Brazil: High Expenditure Levels Challenge Fiscal Stability

Brazil’s fiscal data through August shows a primary deficit of 2.3% of GDP, with expenditure growth outpacing revenue gains despite efforts to increase government income. Social transfers and unemployment benefits contributed to rising expenditures, now at 20.2% of GDP. The Central Bank’s recent rate hikes will increase fiscal pressures, pushing the debt-to-GDP ratio to stabilize around 85%.

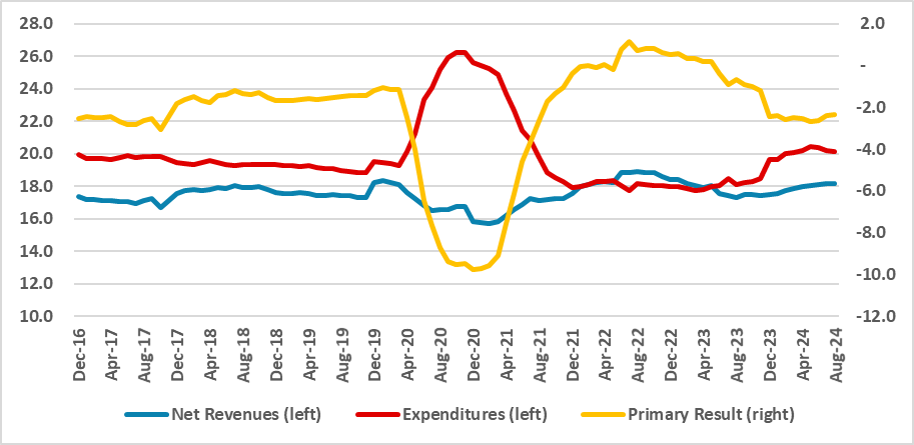

Figure 1: Primary Result (12-months sum, % of the GDP)

Source: National Treasury, BCB and Continuum Economics

Brazil’s National Treasury has released fiscal data up to August. Over the last 12 months, Brazil has registered a primary deficit of 2.3% of GDP, maintaining a level somewhat stable from the numbers recorded in December 2023. At that time, the main contributors to the deterioration of the fiscal balance were payments on judicial sentences (precatorios), which the government resumed after a suspension by the previous administration, and an increase in unemployment insurance benefits.

The good news came from the revenue side. Government measures have successfully increased revenues, which grew 6% in real terms, accumulating to 18.2% of GDP. Rising revenues are also benefiting from strong GDP growth. However, challenges persist on the expenditure side. The government appears to be struggling to control expenditure growth, especially as most Brazilian expenditures are earmarked, limiting the government's ability to reduce them. Expenditures have now reached 20.2% of GDP, and control of their growth will be essential if the government aims to meet its fiscal consolidation goals.

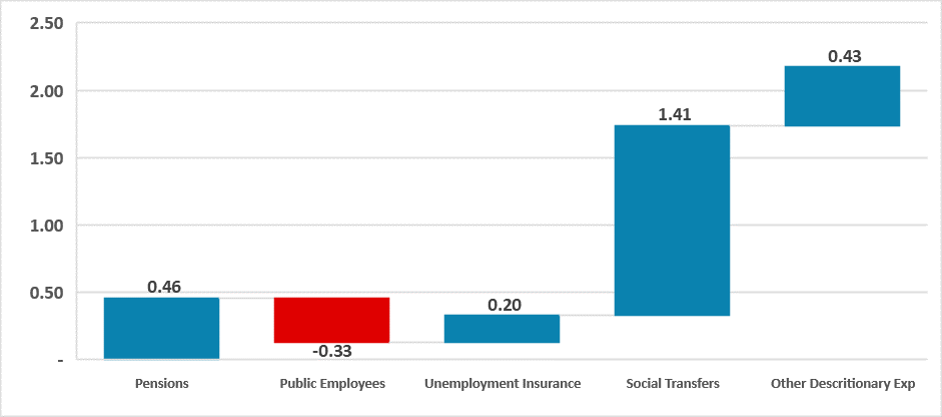

Figure 2: Expenditure Rises from Jan. 2022 (12-months sum, % of the GDP)

Source: National Treasury, BCB and Continuum Economics

Examining expenditures more closely, we note that primary expenditures have grown by approximately 2.4% of GDP since the new administration took office in January 2023. By far, the largest contributor to this increase was the rise in social transfers (+1.4% of GDP), due to enhanced average benefits for low-income households. Additionally, unemployment insurance benefits have increased, contributing an additional 0.2% of GDP. Pensions have risen by 0.4% of GDP, largely as a consequence of an aging population. Other discretionary expenditures have also risen by 0.4% of GDP.

The government is acutely aware of the need to control expenditures, and next week, a package aimed at managing expenditure growth is expected to be presented, focusing on limiting certain expenses. In 2025, the new fiscal framework will be implemented, restricting expenditure growth to 70% of revenue growth, with the goal of reducing the primary deficit to 0.25%, a significant consolidation from the current 2.3% deficit.

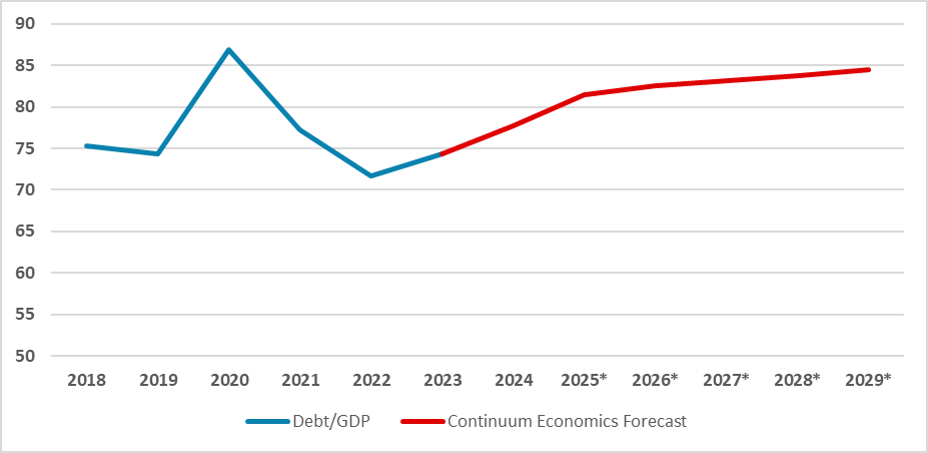

Figure 3: Debt/GDP Forecasts (% of the GDP)

Source: BCB and Continuum Economics

Additionally, the Central Bank of Brazil’s decision to resume interest rate hikes will impact fiscal results due to increased interest expenditures, with the fiscal deficit currently reaching approximately 9% of GDP. Given the government’s challenges in controlling primary expenditures and the prolonged period of higher interest rates, we have revised our debt-to-GDP projections. We now anticipate the ratio will stabilize around 85% of GDP, a high level for an emerging market.