Brazil: What About the Fiscal?

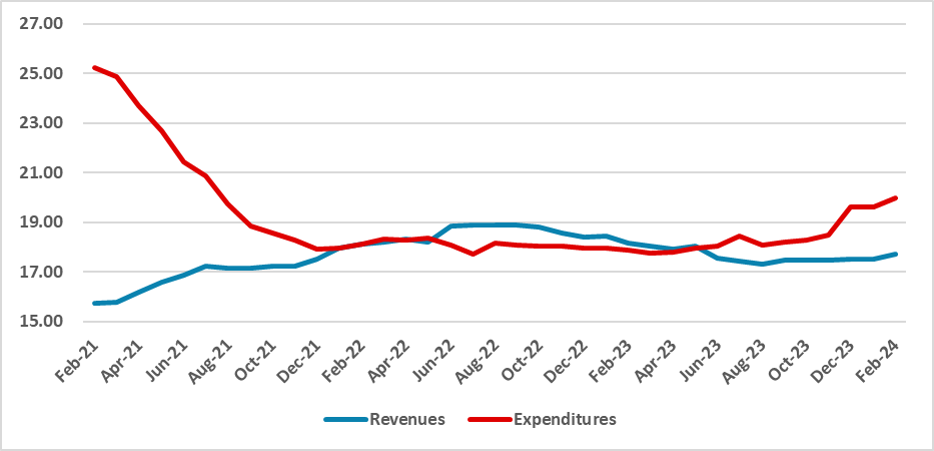

In 2023, Brazil witnessed a significant fiscal decline, with the GDP surplus of 0.5% in 2022 turning into a 2.1% deficit, surpassing the targeted 0.5% deficit set by the new fiscal rule. Despite measures aimed at reinstating fiscal sustainability, immediate adjustments are unlikely. The deterioration stemmed from reduced government revenues and increased expenditures. While the government aims for a 0% primary deficit in 2024 through revenue increases, achieving this goal seems challenging. Despite positive early revenue indicators, sustained growth remains uncertain. The deficit is anticipated to hover around 0.5% of GDP, prompting close fiscal monitoring.

Figure 1: Brazil Federal Revenues and Expenditures (% of the GDP, 12-months sum)

Source: BCB and STN

In 2023, Brazil saw its fiscal accounts deteriorate. The 0.5% GDP surplus in 2022 transformed into a 2.1% deficit, well above the proposed target of 0.5% deficit set by the new fiscal rule. As the new fiscal framework triggers several measures to reinstate fiscal sustainability, the government should put forward measures to contain expenditures. Realistically, those measures will not be valid for 2024, as the new fiscal rule was approved in 2023. The government will only need to apply any fiscal adjustments if they miss the 2024 target in 2025.

Figure 2: Contribution to the Fiscal Deterioration in 2023 (% of the GDP)

Source: STN and Continuum Economics

The fiscal deterioration in 2023 occurred due to a mix of lower government revenues and the government's decision to increase expenditures. First, tax collection dropped in relation to GDP. One possible explanation is that, as most of the growth in 2023 originated in the agricultural sector, which is not as taxed as industry and services, and most of its revenues stay with states and municipalities. Oil revenues and dividends also dropped due to lower international oil prices, and public concessions returned to their normal level, as they were artificially high due to the renewal of TV concessions in 2022. In terms of expenditures, pensions rose by 0.3%, which the government cannot control as it is more related to population aging. The 0.5% increase in social transfers and the payment of precatoriums around the same amount were both choices of the government. The precatoriums are related to the government's judicial obligations with third parties and were restricted to the top of 0.5% of GDP, but the government reviewed it and decided to resume its normal payment, consequently increasing their expenditures.

For 2024, the government aims to reduce the primary deficit to 0%, which would mean a significant fiscal consolidation. However, the task will be difficult. First of all, the government does not aim to reduce its expenditures but rather to increase them, making room for public investments. The main tool to achieve the dream of a 0% primary deficit will rely on increasing revenues. First, government revenues aim to increase tax collection on income. Several measures were approved in this sense by updating the collection rate on individuals and aiming to tax Brazilians who have money applied abroad. Additionally, reinstating taxes on fuels and diminishing tax exemptions for certain sectors are also on the agenda of Finance Minister Fernando Haddad. However, we believe the government is too optimistic in their projection. The government is expecting the economy to grow by 2.4% in 2024, well below our forecast of 1.7%, which could affect revenue growth projections.

The first two months of the year were positive for the government, with revenues for those two months surpassing government forecasts. The increase was impacted by revenues from investments abroad and the reintroduction of taxes on fuel and other sectors, therefore, being little related to economic growth. We still believe that the government will not be able to fulfill its promise of 0% growth, but the finance minister is clearly looking for options to increase revenue to finance government expenditures. We expect the deficit to stay around 0.5% of GDP this year, but we will pay a lot of attention to the fiscal data to update our forecasts.