivers a below target outcome into 2028 (Figure 1). Admittedly, energy prices have fallen back since and markedly so but this is unlikely to calm what if anything may be a continue concern among the MPC majority about price persistence. Indeed, pseudo MPC-dove Dep Gov Ramsden has very much flagged an increased worry about possible inflation persistence based around recent wage data, albeit what we think are still dubiously accurate ONS numbers as suggested above.

Data Conflicts Widen

Indeed, the alleged strength in pay as denoted by circa-6% growth in average earnings looks suspect – HMRC data suggest growth nearer 5%. But it may be even weaker certainly in terms of pay deals as the BoE has acknowledged. Overall, it does seem as if, while not being entirely rosy, the BoE has been showing optimism (or thinking) not supported by the whole array of data. Admittedly, the MPR may see the 2025 GDP forecast lifted from the existing 0.75%, largely on the back of what looks likely to be very strong Q1, albeit where such strength in official growth numbers increasingly departs from the message of alternative data, such as tax revenues, payrolls and business surveys (Figure 2). With this mind, it will be interesting into see how the BoE assesses this upside GDP surprise of late: does it think it is real; is it perhaps a result of a seasonal adjustment swings and whether it may reflect demand and/or supply factors that may further affect spare capacity.

Figure 2: Surveys Pointing South!

Source, ONS, CBI

Policy Outlook

Regardless, this will not change what seems to be growing BoE worries about the short and medium-term real economy outlook. Very much this reflects worries about a trade war which would hit the UK even if it does strike trade deal with the U.S. – business uncertainty is already evident. But the UK has other downside risks, emanating from recent fiscal measures which may dampen activity further and where additional tax rises may still be in the offing in other to meet fiscal rules. Three is also the impact on the consumer from the round of utility and regulated price rises now unfolding, even though energy prices have fallen back steeply, enough to trim inflation more clearly in Q3. We were puzzled that the 0.75 ppt upgrade the BoE made to the 2025 CPI forecast had little impact on its consumer spending projection.

Given what we think is a flailing real economy backdrop, which growing global trade tensions may only accentuate, BoE easing may yet come faster and further as the BoE reassess its optimism about growth and upgrades its estimate extent of slack – particularly in the labor market. Indeed, the BoE may bring forward its CPI return to target to possibly as early as late 2026. As a result, the likelihood is that we will see at least three more moves this year and probably four.