BoE Review: Uncertain MPC Signals It Needs to be Careful

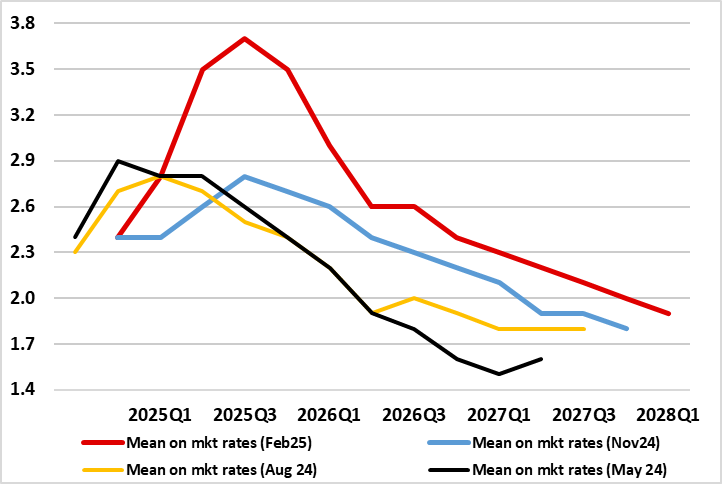

The latest set of BoE forecasts are notable for one major thing – an assumption that underlying growth has fallen, possible to under 1%. This does not explain all of the higher inflation profile (Figure 1) which now only delivers a below target outcome into 2028 – the higher rates projected this year reflect higher energy and regulated prices. But it does seem as if the MPC is not united on this outlook with two dissents in favor of a 50 bp move rather than the as-expected 25 bp the other seven members agreed. But the likely MPC divisions probably reflect increased uncertainty this enough for the BoE to stress the need for policy to be made carefully as well as gradually. The thrust of the Monetary Policy Report (MPR) therefore does not suggest recent market rate pricing is too pessimistic. However, we still think it is given softer underlying inflation signs (Figure 2) with four moves from the current 4.5% on cards by year-end as we think the BoE remains too optimistic about growth and the extent of slack – particularly in the labor market.

Figure 1: BoE Sees More Persistent Inflation

Source: BoE MPR

A Higher Inflation Outlook as Supply Has Been Eroded?

Contrary to out expectation of a softer inflation profile, the latest Monetary Policy Report (MPR) sees a higher one, partly due to higher energy and regulated prices in the course of the next 2-3 quarters. But it then reflects the impact of weaker supply of the economy, largely due estimated potential productivity being seen to be now weaker than can be explained by previously identified factors such as the impacts of past shocks from Brexit and the pandemic. Indeed, the BoE asserts that some of the weakness could reflect increases in employment in health-related activities over recent years that have not been matched by a similar increase in measured output. For example, the MPR forecast incorporates a slowdown in four-quarter potential supply growth from around 1½% at the start of 2024 to around ¾% at the start of this year.

In other words, the BoE does not think that the downgrade in its GDP forecast to l0.75% (2025) is a reflection of weaker demand. Given that we share the 2025 overall outlook but where we also think the labor market is much weaker than the BoE is assuming (the MPR is still using possibly dubious official employment numbers and questionable assumption about productivity, we do not think so and would suggest that is the array of higher energy and regulated prices the BoE envisages proves accurate it will damage even further. We are also skeptical about the economy then recovery to 1.5% though both 2026 and 2027, not least given the added threat posed by a trade war.

But Supply Issues Very Uncertain

Admittedly, the BoE is also aware of these risks, hence why it believes the outlook is more uncertain and enough so that it has to suggest that policy will have to be conducted carefully as well as gradually - with a clear debate about the wording of guidance evident from the minutes. This may explain the dissents and may reflect greater divisions with the MPC than a mere 7:2 split would suggest. What is clear is that the MPC is still keen on offering alternative scenarios. Hitherto, the first case saw remaining persistence in inflation dissipate quickly as pay and price-setting dynamics continued to normalise following the unwinding of the global shocks that had driven up inflation. In the second case, a period of economic slack might be required to normalise these dynamics fully. In the third case, some inflationary persistence might also reflect structural shifts in wage and price-setting behaviour. It seems that the MPC majority is now leaning more toward the latter two scenarios, hence a more hawkish leaning.

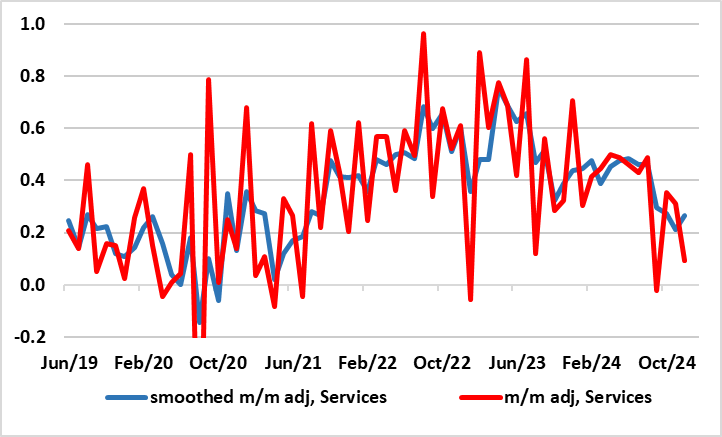

Figure 2: Softer Services Inflation Picture?

Source: ONS, Continuum Economics

Too Gloomy on Supply?

Regardless, even amid this weak supply side backdrop the BoE admits that disinflation continues at an underlying basis and we think the MPC is under-stating it, as it has done several times in the recent past. But the BoE has judged that there has been sufficient progress on disinflation in domestic prices and wages to reduce Bank Rate for a third 25bp move. And we think further such moves are likely with four on the cards as the economy continues to disappoint and underlying inflation dissipates. Indeed, alternative data based on payrolls suggest a somewhat softer pay and less-worrisome productivity backdrop, this possibly explaining what we think are emerging signs of a softening in hitherto resilient services inflation that question the BoE concern about possible more resilient price persistence. Indeed, seasonally adjusted m/m data for services are already painting much more reassuring picture, thereby suggesting that the surprise drop in the y/y figure for services in the December CPI was not a mere aberration (Figure 2).