BCB Minutes: Worsening Conditions Demand Caution

The Brazilian Central Bank's latest meeting revealed a shift in forward-guidance, reducing the cut from 50bps to 25bps. While no immediate actions were taken, the minutes highlighted worsening conditions in three key areas: External Environment, Fiscal, and Economic Activity. Despite split votes on the rate reduction, sentiment remained negative, with increased uncertainty. Looking ahead, predicting policy rates has become more challenging, with expectations leaning towards a hawkish stance. Future decisions will likely hinge on both internal and external factors, necessitating a cautious approach amidst fluid conditions.

The Brazilian Central Bank has revealed the minutes of its last meeting, in which it dismissed the previous forward-guidance of a 50bps cut and reduced it to 25bps. Additionally, regarding the next steps, the BCB has not made any further movements, indicating that their decision will now be based on the data. The minutes were larger than the previous ones and denser in terms of information. However, the decision could be split into three main components that worsened compared to previous meetings: External Environment, Fiscal, and Economic Activity.

The board emphasized that the risks associated with the external scenario have increased and are now adverse. The resilience of labor markets in advanced economies, along with a tighter output gap, coincides with rates being higher for longer. Additionally, revisions around the Fed-fund rates and the higher long-term rates in the U.S. make the general conditions of the financial markets tighter. This is important for emerging markets that need to finance larger amounts of debt in the financial market. However, the transmission mechanism in which higher international rates impact the domestic economy is not automatic. The board stated two possible mechanisms: through the exchange rate, which the board communicated has been minimal so far; and the other through the financing of debt. We don’t see the latter as a huge problem as most of the sovereign debt is financed through the domestic currency, which is not much affected by external conditions. The conclusion of the BCB board was that in an uncertain external environment, it is better to be cautious. This indicates that the BCB is actually paying plenty of attention to what happens outside and, therefore, does not want to risk lowering the gap between the domestic policy rate and the external ones.

On the fiscal side, the board also pointed to a worsening of the situation. They highlighted the importance of a credible fiscal policy to reduce the risk premium and to reduce the uncertainty around the Debt/GDP path. We already highlighted the change in the targets of the fiscal framework, as the government relies on increasing revenues to compensate for increased expenditures. It was clear that the past targets were not attainable, but we still see Debt/GDP stabilizing in the long-term. However, markets, especially the internal ones, which are the forecasts that the BCB looks at, didn’t like the change and are uncertain about fiscal stability, translating it into higher inflation expectations. Additionally, the adoption of directed credit with subsidized credit reduces the power of monetary policy. As we stated, credit is decelerating, but the pace of directed credit through official institutions is increasing with potential side effects for monetary policy.

The BCB board also stated that economic activity is accelerating, while the BCB board was expecting a deceleration. They highlighted especially the resilience of consumption, which also has potential impacts for inflation. The higher-than-expected activity also contributes to a view of a more hawkish stance of the BCB. Additionally, the labor market continues to show dynamism, and although there are some uncertainties around the employment measures, additional caution is needed from the monetary authority.

The reduction to a 25bps cut from the projected 50bps cut from the past forward-guidance was not unanimous and won by a small margin, 5-4 in votes. The minutes were keen to emphasize that although the board was split, the divergence of the board was more related to the commitment of the BCB regarding the forward-guidance rather than the analysis of the outlook. All the board was aligned around the worsening of the conditions. However, for the ones who voted for a 50bps cut, they stated that the possibility of cutting 50bps would not be that damaging as it does not condition the terminal rate. Some narratives in the market are pushing for a view that the next BCB President, who will likely be one of the members who voted for a 50bps cut, will be more conservative with inflation, which is one of the reasons for a rise in the inflation forecast. The minutes try to reduce this damage by stressing the commitment of all the board members to inflation convergence.

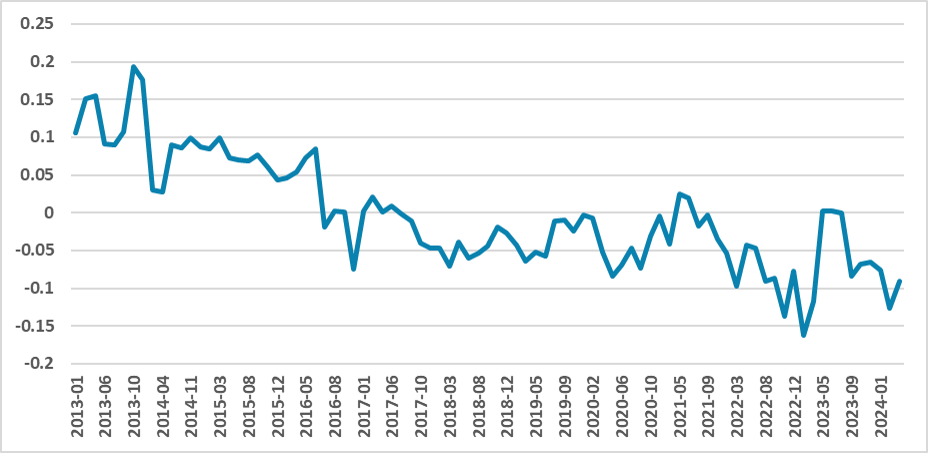

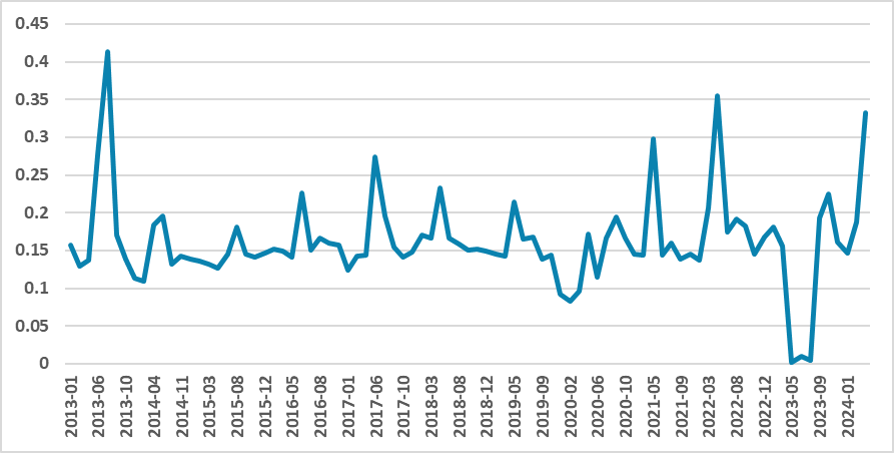

We ran our model of sentiment analysis on the minutes. The sentiment was negative (hawkish) but not more negative than the March minutes. What really increased was the uncertainty of the minutes. Our uncertainty index rose, revealing that the views of the board are more conditioned to uncertainty, which of course makes things more difficult to predict.

Figure 1: Minutes Sentiment

Source: Continuum Economics

Figure 2: Minutes Uncertainty

Source: Continuum Economics

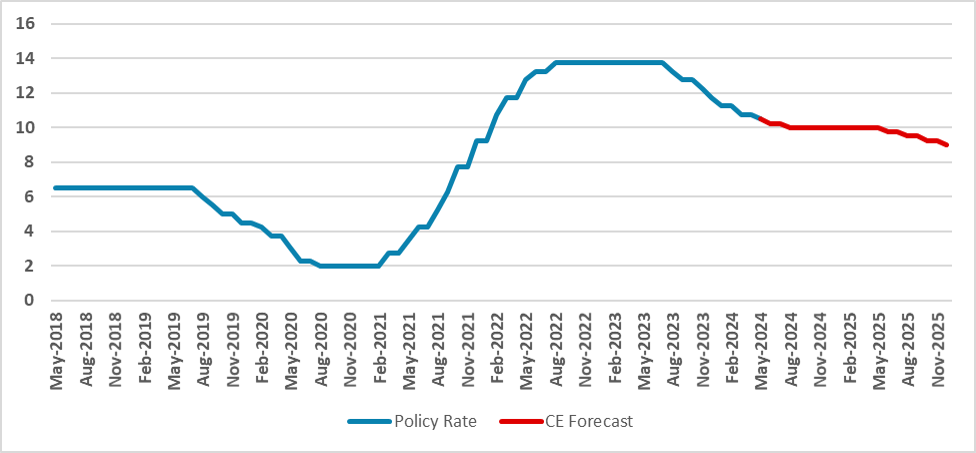

The policy rate is now much more difficult to predict, with markets diverging on the terminal rate and the future movements of the policy rate. The swing in communication points to a more hawkish stance and with a higher terminal rate. The BCB will continue to look externally to calibrate their decision. It is very likely they were looking to Banxico, which is also a large economy in the emerging market, and applied a pause. We are looking for BCB to apply two 25bps cuts and then a pause around 10%. Then they will likely resume cutting in 2025 until it goes to around 9.25%. However, the situation is fluid now and it could change due to a worsening of not only internal conditions but also external ones.

Figure 3: Policy Rate (%)

Source: BCB and Continuum Economics