UK GDP Review: Previous Resilience Gives Way to Softer Surveys

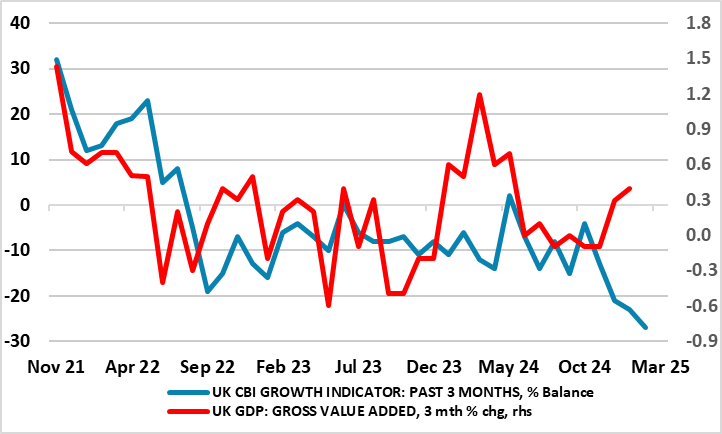

Despite a fresh downside surprise for January numbers, the odds are increasing that current quarter GDP will be decidedly positive as opposed to the weak(ish) picture we perceive. The upside surprises in December contrasts with a much softer impression from surveys (Figure 1), the latter now showing weakness spreading into hitherto strong construction. Thus despite a clear bounce in retail sales for the month, marked corrections in industry caused a small m/m drop in January of 0.1% m/m – as we expected. The firmness in December still implies a current quarter gain of 0.2% but the January drop underscores actual weakness regardless of what were actual upside risks from cold weather boosting already below-par utility output. The data will have little impact on BoE thinking which is more biased towards labor market developments - at least for the time being!

Figure 1: Momentum Mixed Despite Continued Downside Risks From Surveys?

Source: ONS, CBI Growth Indictor which combines results from three separate sector surveys

At the moment we still envisage growth of 0.2 q/q this quarter, twice what the BoE envisage. The question is what markets and the BoE prioritizes in assessing the policy outlook – weak survey data or apparently resilient official numbers. Perhaps more notably, the data volatility of late suggest what may be changing seasonal factors post pandemic which may mean the UK economy in early 2025 sees similar but short-lived strong growth as seen in in the same period of last year – thus any solid Q1 gain needs to be put into that perspective

As for the backdrop, GDP data for the end of 2024 very much surprised on the upside albeit still failing to convey an impression of UK’s economy displaying solidity, if not strength. Admittedly GDP rose by 0.4% m/m in December, the largest such gain in 11 months and enough to have allowed Q4 see growth of 0.1% as opposed to the largely expected same-sized fall. The data means the economy grew 0.9% in 2024 but amid what looks to be a possible involuntary rise in inventories that supported Q4 GDP and a suspect (ie survey conflicting) jump in manufacturing that boosted December numbers, we doubt that genuine fresh momentum has emerged – GDP per head actually fell. Indeed, we still see growth around 0.7-0.8% for the whole of this year, despite the looming fiscal boost that has persuaded some forecasters to upgrade their projection for the year, albeit now where budget tightening may be on the cards as the government grapples with meeting its fiscal targets. Instead we note the sobering message from business surveys as well as from payroll data, all more consistent with tepid if not negative growth (Figure 1) rather than the upbeat growth aspiration of the government.