Brazil: Credit Decelerating Amid Tighter Conditions

Despite the BCB's initiation of the cutting cycle, credit is anticipated to decelerate due to monetary policy lags. Enterprises face the most significant impact, with nominal growth dropping to 4.1% in February from 12.1% a year prior. While household credit growth slows to 10.4% annually from 17%, earmarked credit accelerates, particularly for enterprises, contrasting starkly with non-earmarked credit. This disparity challenges monetary policy effectiveness, potentially necessitating a higher terminal interest rate to curb inflationary pressures.

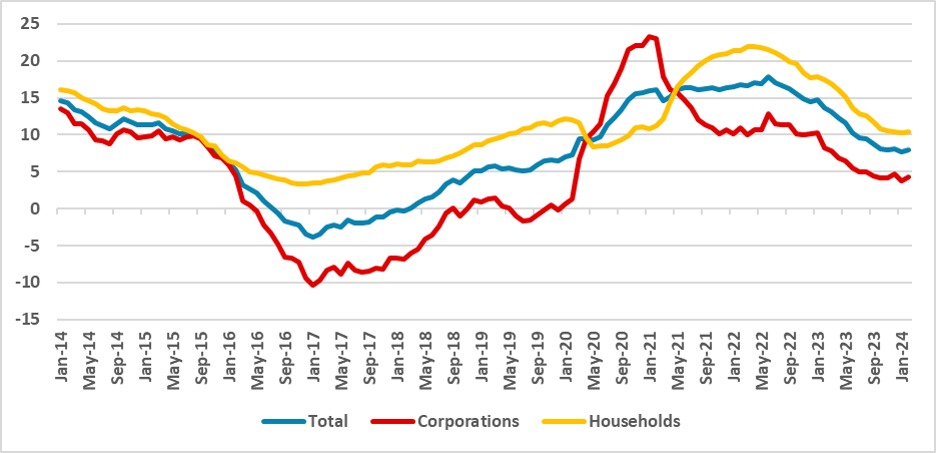

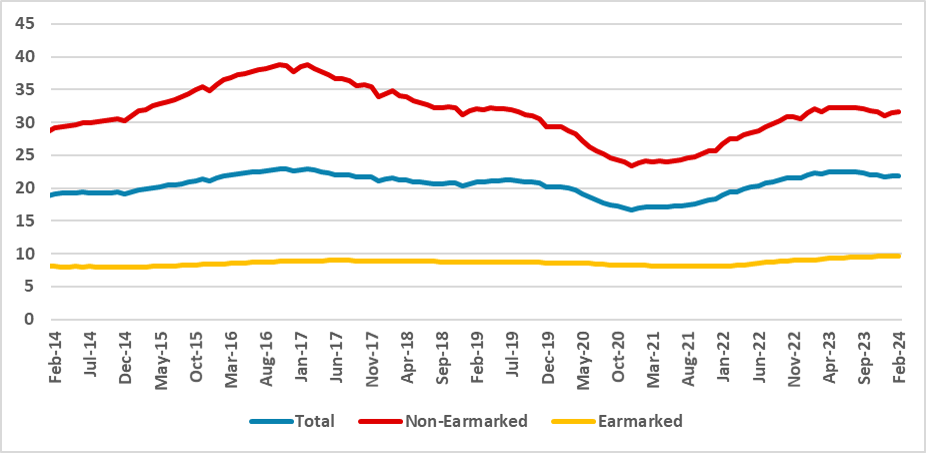

Figure 1: Annual Nominal Credit Growth (%)

Source: BCB

Although the BCB has already started its cutting cycle, due to the lags in which monetary policy acts, we believe credit will continue to decelerate. At the moment, the most affected credit is the one designed for enterprises, which has decelerated to a 4.1% nominal growth in February. Just 12 months before, this same indicator was registering a 12.1% nominal growth. Credit to households is decelerating slower; at the moment, it registers a 10.4% annual nominal growth, although just 12 months before, it was growing at 17%.

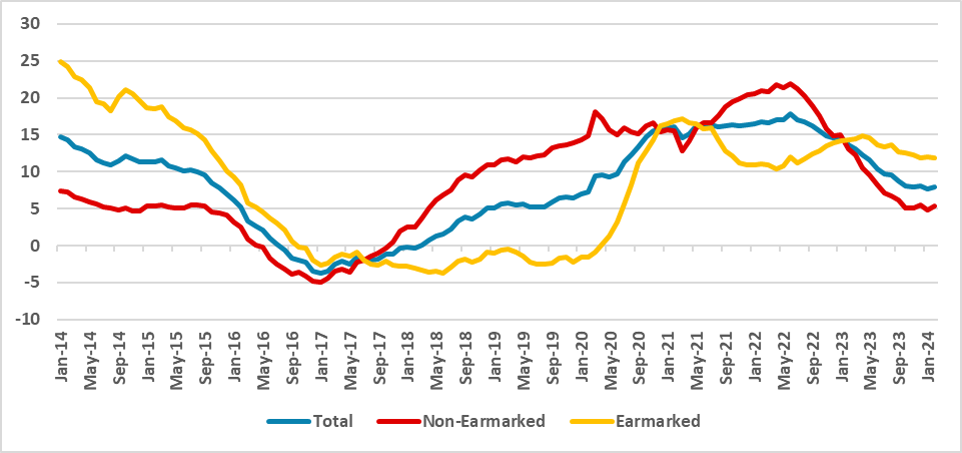

Figure 2: Annual Nominal Credit Growth (%)

Source: BCB

Notably, there is a marked difference between earmarked credit and non-earmarked credit. Since returning to the Presidency, Lula’s government has been trying to increase the participation of public credit in the market, mostly through the use of state-owned banks and, in many cases, with subsidized rates. Earmarked credit to enterprises has been accelerating since the beginning of 2023 and in February registered a 9.9% nominal growth, contrasting with non-earmarked credit, which grew 1.2% in annual nominal terms in February. A similar situation is seen in credit to households, which are mostly related to consumption. Earmarked credit to households has recently grown 9.1%, while non-earmarked has grown 5.4%.

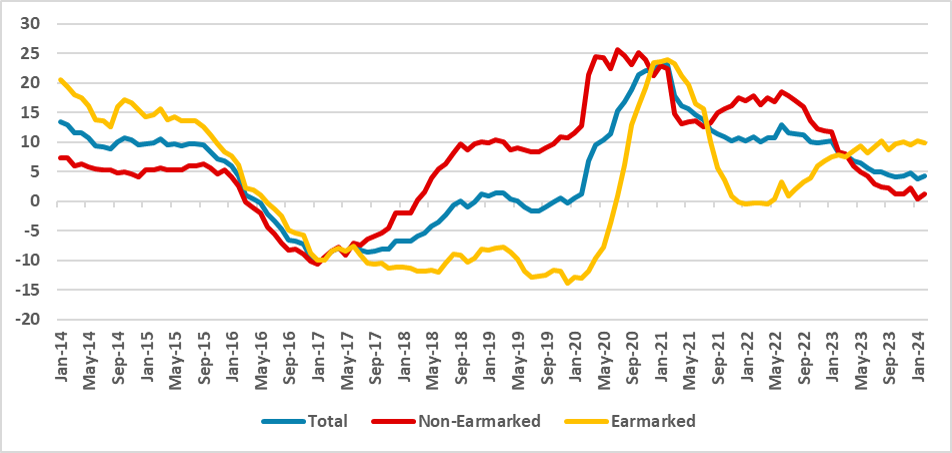

Figure 3: Annual Nominal Credit Growth to Enterprises (%)

Source: BCB

We believe that this difference in patterns of earmarked and non-earmarked credit is bad for monetary policy. While the BCB was trying to tighten monetary policy, government measures were, on the other side, increasing the supply of credit, jeopardizing the efficiency of monetary policy. Earmarked credit, which at the moment corresponds to 42% of the total credit in the Brazilian economy, has increased its participation in total credits by around 10 percentage points since returning in January 2022.

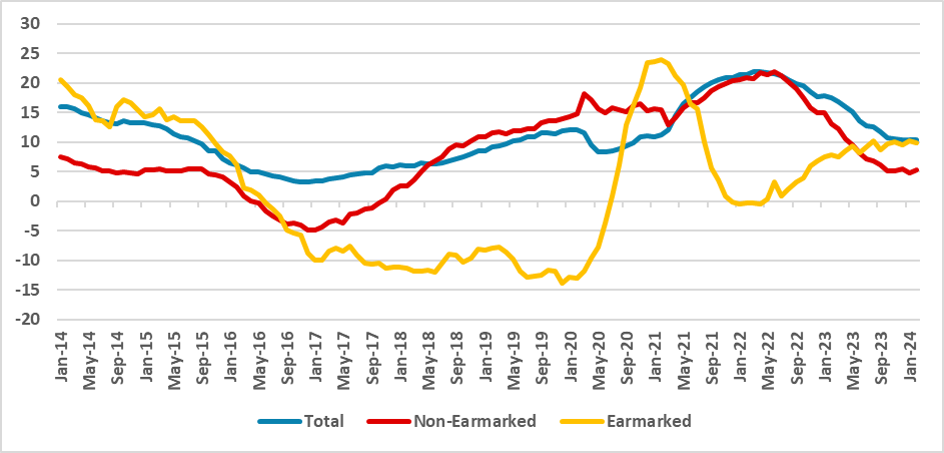

Figure 4: Annual Nominal Credit Growth to Households (%)

Source: BCB

Interest rates are also lower in earmarked credit, which makes it more attractive. The current composition of high credit for households and the slowing for enterprises points to inflationary pressures. It is very likely that credit to enterprises will continue to decelerate in the upcoming months, while credit to households remains somewhat stable. This combination of increasing earmarked credit and slowing down credit to enterprises is actually a factor indicating that the terminal interest rate of the cutting cycle will need to be above neutral, putting a brake on the government's inflationary measures.

Figure 5: Annual Nominal Credit Growth to Households (%)

Source: BCB