Brazil CPI Preview: Inflation to Rise in July

The Brazilian CPI is expected to rise by 0.3% m/m in July, pushing Y/Y CPI to 4.4%. This increase is mainly due to higher gasoline prices affecting the Transport and Housing groups. Inflationary risks are emerging, with strong economic activity and sticky service inflation, but a policy rate cut remains uncertain as BCB faces challenges.

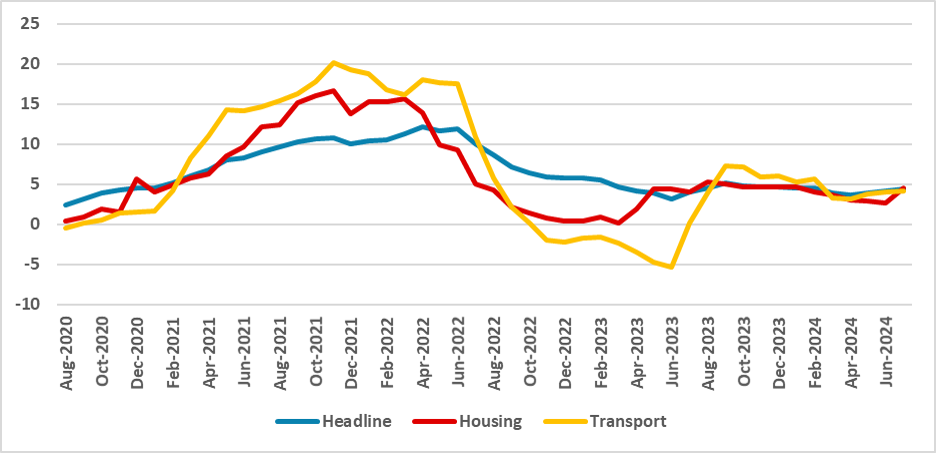

Figure 1: Brazil CPI (Y/Y, %)

Source: IBGE and Continuum Economics

Source: IBGE and Continuum Economics

On Aug. 9, the Brazilian National Statistics Institute will release the CPI figure for July. We forecast the Brazilian CPI to continue to grow in July with a 0.3% m/m rise. This will lead the Y/Y CPI to rise to 4.4% from 4.2%, approaching the upper limits of the target band. However, we see most of this rise being concentrated in the Transport group, reflecting the increase in regulated gasoline prices. Due to increased costs, Petrobras has raised the distribution prices of fuel, and we see this item affecting both the Transport group and the Housing group.

Some inflationary risks are starting to appear on the horizon, and we will be very attentive to whether this materializes in higher CPI figures. First, higher fuel prices could pass through to other groups as a response to higher transportation costs. The BCB is still having some difficulties aligning inflation expectations with its targets, and the criticism from government members towards the BCB could indicate that the next BCB President will be more complacent with inflation. This increases the costs of disinflation, making inflation stickier. Second, it seems that the exchange rate will remain at a higher level for longer, possibly impacting the tradable group. Finally, the economy continues to be strong, as indicated by the latest employment data, with possible increases in costs for companies. Service inflation is also remaining sticky, which is not good news for inflation convergence.

We still see the economy cooling down in the second half of the year and inflationary risks dissipating in the second half of the year. Whether there will be a cut in the policy rate is yet to be seen, but so far, we are beginning to incline towards the BCB continuing its long pause.