BCB Preview: 25bps or 50bps cut?

The Brazilian Central Bank (BCB) convenes on May 8 to set the policy rate. Previous forward guidance hinted at a 50bps cut in May, but recent statements from BCB President Roberto and some weakness in the BRL have shifted expectations to a 25bps cut. However, we anticipate the BCB maintaining a 50bps pace, as Campos Neto's hawkish stance may not be unanimous in the board. Inflation softening offers room for a 50bps cut, yet risks from regional floods remain. We lean towards a 75% chance of a 50bps cut, but a reduction to 25bps in June is granted.

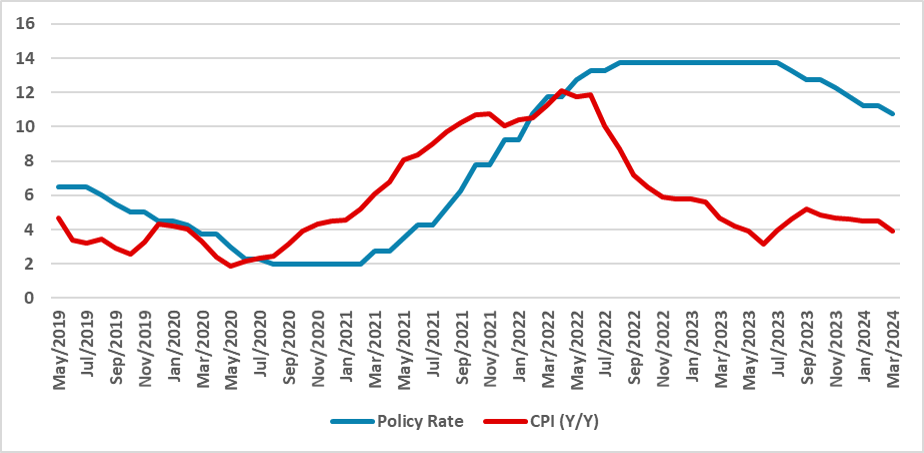

Figure 1: Policy Rate and CPI (Y/Y)

Source: BCB and IBGE

The Brazilian Central Bank (BCB) board will convene on May 8th to decide on the policy rate. In their last meeting (here), the board gave forward guidance of a 50bps cut in their May meeting, but stated that a June 50bps cut was not guaranteed and would be dependent on data. However, things have changed, at least for BCB President Roberto Campos Neto. During the IMF-World Bank Spring Meeting, the BCB President stated that the 50bps cut was no longer guaranteed and with the economy approaching full employment, caution would be necessary for the monetary authority. Additionally, the recent weakness in the BRL is due to the Fed delaying cuts.

This change in tone from the BCB President and the relative weakness of the BRL has shifted expectations of a BCB cut towards 25bps. Although we see this as a possibility, we believe the BCB will maintain its 50bps pace in a split decision. It is important to remember that this change in tone from the BCB came mostly from the BCB President, and at the moment, the government has already indicated the majority of the board, and Campos Neto’s hawkish views are not shared by most members.

Figure 2: BRL/USD

Source: BCB

Additionally, regarding the weakness of the BRL, we highlight that most of the BRL's rise was reversed in the last days, and although most of it could be related to a realignment of expectations from the agents, who now view a higher terminal rate, we believe a 50bps cut with a hawkish view could stabilize the BRL.

In terms of inflation, the BCB meeting will occur before the release of the inflation figures in April. The latest measures point to inflation softening further in April, which actually provides room for the BCB to further cut by 50bps. One possible risk for the 50bps is the current flood in the southern region of the country. This region is an important producer of agricultural goods, such as meat and rice, and the floods will likely have some inflationary impact in the coming months. At the moment, we see a 75% chance of a 50bps cut and a 25% chance of a reduction to 25bps. However, we could assume that the BCB will slow down to 25bps in June.