BCB Minutes: Doors Opens to Diminish the Cuts Pace in June

The Brazilian Central Bank has released the minutes of their last minutes. The minutes highlighted the uncertainty, labour market pressures and unanchored expectations. They decided to reduce the horizon of the 50bps ace to the May meeting which indicates a prospective reduction to diminish the pace cuts in June. We keep our view that we will see a reduction of the pace cuts to 25 bps in June.

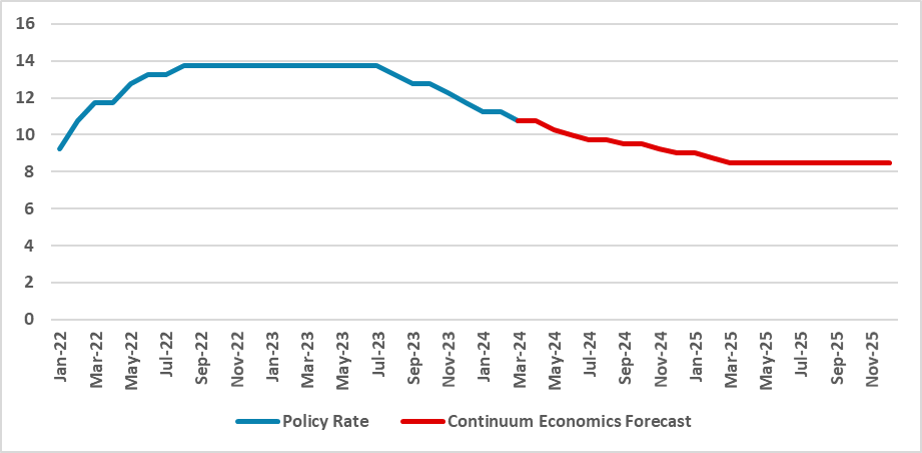

Figure 1: Brazil’s Policy Rate (%) Source: Continuum Economics and BCB

Source: Continuum Economics and BCB

The Brazilian Central Bank (BCB) has released the minutes of its last meeting (here), in which it cut the policy rate by 50bps to 10.75%. While the communique made it clear that they envisage a 50bps cut in May, it has left the door open to diminish the pace of cuts in June. The minutes confirm the view that diminishing the pace of cuts is starting to be on the radar due to uncertainty and the prospective terminal rate. The minutes are clear that some members are looking into the labor market. Although consumption contracted in the last quarter of 2023, its numbers were strong throughout last year. Additionally, the recent wage hikes could be a sign of labor market pressures. Although there is no direct mechanism between wage inflation and general inflation, the board stated they will meticulously review the data and its impacts.

One paragraph about the BCB communication was added to the minutes. According to them, the change in communication was necessary due to the increase in uncertainty. In the last meetings, the BCB was maintaining the message that a 50bps pace cut was the right one to follow, but now they have decided to restrict the 50bps cut to the next meeting in May. However, at the moment, the costs of advancing the magnitude of the cuts over a larger horizon were bigger than the benefits. We see this as an indication that they will likely reduce the magnitude of the cuts in June, and probably the May communique will signal that the cut, either 25bps or 50bps, will be decided with the available data.

Overall, disinflation is occurring as the BCB expects, but there is a consensus that the Monetary Policy still needs to be at contractionary levels as inflation expectations are not aligned with the target and the labor market is pressured. Additionally, as we approach 2025, the level of terminal rates w;ill begin to be discussed, and the velocity at which you approach it will also be pivotal. We maintain our view that the BCB will reduce the pace to 25bps in June and will keep it until they reach the terminal rate. This means the policy rate will finish 2024 at 9.0% and 2025 at 8.5%.