BCB Review: A Pause in the Cutting Cycle

The Brazilian Central Bank kept the policy rate at 10.5%, citing economic uncertainty and a need for caution. Inflation expectations for 2025 are 3.8%, above the 3.0% target. Political interference concerns persist, but the unanimous decision indicates a technical approach. The BRL's depreciation may reverse in the second half of the year and the fiscal situation tends to improve, allowing potential rate cuts by year-end.

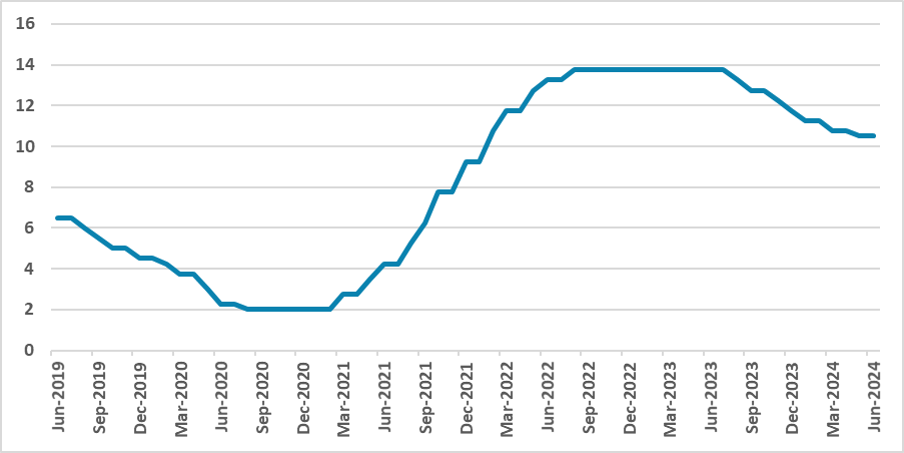

Figure 1: Brazil Policy Rate (%)

Source: BCB

The Brazilian Central Bank (BCB) has convened to decide the policy rate. In a unanimous decision, the board opted to keep the policy rate unchanged at 10.5%, in line with market expectations and our preview. Regarding the foreign scenario, the board emphasized the uncertainty regarding policy rate cuts in the U.S. and the pace at which inflation will fall in advanced economies. This high-uncertainty scenario demands caution, according to the BCB. No comments were made regarding the recent depreciation of the BRL, which rose to 4.3 BRL/USD in recent days.

In the domestic scenario, the BCB stated that economic activity and the labor market were demonstrating greater dynamism than previously expected. Given the current outlook, where the disinflation process tends to be slower, inflation expectations are de-anchored, and the external scenario is more challenging, the conduction of monetary policy needs to be serene and moderate.

Inflation expectations for 2025 now stand at 3.8%, which is significantly above the 3.0% target set by the Monetary Committee. Recent statements from Lula attacking the BCB President are not helpful in the conduction of monetary policy, as many market participants believe there will be political interference in the BCB when Lula appoints the new BCB President in December. However, the unanimous vote to keep the policy rate unchanged is helpful as it shows that all the board members favor a more technical view, indicating that inflation needs to be tackled with higher rates.

Recently, there has been noise around fiscal policy in Brazil and the difficulties in pursuing a sustainable policy. The BCB commented that they are monitoring the situation and that a credible fiscal policy contributes to the anchoring of expectations. However, there is little the BCB can do on that front.

It was also interesting to note that the BCB used in its modeling the scenario of keeping the policy rate unchanged at 10.5% until the end of 2025. This shows that some members are working with a scenario in which no changes occur in the policy rate in their relevant horizon. In this scenario, the BCB model shows that inflation will likely finish 2025 at 3.1%, close to the 3.0% target.

Moving forward, we believe some of the depreciation of the BRL will be reversed in the second half of the year, and government revenues will likely compensate somewhat for the high expenditures. In the end, the government will likely register an acceptable 0.7% primary deficit. This will likely give room for the BCB to resume cutting the policy rate at the end of the year, meaning the policy rate will end 2024 at 10.0%.