BCB Minutes: Hawkish and Indicating Hikes

The Brazilian Central Bank (BCB) remains hawkish, raising rates by 50 bps to 11.25% amid resilient domestic growth and unanchored inflation expectations. Key concerns include rising uncertainty in the fiscal landscape and exchange rate volatility, prompting cautious monetary policy. The BCB signals data-driven decisions ahead, with a potential acceleration in hikes if inflation worsens. Our forecast remains two more 50-bps hikes, with possible market relief if government spending cuts address debt sustainability concerns.

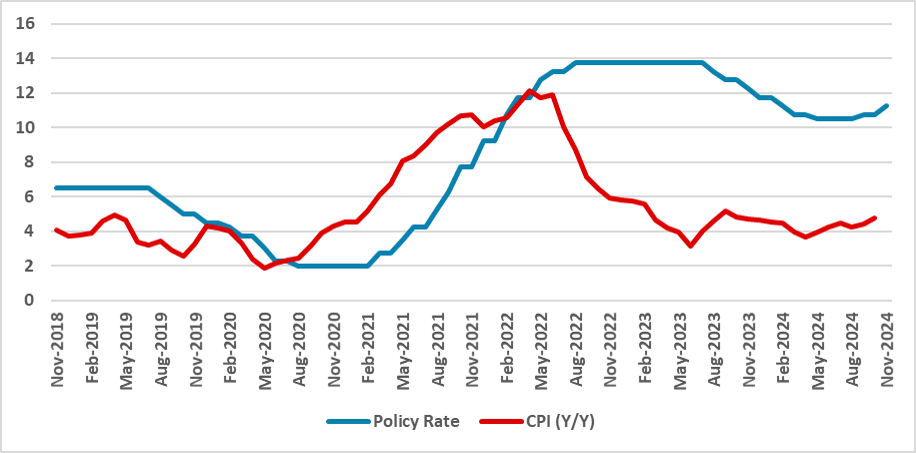

Figure 1: CPI and Policy Rate (%)

Source: BCB and IBGE

The Brazilian Central Bank (BCB) has released the minutes of its last meeting, in which it raised the policy rate by 50 basis points to 11.25% (here). Overall, the minutes retained the usual hawkish tone used to justify the current hiking cycle, with some new elements added, especially regarding fiscal policy. In discussing the foreign environment, the BCB highlighted the increased uncertainty due to the election of Donald Trump and the possible impact of the Chinese stimulus package, which we believe will have limited stimulative effect (here). One notable statement was that monetary policy will tend to be heterogeneous from now on due to the different economic cycles, which we believe was mainly used to justify the BCB hiking while most of the world is cutting rates.

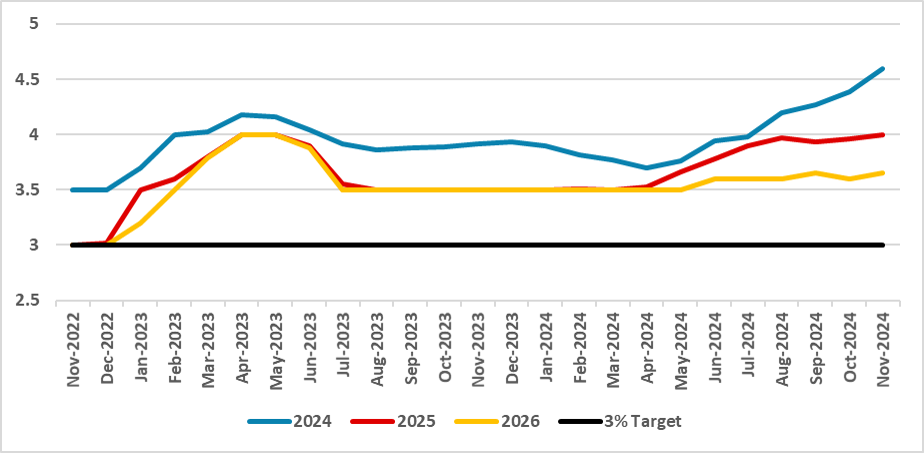

Figure 2: Inflation Expectations (%)

Source: BCB

Domestically, the BCB stated that economic activity continues to be resilient, with strong GDP and labor market figures indicating a positive output gap, though some indicators could point to an emerging moderation in economic activity. The BCB noted it will continue to monitor the pass-through from wages to prices, which will likely be a topic in the next Quarterly Inflation Report. Most significant in these minutes were the statements on fiscal policy, to which the BCB dedicated three paragraphs. First, it noted that stimulative fiscal policy should be used as an anti-cyclical tool, which is not appropriate given the current strength of the economy. Second, the uncertainties surrounding fiscal policy are contributing to unanchored inflation expectations, raising the cost of disinflation—an observation that marks a shift from the BCB's previous skepticism about the fiscal policy’s impact on inflation.

Inflation expectations remain unanchored across all horizons, with long-term expectations at 3.6%, well above the BCB’s 3.0% target. In the short term, the BCB acknowledges the need for caution, justifying a more hawkish stance. The increase in exchange rate volatility is another factor that demands caution from the BCB. Our sentiment analysis tool indicates that the tone of the minutes remains hawkish, though it does not signal a marked increase in hawkishness.

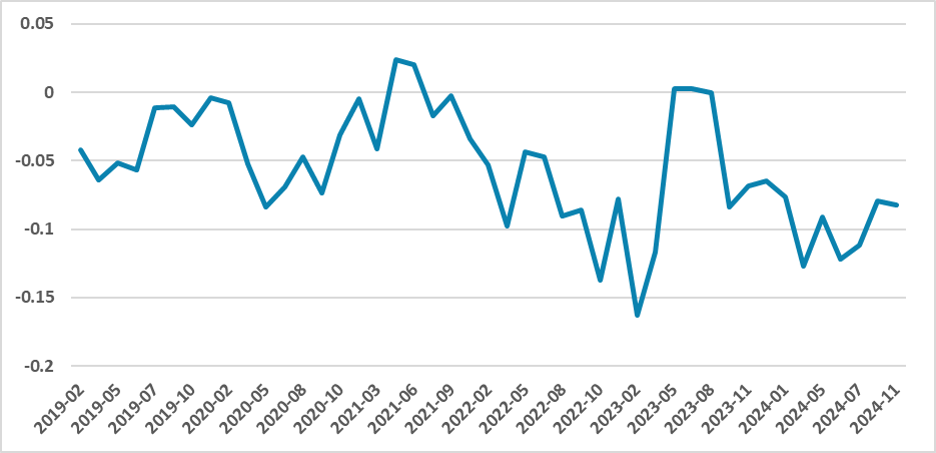

Figure 3: Minutes Sentiment (Negative Means More Hawkish)

Source: Continuum Economics

Looking ahead, the BCB stated it prefers not to provide any guidance, noting that its next moves will depend on the data. However, a scenario in which headline inflation and expectations deteriorate could indicate they evaluate accelerating the pace of hikes. However, we see no reason to change our view of two additional 50-basis-point hikes followed by a pause. Services inflation will likely continue to decline gradually, and a government spending cut project could calm market concerns regarding debt sustainability.