Brazilian Central Bank

View:

September 18, 2025

Brazil: 15% Well Into 2026

September 18, 2025 6:29 AM UTC

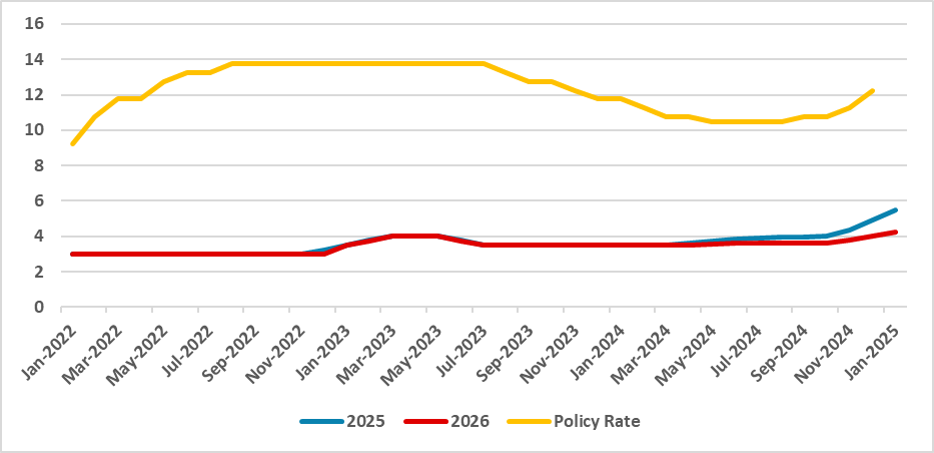

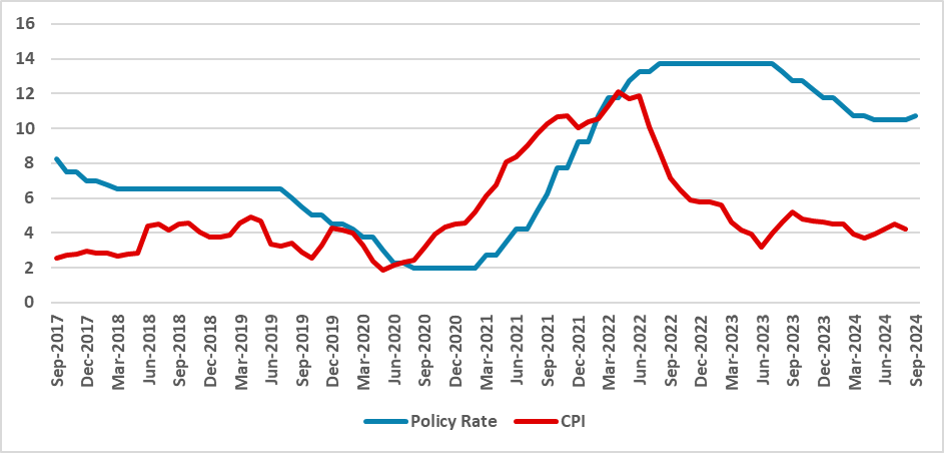

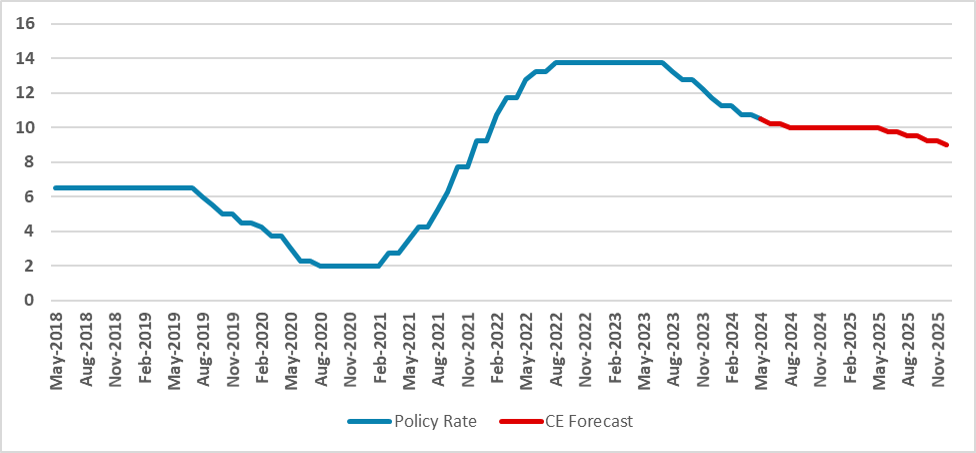

The BCB statement was clear that the deanchored inflation picture still requires interest rates to be kept at current levels for a very prolonged period of time. The consensus for economists is that this will change in Q1 2026 with a 50bps cut, though ideas of December are fading. We suspect it

August 07, 2025

EM Rates: Domestic Fundamentals Dominate

August 7, 2025 9:30 AM UTC

Once trade is agreed with the U.S., the good fundamentals actually argue for a 10yr Mexico-U.S. spread close to 400bps and this is our favored strategic risk reward for big EM government bonds. In Brazil a case can be made for a 12.75% policy rate end 2026 and 10% in 2027, but this could only mean 1

July 28, 2025

Food Glorious Food

July 28, 2025 10:15 AM UTC

· Global food prices should see small increases in the future, as production continues to rise broadly in line with increasing demand driven by population and a rising consumption per person in EM countries. However, China will remain dependent on food imports given it has limited roo

July 24, 2025

EM Currencies with a USD Downtrend

July 24, 2025 10:15 AM UTC

· BRL, ZAR and MXN have been helped by FX carry trades and bond inflows on still wide interest rate differentials. However, actual reciprocal tariff risks are high for all three countries and a wave of profit-taking could be seen. Elsewhere, though we see a U.S./China trade deal by

June 25, 2025

EM FX Outlook: USD Less in Favor, but EM Mixed

June 25, 2025 8:05 AM UTC

• EM currencies face cross currents on a spot basis. The USD downtrend against DM currencies can be a positive for undervalued or strong EM currencies. This could benefit the Brazilian Real (BRL), Mexican Peso (MXN) and Indonesian Rupiah (IDR), though moves will be choppy with occasiona

March 26, 2025

LatAm Outlook: Navigating the Uncertainty

March 26, 2025 9:56 PM UTC

· Brazil and Mexico economy are likely to decelerate in terms of growth in 2025, although we see this being stronger in Mexico. Mexico institutional reforms and its close ties with U.S. increases uncertainty for 2025, especially after Trump victory, and the menaces of Trump imposing tar

EMFX Outlook: Divergence versus the USD

March 26, 2025 9:16 AM UTC

EM currencies will be helped by the ongoing USD downtrend against DM currencies, but prospects also depend on relative inflation differentials versus the USD and starting point in terms of valuations. The Brazilian Real (BRL), Mexican Peso (MXN) and Indonesian Rupiah (IDR) should all make modest s

March 25, 2025

BCB Minutes: Caution Rather than Optimism

March 25, 2025 10:51 PM UTC

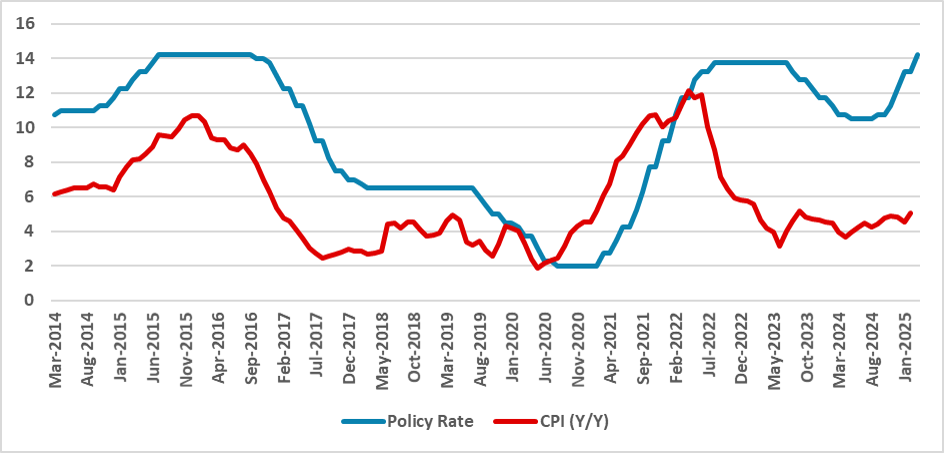

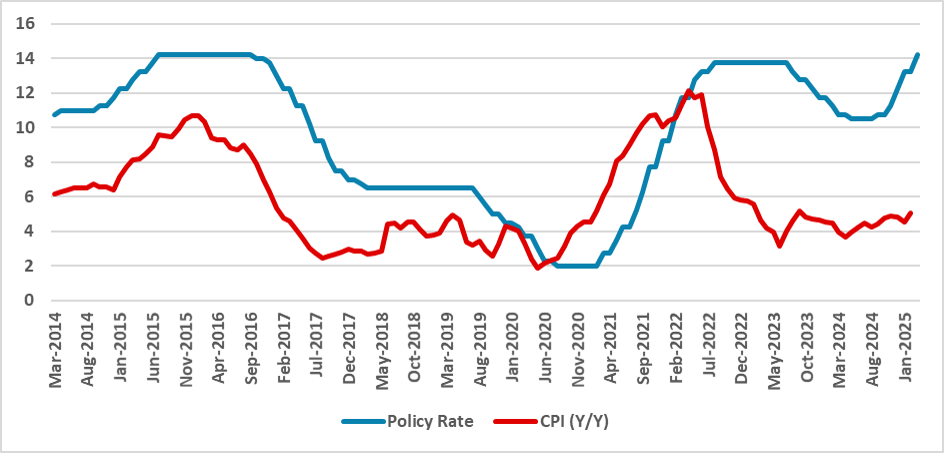

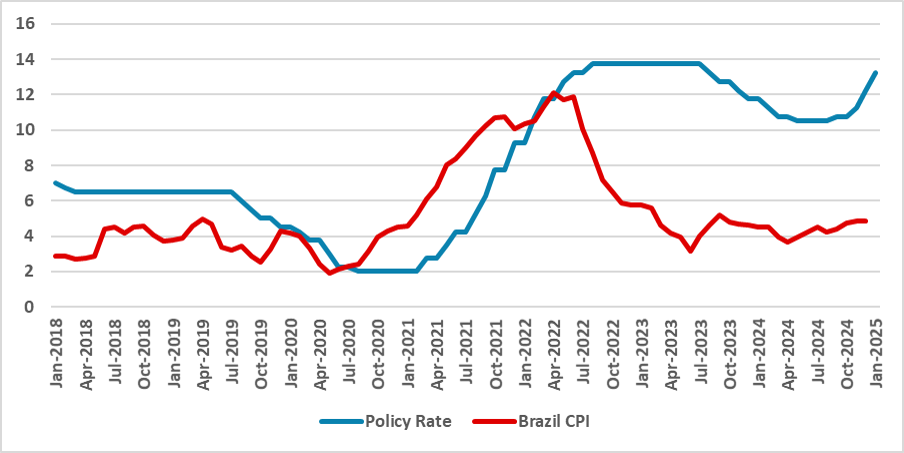

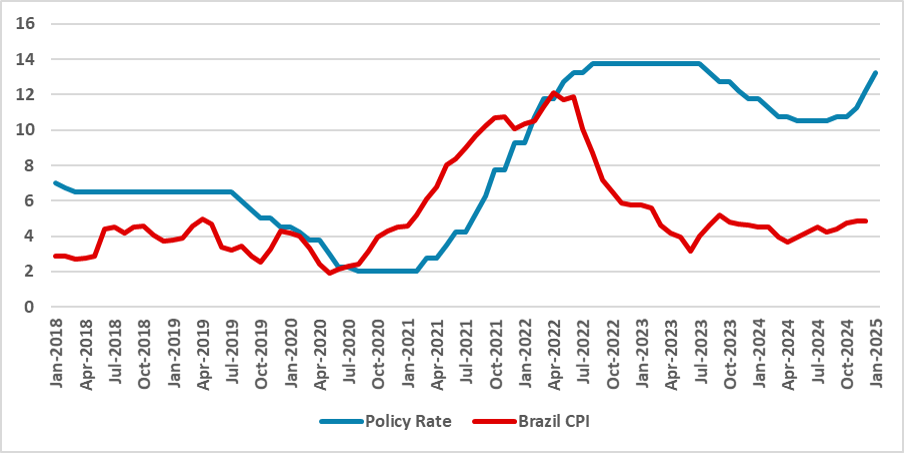

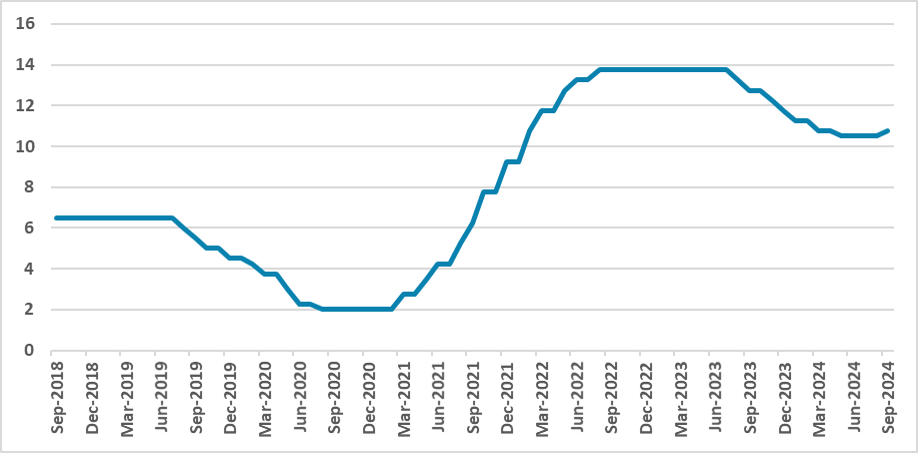

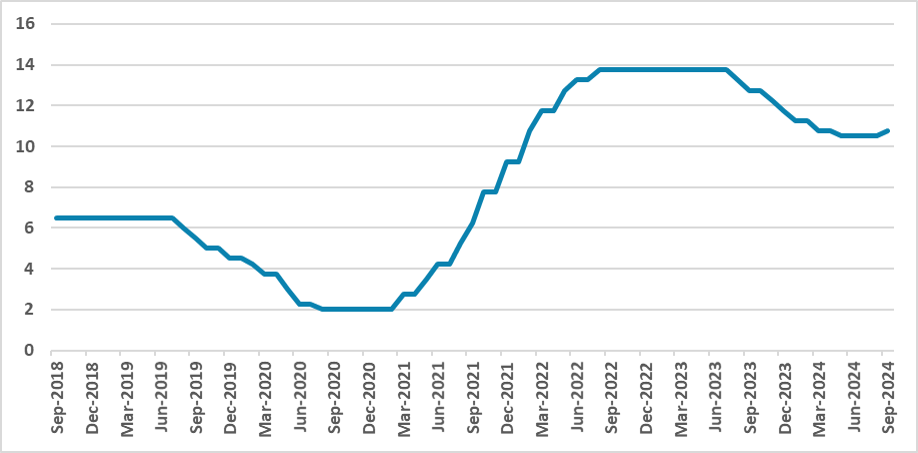

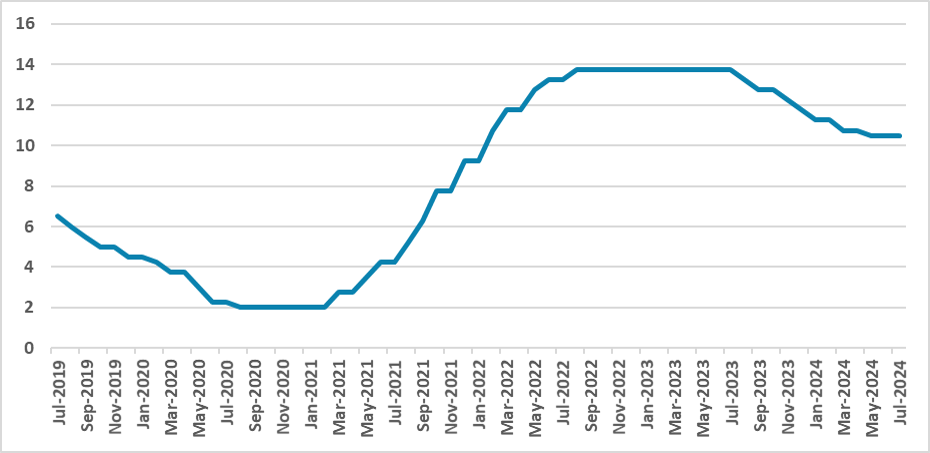

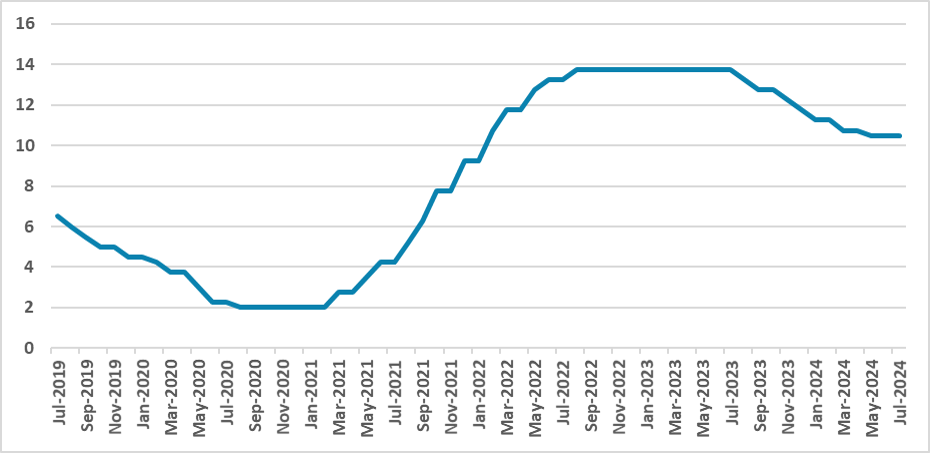

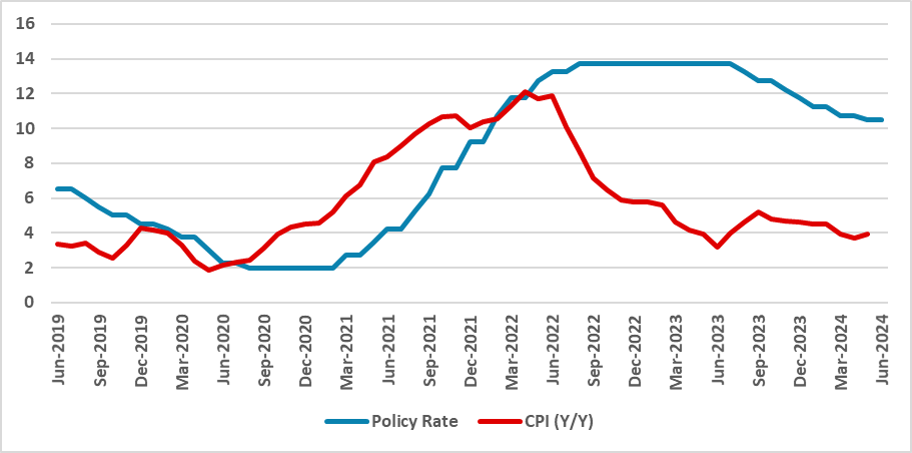

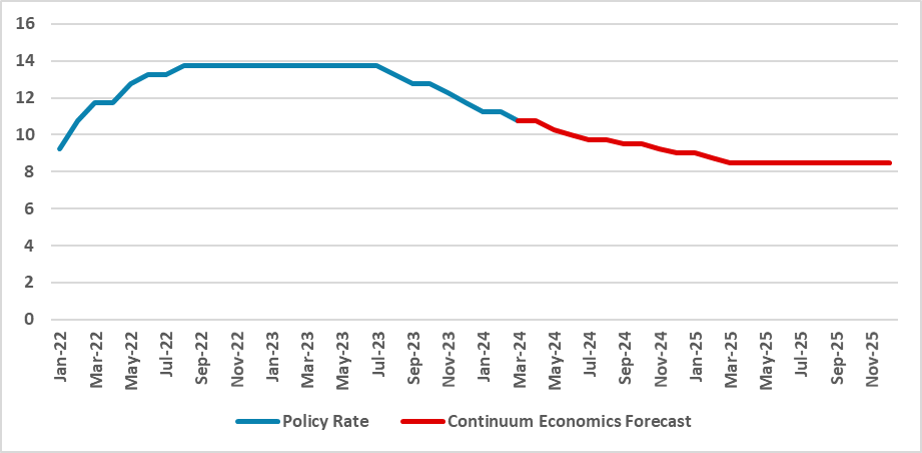

The Brazilian Central Bank (BCB) raised the policy rate by 100bps to 14.25% amid signs of economic deceleration, including slower growth, job creation, and consumption. The BCB highlighted external uncertainties, such as U.S. trade policy, and domestic challenges with rising inflation. It emphasized

March 19, 2025

BCB Review: Confirming More Hikes

March 19, 2025 10:38 PM UTC

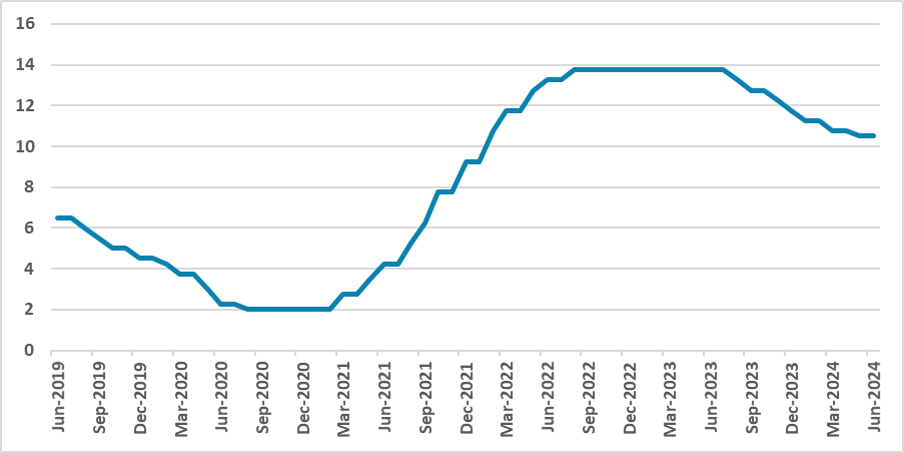

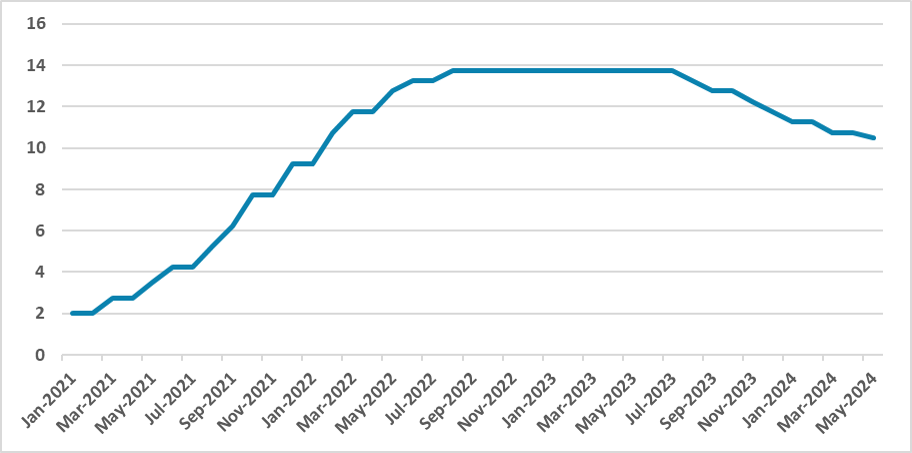

The Brazilian Central Bank (BCB) raised the policy rate by 100 bps to 14.25% and signaled further hikes, likely reaching 15.0% by May, potentially ending the current tightening cycle. The BCB emphasized inflation concerns and strong economic activity, suggesting a hawkish stance. Fiscal policy was n

February 04, 2025

BCB Minutes: Detailing the Deterioration

February 4, 2025 6:29 PM UTC

The BCB raised rates by 100bps to 13.25%, signaling another hike in March. External uncertainty remains, but domestic risks worsened, with inflation expectations rising. The BCB stressed fiscal-monetary coordination and warned about policy distortions. Despite markets pricing a 15% rate, we expect s

January 30, 2025

BCB Review: Maintaining the Course

January 30, 2025 6:09 PM UTC

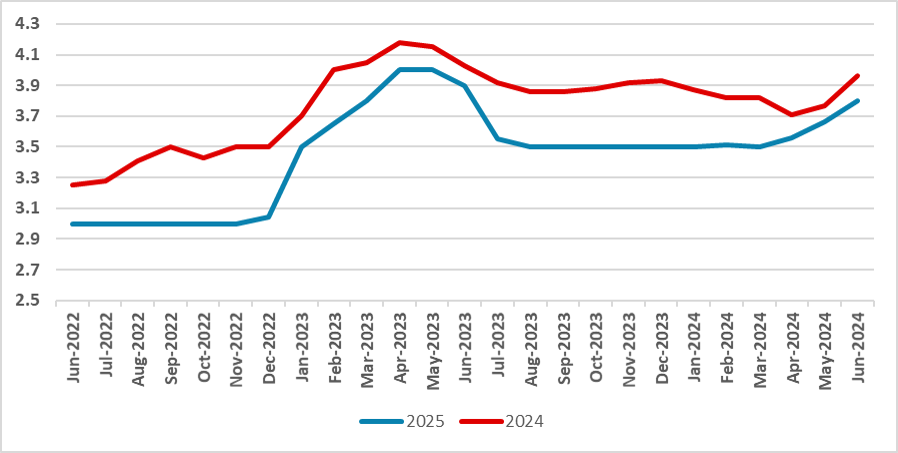

The Brazilian Central Bank (BCB) raised the policy rate by 100bps to 13.25%, signaling another hike in March while monitoring economic data. The statement had a neutral-to-dovish tone, with inflation risks stemming from services CPI, unanchored expectations, and fiscal policy. Market projections see

January 27, 2025

BCB Preview: 100bps Hike Will Buy Some Time

January 27, 2025 7:09 PM UTC

The Brazilian Central Bank is expected to maintain its course with two 100bps hikes, reaching 14.25% by March. Inflation forecasts for 2025 exceed the target, necessitating a firm policy stance. Despite market concerns, new President Gabriel Galípoli is likely to act decisively. The Real’s recent

January 20, 2025

Brazil Risk Premia and EM Debt

January 20, 2025 8:15 AM UTC

Brazil debt market has two domestic crises rather than a spillover from the U.S. in the form of inflation and fiscal policy. Very restrictive BCB policy can help produce some disinflation and we forecast 4.1% for 2026, which some allow some rate cuts in H2. Brazil risk premium will likely be reduced

January 02, 2025

EM Government Debt: BRICS Divergence

January 2, 2025 8:05 AM UTC

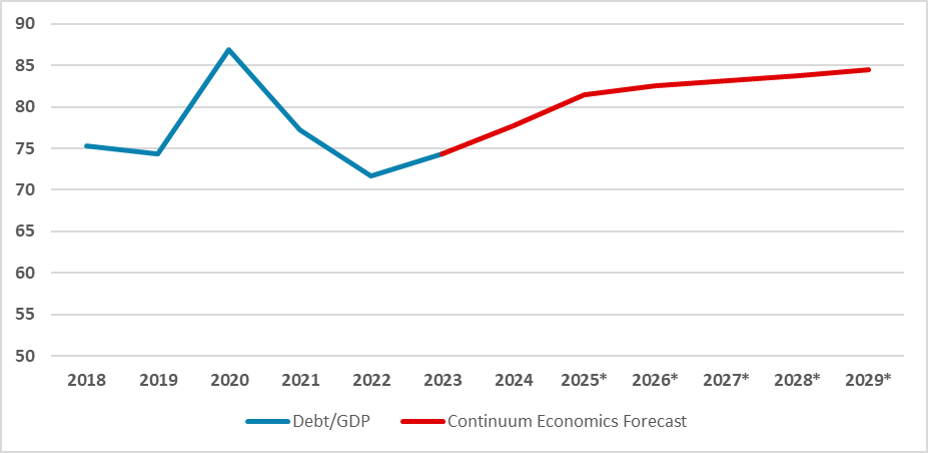

Brazil and South Africa suffer from debt servicing costs outstripping nominal GDP, which will remain a concern unless a consistent primary budget surplus is seen – though S Africa enjoys a much longer than average term to maturity than Brazil. India and Indonesia, in contrast, enjoy nominal

December 20, 2024

EMFX Outlook: Hit From Tariffs, Before Divergence

December 20, 2024 10:00 AM UTC

· EM currencies on a spot basis will remain on the defensive in H1 2025, as we see the U.S. threatening and then introducing tariffs on China imports – 30% against the current average of 20%. China’s response will likely include a Yuan (CNY) depreciation to the 7.65 area on USD/CN

December 18, 2024

LatAm Outlook: Economic Shifts

December 18, 2024 5:21 PM UTC

· Brazil and Mexico economy are likely to decelerate in terms of growth in 2025, although we see this being stronger in Mexico. Mexico legal reforms and its close ties with U.S. increases uncertainty for 2025, especially after Trump elections, although we see tariffs in 2025 as unlikely

December 12, 2024

BCB Review: Shock 100bps Hike

December 12, 2024 10:12 AM UTC

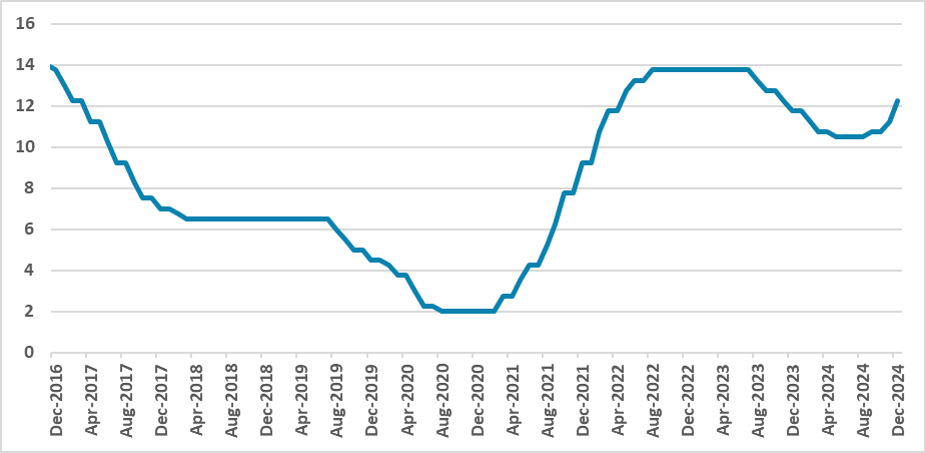

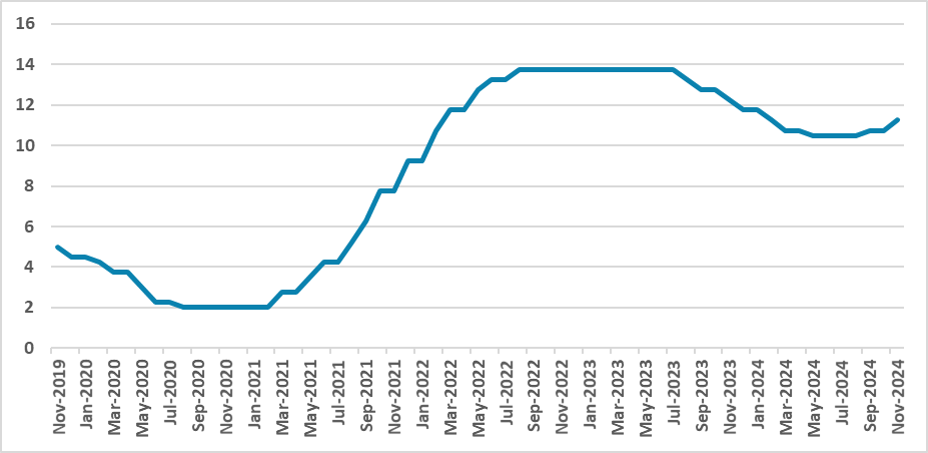

The Brazilian Central Bank raised the policy rate by 100bps to 12.25%, with plans for two more 100bps hikes, reaching 14.25% by early 2025—the highest in 18 years. The decision reflects fiscal concerns, inflation risks, and a 10% depreciation of the Real. The BCB aims to curb inflation and protect

November 12, 2024

BCB Minutes: Hawkish and Indicating Hikes

November 12, 2024 2:49 PM UTC

The Brazilian Central Bank (BCB) remains hawkish, raising rates by 50 bps to 11.25% amid resilient domestic growth and unanchored inflation expectations. Key concerns include rising uncertainty in the fiscal landscape and exchange rate volatility, prompting cautious monetary policy. The BCB signals

November 07, 2024

BCB Review: Unanimous 50bps Hike

November 7, 2024 2:19 PM UTC

The Brazilian Central Bank raised its policy rate by 50 basis points to 11.25%, signaling heightened concerns over inflation risks driven by domestic dynamics and global uncertainties. While noting external volatility and fiscal policy impacts, the BCB emphasized that persistent inflation requires a

November 04, 2024

BCB Preview: 50bps Hike and More to Come

November 4, 2024 8:05 PM UTC

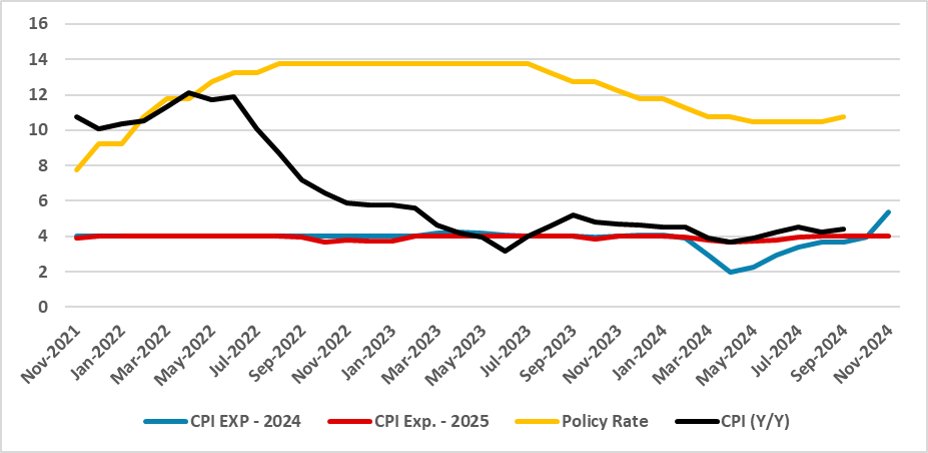

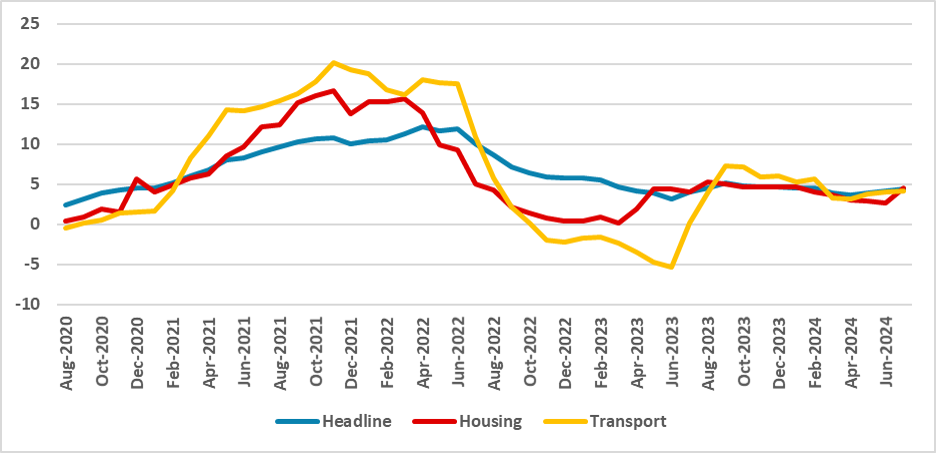

The Brazilian Central Bank (BCB) is expected to raise rates by 50bps in November to curb rising inflation, which could exceed the 4.5% upper limit if inflationary shocks persist. Market concerns focus on food prices, a strong labor market, and external exchange rate pressures. The new BCB President,

October 25, 2024

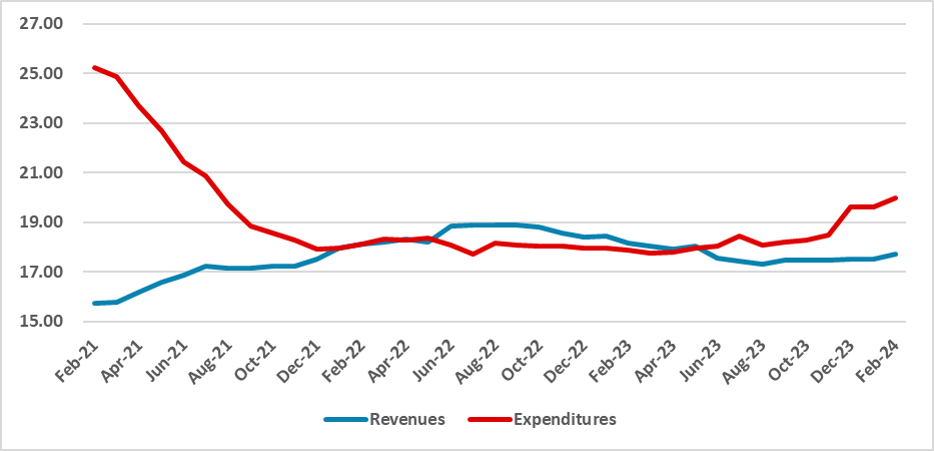

Brazil: High Expenditure Levels Challenge Fiscal Stability

October 25, 2024 5:40 PM UTC

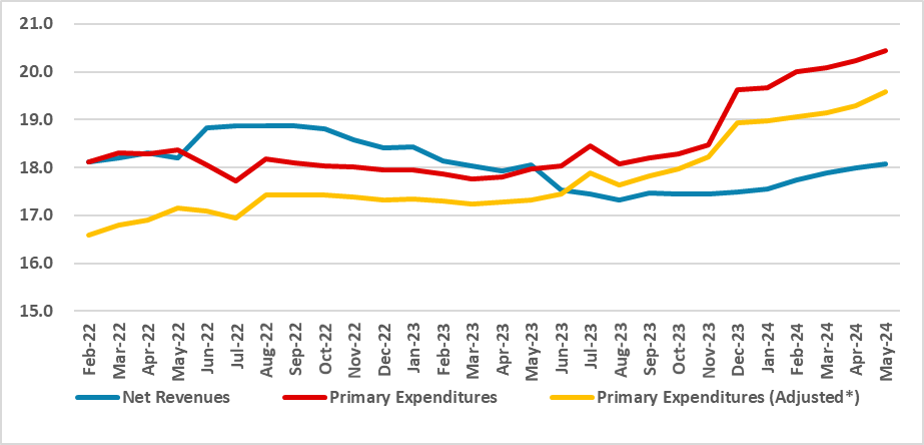

Brazil’s fiscal data through August shows a primary deficit of 2.3% of GDP, with expenditure growth outpacing revenue gains despite efforts to increase government income. Social transfers and unemployment benefits contributed to rising expenditures, now at 20.2% of GDP. The Central Bank’s recent

October 17, 2024

Brazil: Demand and Imported Prices Lead Inflation Rise

October 17, 2024 6:33 PM UTC

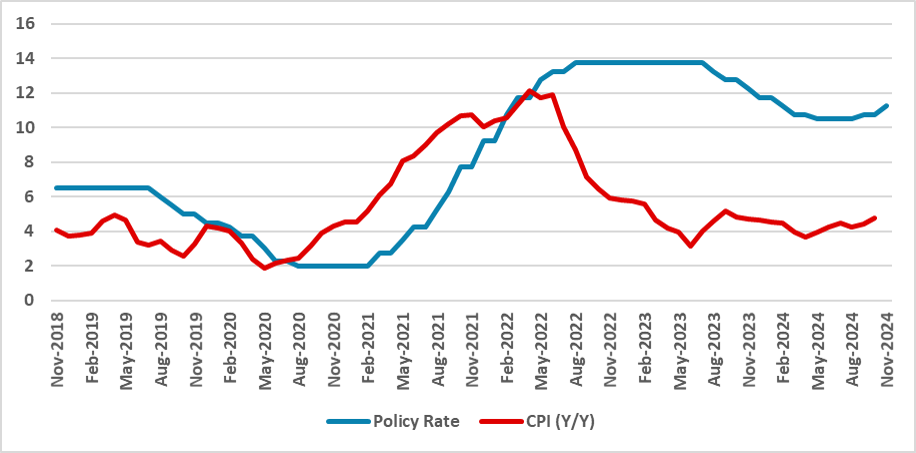

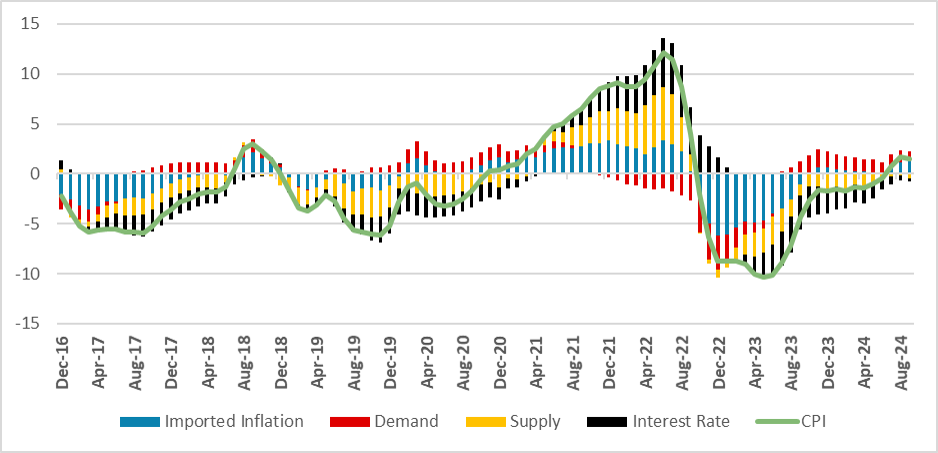

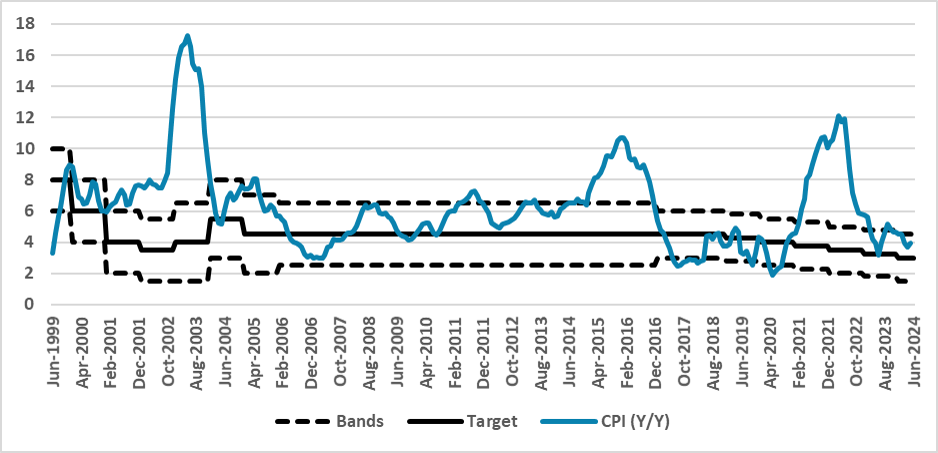

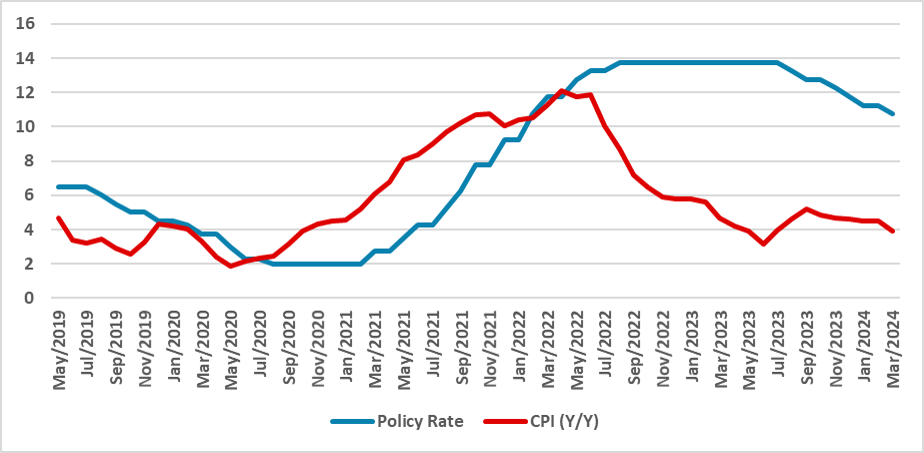

Our updated model shows that stronger-than-expected demand and BRL depreciation are driving Brazil’s inflation higher, while supply remains stable. Despite recent rate hikes, inflation expectations have risen, loosening monetary policy. We expect the BCB to implement two more 50 bps hikes before p

October 01, 2024

Brazil: Quarterly Inflation Report Shows BCB Worries

October 1, 2024 2:10 PM UTC

The Brazilian Central Bank's latest report highlights stronger-than-expected economic growth of 1.4% in Q2 and a positive output gap, raising inflation risks. While non-core inflation decreased, core measures like services inflation remain sticky. Credit growth continues to be robust, but fiscal pol

September 26, 2024

EM FX Outlook: Fed Easing Helps but Divergent Trends

September 26, 2024 8:00 AM UTC

USD strength is ebbing across the board, which provides a positive force for most EM currencies on a spot basis. However, where inflation differentials are large, the downward pressure will remain in 2025 e.g. Turkish Lira (TRY). Where inflation differentials are modest against the U.S., but

September 25, 2024

BCB Minutes: Adding Some Hawkishness to the Communique

September 25, 2024 1:44 PM UTC

The Brazilian Central Bank raised the policy rate by 25 bps to 10.75%, citing stronger-than-expected economic activity and deteriorating inflation expectations. The committee highlighted rising inflationary pressures, especially in wages and credit growth. While future rate hikes are likely, no forw

September 24, 2024

LatAm Outlook: Diverging Patterns

September 24, 2024 12:54 PM UTC

· Brazil and Mexico started to diverge in terms of growth. While we see Brazil GDP growing above 3.0% in 2024 (pushed by the internal demand), we see Mexico’s growth decelerating to 1.3%, due to weaker demand from U.S. and contractionary monetary policy. In 2025, we see Brazil growing

September 19, 2024

BCB Review: Switching Back to Hikes

September 19, 2024 12:50 PM UTC

The Brazilian Central Bank (BCB) raised the policy rate to 10.75%, signaling more hikes due to domestic pressures, including stronger economic activity and de-anchored inflation expectations. Despite global uncertainties, the decision reflects concerns about Brazil's positive output gap and fragile

August 14, 2024

EM Markets Divergence with China Harder Landing Concerns

August 14, 2024 3:35 PM UTC

Global market turbulence has had a spillover impact into EM, but also some EM assets have benefitted from rotation away from the U.S. What are the prospects in the coming months?

We see scope for a 2nd wave of U.S. equity and Japanese Yen (JPY) correction, which are a mixed influence for EM assets

August 06, 2024

BCB Minutes: Hawkish and Consideration over Hikes

August 6, 2024 2:55 PM UTC

The Brazilian Central Bank kept the policy rate at 10.5%, emphasizing a hawkish stance amidst global uncertainties and risk aversion. Inflation is projected at 3.2%, above the 3% target. The board remains cautious, with potential rate hikes if the economic situation worsens. A rate cut may be possib

August 05, 2024

Brazil CPI Preview: Inflation to Rise in July

August 5, 2024 3:13 PM UTC

The Brazilian CPI is expected to rise by 0.3% m/m in July, pushing Y/Y CPI to 4.4%. This increase is mainly due to higher gasoline prices affecting the Transport and Housing groups. Inflationary risks are emerging, with strong economic activity and sticky service inflation, but a policy rate cut rem

August 01, 2024

BCB Review: A Hawkish Tweak

August 1, 2024 1:45 PM UTC

The Brazilian Central Bank (BCB) kept the policy rate unchanged at 10.5%, with a hawkish tone highlighting risks. Strong domestic growth and employment data persist despite monetary tightening. Inflation expectations for 2024 and 2025 are at 4.1% and 4.0%, respectively, above the 3.0% target. Fiscal

July 23, 2024

Brazil: An Eye on the Lower Bound of the Fiscal Target

July 23, 2024 4:07 PM UTC

The Brazilian government will implement BRL 15 billion in contingency expenditures to meet fiscal targets, aiming for a 0.25% GDP primary deficit in 2024. This move, though addressing fiscal issues, pursues the lower target band and may undermine fiscal credibility. The contingency is due to revenue

July 01, 2024

EM After the Elections: Fiscal Focus and Inflation Questions

July 1, 2024 8:05 AM UTC

Enhancing fiscal credibility is key post-election in India and S Africa, but also for Brazil. India, will do this in the 3 week of July, but S Africa needs to move from ANC/DA led coalition optimism to reality quickly. Brazil needs to stop the vicious circle of sentiment building up on fiscal slip

June 27, 2024

Brazil: Adoption of Continuous Targeting Means Not Much Change

June 27, 2024 1:28 PM UTC

The Brazilian government has revised the BCB's inflation targeting framework, effective January 2025, to a continuous target system. If inflation exceeds the target bands for six consecutive months, the BCB must explain the discrepancy. The 3.0% target with 1.5% bands remains unchanged, alleviating

June 26, 2024

BCB Minutes: Deterioration of the Scenario Requires Higher Rates

June 26, 2024 1:32 PM UTC

The Brazilian Central Bank maintained the SELIC rate at 10.5%, emphasizing a unanimous, hawkish stance on inflation. Markets question BCB's inflation control with upcoming leadership changes. External uncertainties, domestic consumption surprises, and rising inflation expectations were highlighted.

June 25, 2024

EMFX Outlook: USD Strength to Ebb with Different EM Impact

June 25, 2024 8:05 AM UTC

We see Fed rate cuts from September starting to soften USD strength into year end and 2025. Beneficiaries will include currencies with inflation moving towards target and high real rates or, alternatively, undervalued currencies. This should benefit the Brazilian Real (BRL) and Indonesian Rupiah

June 24, 2024

LatAm Outlook: Pausing the Cuts

June 24, 2024 6:00 PM UTC

· Brazil and Mexico growth will decelerate from the growth rates in 2023. The stronger basis of comparisons in 2023 and the tight monetary policy will diminish growth during 2024. Brazil robust Agricultural growth will not repeat in 2023 while Mexico is on the limit of growing due to a

June 19, 2024

BCB Review: A Pause in the Cutting Cycle

June 19, 2024 10:17 PM UTC

The Brazilian Central Bank kept the policy rate at 10.5%, citing economic uncertainty and a need for caution. Inflation expectations for 2025 are 3.8%, above the 3.0% target. Political interference concerns persist, but the unanimous decision indicates a technical approach. The BRL's depreciation ma

June 17, 2024

BCB Preview: A Pause Amid the Risks

June 17, 2024 2:34 PM UTC

The Brazilian Central Bank (BCB) is expected to maintain the SELIC rate at 10.5% amid external sector volatility, stubborn service inflation, and deteriorating inflation expectations. A hawkish majority on the board suggests a pause despite potential for cuts. Risks include rising food prices post-f

May 14, 2024

BCB Minutes: Worsening Conditions Demand Caution

May 14, 2024 2:35 PM UTC

The Brazilian Central Bank's latest meeting revealed a shift in forward-guidance, reducing the cut from 50bps to 25bps. While no immediate actions were taken, the minutes highlighted worsening conditions in three key areas: External Environment, Fiscal, and Economic Activity. Despite split votes on

May 09, 2024

BCB Review: 25bps Cut, No Additional Guidance

May 9, 2024 1:11 PM UTC

The Brazilian Central Bank convened, opting against a 50bps cut, reducing it to 25bps, lowering the policy rate to 10.5%. A split vote ensued, with 25bps winning 5x4. The communique, vague possibly due to board division, noted labor market and economic activity surpassing expectations. Foreign marke

May 06, 2024

BCB Preview: 25bps or 50bps cut?

May 6, 2024 1:02 PM UTC

The Brazilian Central Bank (BCB) convenes on May 8 to set the policy rate. Previous forward guidance hinted at a 50bps cut in May, but recent statements from BCB President Roberto and some weakness in the BRL have shifted expectations to a 25bps cut. However, we anticipate the BCB maintaining a 50bp

May 03, 2024

EMFX: Diverging On Domestic Forces Not Less Fed Easing Hopes

May 3, 2024 10:45 AM UTC

While U.S. economic developments, plus Fed policy prospects, will be important in terms of EM currency developments, domestic politics and fundamentals will also be decisive. These can keep the South Africa Rand volatile in the remainder of 2024, given the risk of a coalition government and African

May 02, 2024

Moody’s Improves Outlook Perspective Due to Higher Growth

May 2, 2024 2:27 PM UTC

Moody’s upgraded Brazil's outlook to positive from stable, maintaining its Ba2 rating, signaling a potential move to Ba1 soon. Strong growth prospects, attributed to institutional reforms, drove this shift. Despite lingering doubts, improved fiscal conditions and anticipated tax reform are bolster

April 26, 2024

Brazil: Credit Decelerating Amid Tighter Conditions

April 26, 2024 1:21 PM UTC

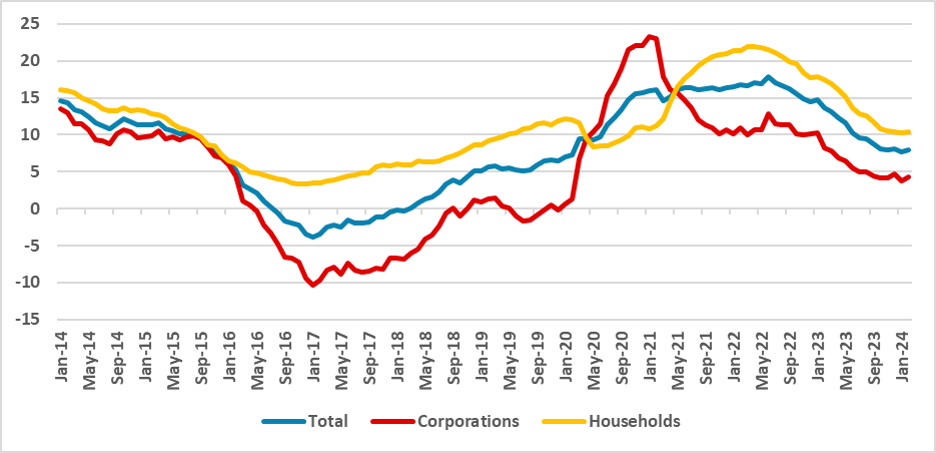

Despite the BCB's initiation of the cutting cycle, credit is anticipated to decelerate due to monetary policy lags. Enterprises face the most significant impact, with nominal growth dropping to 4.1% in February from 12.1% a year prior. While household credit growth slows to 10.4% annually from 17%,

April 24, 2024

Brazil: Wage Inflation Will Likely Not Be a Big Deal

April 24, 2024 3:19 PM UTC

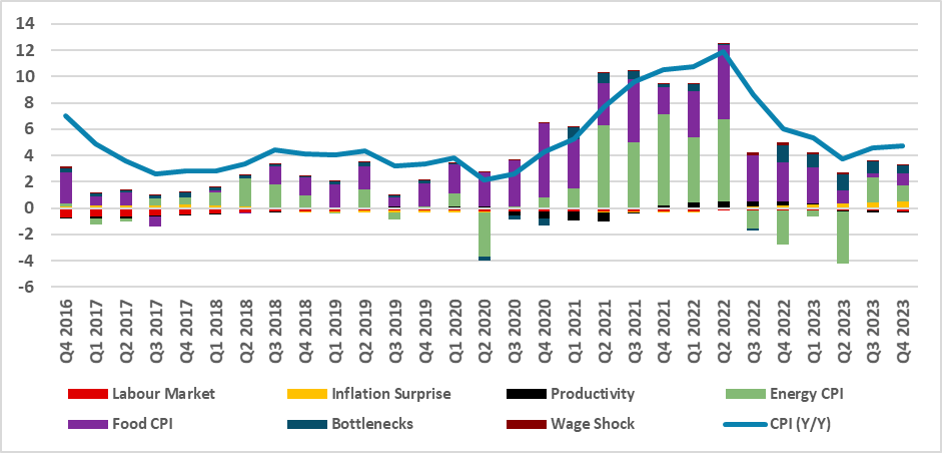

Our analysis delves into recent trends in the Brazilian labor market, focusing on CPI and wage inflation. Utilizing a model akin to Ghomi et al. (2024) and Blanchard and Bernanke (2023), we dissect recent spikes in wage inflation and CPI growth. Notably, our findings suggest that recent wage spikes

April 18, 2024

Brazil: Revision of Targets Shows the Weakness of the New Fiscal Framework

April 18, 2024 1:39 PM UTC

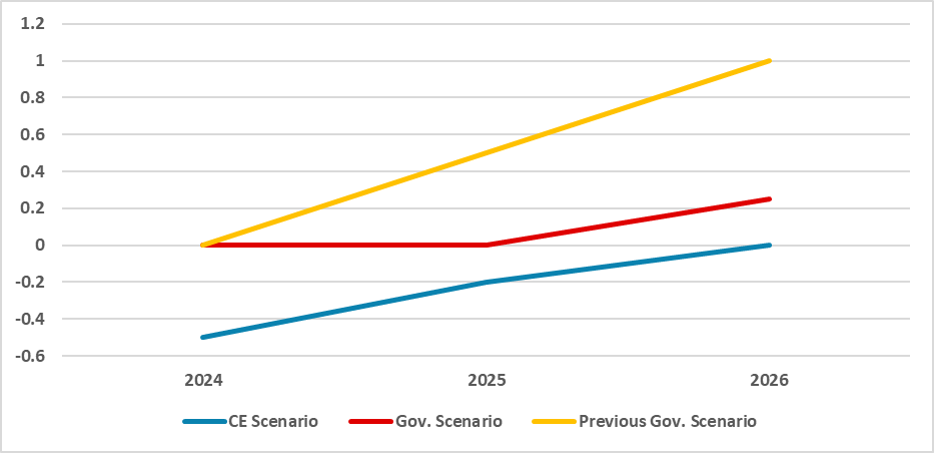

The Brazilian government has revised its budget targets for 2025 and 2026, lowering the deficit to 0% and a 0.25% surplus in 2025 and 2026 respectively, from 0.5% surplus in 2025 and 1% in 2026. However, reliance on revenue increases poses challenges amid resistance from Congress. Despite reduced ta

April 03, 2024

Brazil: What About the Fiscal?

April 3, 2024 2:31 PM UTC

In 2023, Brazil witnessed a significant fiscal decline, with the GDP surplus of 0.5% in 2022 turning into a 2.1% deficit, surpassing the targeted 0.5% deficit set by the new fiscal rule. Despite measures aimed at reinstating fiscal sustainability, immediate adjustments are unlikely. The deterioratio

March 28, 2024

Brazil: Inflation Report Points to a Scenario Too Good for the BCB Board to Believe it

March 28, 2024 2:20 PM UTC

The Brazilian Central Bank's Quarterly Inflation Report reflects uncertainty over disinflation and emphasizes caution in monetary policy. Despite slower expected disinflation and inflationary surprises in certain sectors, the BCB projects optimism with inflation nearing target. Labor market data sho

March 26, 2024

BCB Minutes: Doors Opens to Diminish the Cuts Pace in June

March 26, 2024 1:11 PM UTC

The Brazilian Central Bank has released the minutes of their last minutes. The minutes highlighted the uncertainty, labour market pressures and unanchored expectations. They decided to reduce the horizon of the 50bps ace to the May meeting which indicates a prospective reduction to diminish the pace