BCB Preview: 100bps Hike Will Buy Some Time

The Brazilian Central Bank is expected to maintain its course with two 100bps hikes, reaching 14.25% by March. Inflation forecasts for 2025 exceed the target, necessitating a firm policy stance. Despite market concerns, new President Gabriel Galípoli is likely to act decisively. The Real’s recent appreciation may ease inflationary pressures, with future hikes after March dependent on evolving data.

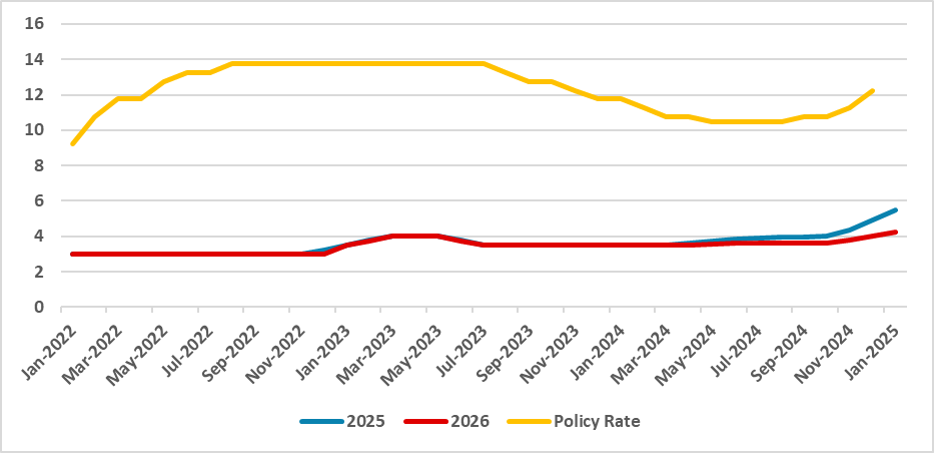

Figure 1: Policy Rate and Inflation Expectations (%)

Source: BCB

The Brazilian Central Bank (BCB) will convene to decide the policy rate on Jan. 29. The BCB has already stated its intention to make two additional 100bps hikes to the current 12.25% level. Therefore, we expect no deviation from this course despite some deterioration in the scenario. We expect the BCB to remain firm, maintaining its decision for another 100bps hike in March, although some additional forward guidance could be possible.

The latest expectation reports point to a significant deterioration on the inflationary front, with the median of forecasters predicting a 5.5% CPI growth in 2025, above the BCB target, indicating an unanchoring of expectations. The tone of the communiqué will need to be firm to signal the BCB’s commitment to reducing inflation.

This will also be the first BCB meeting presided over by the new President, Gabriel Galípoli. Markets have expressed concerns about whether he might be complacent with inflation to foster growth. However, as he was appointed by President Lula, government criticism regarding the high interest rate level has ceased, likely giving him the freedom to raise the policy rate to levels compatible with lowering inflation toward the target.

However, we believe markets are overreacting slightly. The main argument for raising inflation forecasts is likely the potential for Trump’s policies and the threat of tariffs, which could increase inflation rates in the U.S. and globally. Another factor is the current depreciated exchange rate, which, in a heated economy, could increase the pass-through of depreciation to price levels. We believe asserting both factors is premature. The Brazilian Real has appreciated in recent days, and the current interest rate levels will likely lead to further appreciation throughout the year.

The BCB will buy time now to see whether current volatility subsides and inflationary pressures ease. That is why we believe they will maintain the 100bps hike for March and state that future hikes will be evaluated based on available data. We believe inflationary conditions will likely improve in the coming months, and we continue to forecast that 14.25% will be the peak policy rate this year, although markets believe it could rise to 15%.