EMFX: Diverging On Domestic Forces Not Less Fed Easing Hopes

While U.S. economic developments, plus Fed policy prospects, will be important in terms of EM currency developments, domestic politics and fundamentals will also be decisive. These can keep the South Africa Rand volatile in the remainder of 2024, given the risk of a coalition government and African National Congress (ANC) infighting post-election. India Rupee resilience should be maintained, though we do see China authorities accepting a weaker Yuan. Finally, if Donald Trump is elected as the president in the U.S., then it could cause Mexican Peso jitters on fears that an immigration crackdown could sour U.S.-Mexico relations.

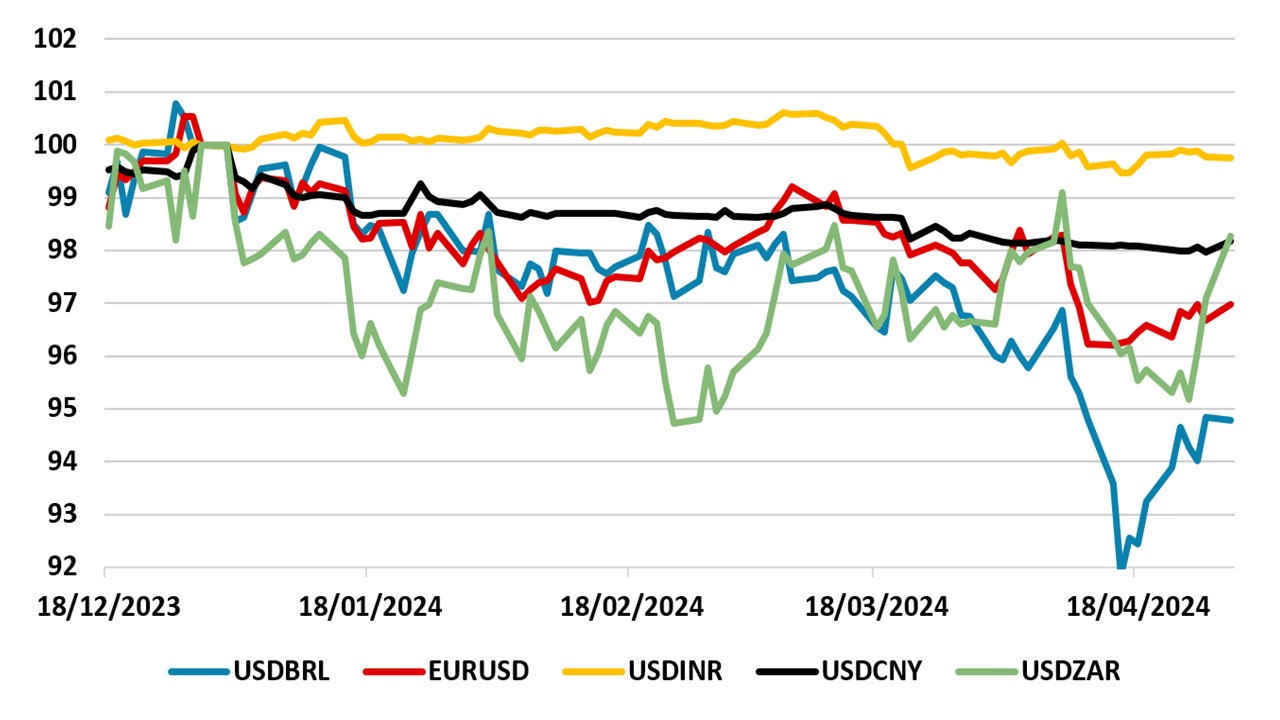

EM currencies have lost value against the USD this year, but not more than DM currencies and with similar divergence. What will happen in the rest of the year?

Figure 1: Big EM Currencies Lose Against USD But Not Significant (31/12/23 =100)

Source: Datastream/Continuum Economics

EM currencies have been on the defensive this year so far, partially as the USD has gained ground across the board with the resilient U.S. economy and 2024 Fed easing expectations having been reduced substantively. However, EM currencies have not shown more significantly weakness than DM currencies and the story has been one of divergence based on domestic politics and fundamentals rather than an EM risk off phase. Though some big EM currencies have fallen more than the EUR against the USD, this is not on the scale of Japanese Yen (JPY) weakness and the Chinese Yuan (CNY) and India Rupee (INR) have gained ground against the EUR (Figure 1). The Brazilian Real (BRL) weakness is also partially an unwinding of carry trades and last year’s strength, amplified by some concerns over the fiscal situation. The lack of EM risk off relates to a number of considerations.

· EM spreads are mainly positive versus U.S. Though most DM currencies have a negative spread versus the U.S., most major EM currencies enjoy a positive spread (Figure 2) and largely inflation heading towards central bank targets. China is a major exception on the spread front with a restricted capital account and PBOC discouragement helping to slow the CNY losses against the USD. This picture will not change radically with South African Reserve Bank (SARB) (here) and Reserve Bank of India (RBI) (here) likely delaying rate cutting plans and Brazil likely to slow the pace of easing (here) and still maintain a large short-term spread versus the U.S.

Figure 2: 2YR Yield Spread Versus. U.S. Treasuries (%)

Source: Datastream/Continuum Economics

· Political and Fiscal Policy Uncertainties. S. Africa faces post-election fiscal uncertainties (here), as the ability of the likely coalition government to control the budget deficit is in question after the May 29 election. This has pushed 10yr S Africa yields up and produced a steeper 10-2yr yield curve in 2024 (Figure 3) and a clear risk premia, with less impact on the South African Rand (ZAR). In contrast, expectations that PM Modi will remain in power after India’s election leaves the government bond market relaxed as a pro-reform government is expected to sustain a goldilocks combination of healthy growth and moderate inflation that controls the government debt/GDP trajectory via double digit nominal GDP – India yields are also being capped by expectations on global fund inflows when India is including in some bond indices. The Mexican Peso (MXN) and domestic markets have also been calm, as the June 2 election is expected to see a continuation of current policies (here). Meanwhile, Brazilian markets have also had some debate on fiscal policy (here) not providing enough confidence on the debt trajectory, though the 10-2yr spread is modest and driven by the rate cutting cycle rather than showing an S. Africa style risk premia. China also has no risk premia in the government bond curve, as flight to quality in government bonds has dominated domestic investor’s decision making and surpassed yield across the curve below the 1yr Medium-Term Facility (MTF) rate.

Figure 3: 10-2yr Government Bond Curve for Big EM (%)

Source: Datastream/Continuum Economics

Prospects for the remainder of 2024?

The key drivers for the remainder of 2024 will likely be the Fed decision on policy easing in addition to domestic politics and policy. If the Fed were to signal that tightening was more likely than easing due to sticky inflation, then this would cause a shock to EM currencies. However, we feel that such a scenario is low to modest risk and the baseline is still for Fed easing to start in 2024 and continue through 2025 – this appears to be the message at the May 1 FOMC meeting.

· USDCNY. We look for a Yuan decline to 7.40 versus the USD by end 2024 on our baseline. Interest rate differentials will remain adverse, as some further PBOC easing will likely be evident – the late April politburo read out also leaves this impression. Meanwhile, China authorities in the end favor a depreciation to help export competitiveness, but this will be controlled to avoid capital flight or U.S. protests (here). If Donald Trump were elected U.S. president in November, then it could mean some more CNY weakness on trade war fears – though we would see the main CNY price action coming in 2025, when USDCNY could reach 7.80 under a Trump inspired trade war scenario.

· USDINR. We see little change by year-end in the INR, as equity/bond and FDI inflows are financing the C/A deficit smoothly and actually putting upward pressure on the INR versus the USD. RBI has thus been buying USD’s to cap the INR. If Modi had a significantly worse poll result than the last election, then it could raise question about how a BJP led coalition would operate and could cause some June INR volatility – election results are expected on June 4. This is not our central scenario.

· USDBRL. BRL has drifted lower this year, but the yield pick-up versus the U.S. at the short and long-end of the curve remains. The Brazilian central bank will also likely slow the pace of easing during the year (here), which will make further easing more digestible for the BRL. Though domestic players are worried about the fiscal situation, foreign players contrast the relative stability in Brazil with uninvestable Russia, volatile S. Africa and mixed feelings towards China’s markets. Though India is loved, the stock market is already overvalued. We look for a small rise in the BRL in the remainder of 2024.

· USDMXN. The Mexican election will likely see MORENA candidate elected and ensure that policy follows the previous path, which will reassure global investors. Though Banxico has started the easing cycle, all the indications are that they will be cautious and move in 25bps steps. We see a 9.50% policy rate by end 2024 and this will still leave a large yield spread versus the U.S. However, the MXN has not seen a shakeout like the BRL, and our baseline is for 17.4 on USDMXN for end 2024. Moreover, if Donald Trump is elected president in November then it will likely hurt the MXN in Q4. Though Trump is expected to be more focused on China in the economic arena, Trump wants to curtail immigration and could threaten Mexico economically to get leverage.

· USDZAR. Our view has been that post-election uncertainty should decrease and help a gentle recovery in the ZAR by end 2024 – we forecast 18.50. An ANC-DA led coalition at face value could be more market friendly than the ANC alone. However, we would warn against overconfidence, as a low ANC vote could produce bitter infighting that seeks to take on board EFF or Zuma’s party market unfriendly policy (here). We would see a continued volatile period for the ZAR in the remainder of 2024, and we would be watchful for any signs that the ANC wants market-unfriendly policies.