EMFX Outlook: USD Strength to Ebb with Different EM Impact

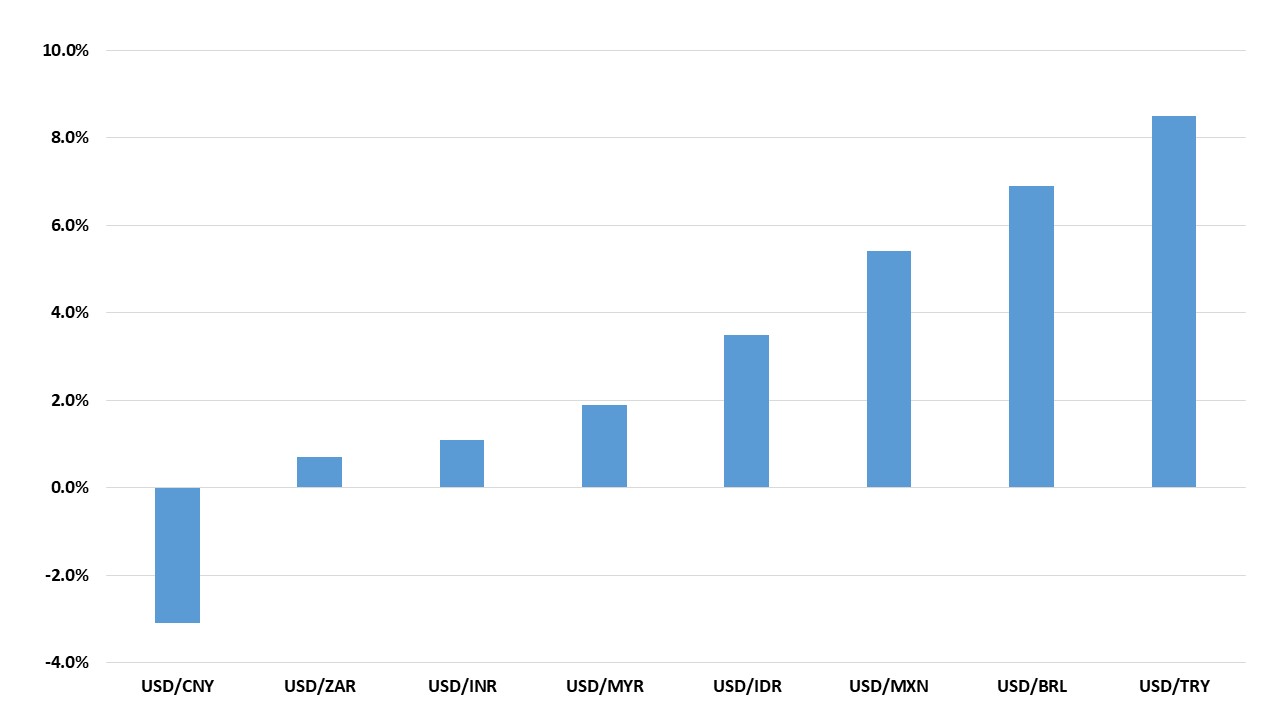

We see Fed rate cuts from September starting to soften USD strength into year end and 2025. Beneficiaries will include currencies with inflation moving towards target and high real rates or, alternatively, undervalued currencies. This should benefit the Brazilian Real (BRL) and Indonesian Rupiah (IDR). In contrast, structural economic weakness in China should see the authorities accepting some Yuan (CNY) losses to help sustain competitiveness. We see 7.40 on USDCNY by end 2024. The Mexican Peso (MXN) is trickier after the recent correction, with still healthy interest rate differentials, but event risks surrounding the U.S. presidential election. A reelected Donald Trump would likely pick a fight with Mexico to slow immigration.

· On a total returns basis, we would favour the BRL given that BCB have slowed easing, but real rates and interest rate differentials remain high. The IDR total returns can benefit from the spot move we forecast, but also as Bank Indonesia cuts more slowly than the Fed. We forecast the CNY to have negative total returns, as the interest rate differential against the U.S. is also adverse and the PBOC are likely to follow the Fed in cutting interest rates.

· Elsewhere, the Turkish Lira (TRY) has been the standout carry trade in Q2 as the spot rate has stopped declining since the spring. Though we see no rate cuts in Turkey until 2025, the authorities will likely restart modest currency depreciation to avoid the TRY real exchange rate hurting exports and we see 37.50 by end 2024 on USDTRY.

Risks to our views: A serious economic slowdown in the U.S. would likely mean a larger decline of the USD versus DM currencies on more proactive Fed cuts and spill over to benefit EM currencies. Alternatively, a renewed large surge in U.S. 10yr yields could help the USD generally, but also cause funding problems for weak EM and frontier countries.

Figure 1: 6mth Total Returns Versus the USD (%)

Source: Continuum Economics

Asia

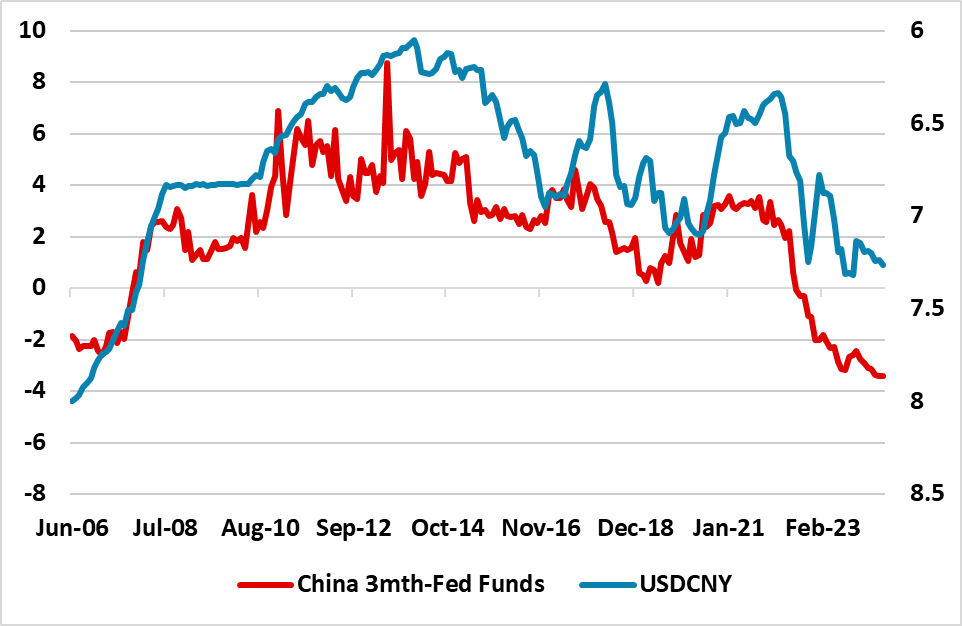

CNY should weaken further based on interest rate differentials, plus the need to help competitiveness in the face of some supply chains shifting out of China. However, China authorities want to ensure any decline is modest and controlled to avoid a pick-up in capital flight and a political backlash against the authorities. Thus we look for a slow rise to 7.40 in USDCNY by end 2024. Cuts in China’s medium-term facility lending rate have been pushed back to October once the Fed starts easing (here).

Figure 2: USDCNY and China 3mth-U.S. Fed Funds Target (%)

Source: Continuum Economics

Our baseline 2025 CNY forecast includes no major changes in China/U.S. relations, both due to uncertainty about the U.S. presidential election and about what trade policy changes towards China will actually occur in 2025. The baseline is for 7.40 by end 2025, despite our forecast of a generally weaker USD across the board. If Trump were elected president and decided to tackle trade in 2025 (immigration and making tax cuts permanent are higher priorities), then the USDCNY outlook would be for 7.80 by end 2025. A president Trump would likely increase tariffs on China again, though not to the penal 60% suggested. Just as in 2018, this would likely see China authorities allowing some controlled exchange rate decline to provide an offset. We attach a low probability to a China invasion or blockade of Taiwan, as China military capabilities will not be sufficient until the 2030’s to ensure a successful major seaborne operation and given a pro-China speaker in Taiwan’s parliament (here).

Although the Indonesian Rupiah (IDR) has seen increased volatility in recent months, the currency will recover over H2-2024. The value of the IDR will firm up later in the year as the new government takes charge in October and policy uncertainty fades, which will also align with the rate cuts by the Federal Reserve starting in September. Despite the expected strengthening in H2-2024, the rapid depreciation in recent months will see the currency close 2024 at 15,900 USD/IDR; it will appreciate over 2025 to end at 15,500 USD/IDR. Meanwhile in Malaysia, continuous current-account surplus and Bank Negara Malaysia’s proactive market intervention to curb excessive currency fluctuations, supported by substantial international reserves accrued from the ongoing trade surplus, will contribute to mitigating extreme volatility for the Ringitt (MYR). As a consequence, we expect the currency to close at 4.58 USD/MYR in 2024. The ringgit is likely to recover to 4.50 USD/MYR by end-2025, driven by a lowering interest-rate differential and a steady improvement in the economic fundamentals. The Indian Rupee (INR) will continue to be supported by the Reserve Bank of India’s intervention. Election related volatility saw the INR sliding to a record low in June, but the inclusion of Indian bonds in global indices from 2024 will provide support. In 2024 though, the currency will decline to 83.4 USD/INR, especially as delayed rate cuts by the Federal Reserve keep the currency under pressure. Strong growth, controlled inflation and increasing capital flows will help the USD/INR to fall to 83.1 by end-2025.

LatAm: Some Sell-off but a Recovery in the End of the Year

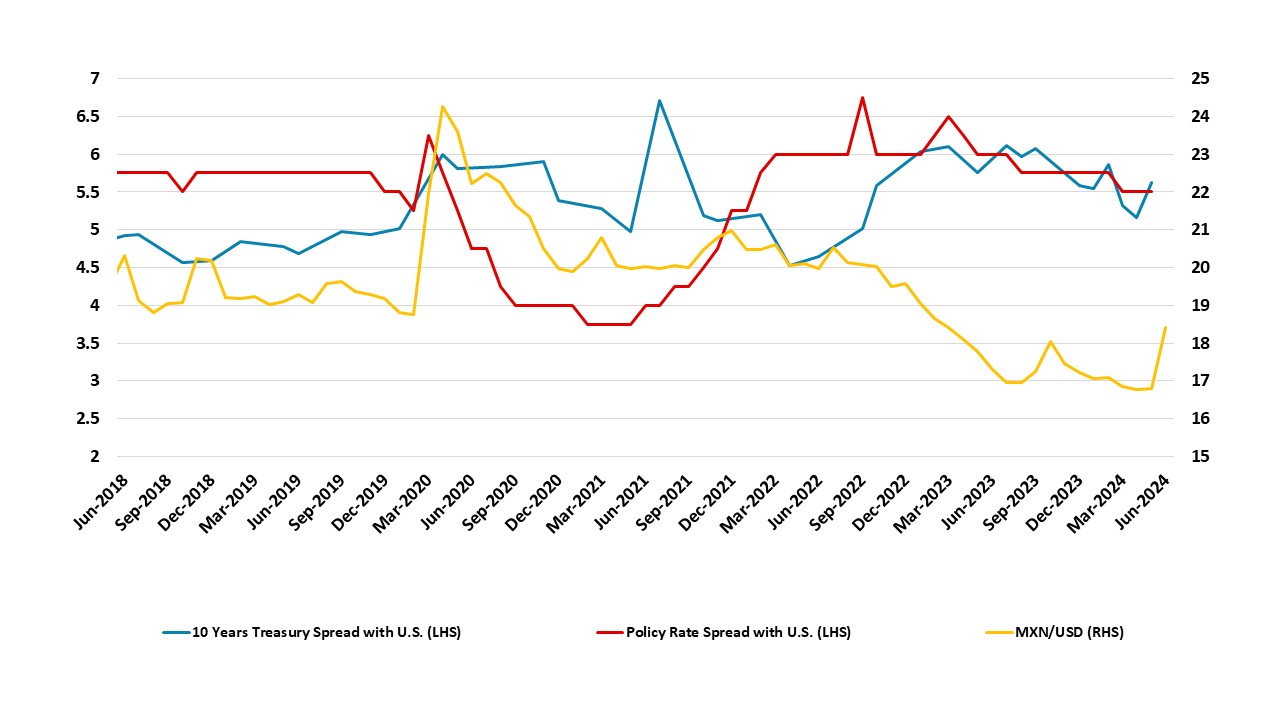

Some sell-off of EM currencies has been seen in recent weeks, particularly affecting the MXN and BRL, after the Mexican election prompted concerns about market unfriendly constitutional changes (here). Despite strong fundamentals, such as high yield spreads and robust exports, market fears of significant policy changes in Mexico have prompted a strong decline of the MXN. It is true that the decline was amplified by liquidation of carry trades. It is also true that the MXN was somewhat overvalued.

Figure 3: Mexico Exchange Rate, 10-year Yield Spread, and Policy Rate Spread with U.S.

Source: Datastream and Continuum Economics

We expect the MXN to remain above the 18 USD/MXN for the next few months. Although, Banxico will wait until the end of the year to resume rate cuts, possible changes in the institutional framework in the first months of Claudia Sheinbaum's government will likely keep market fears of anti-market policies alive. However, once it is clear when the U.S. will start cutting rates, we foresee the MXN appreciating slightly by the end of the year, finishing 2024 at 17.6 USD/MXN. In 2025, we see some room for appreciation towards 17.4 USDMXN, as the yield spread with the U.S. will be high and the government regains market confidence. However, if Donald Trump were to be elected president, he would likely pick a fight with Mexico over immigration and could threaten trade relations. This could see a MXN 5% plus weaker than the baseline.

In the case of Brazil, we believe the BRL is also being affected by the sell-off triggered by the election results in Mexico. However, there are also internal concerns, as there are doubts about the sustainability of fiscal policy and whether the central bank will satisfy government officials. Similar to Mexico, we believe that once the Fed starts cutting rates, the BRL will appreciate slightly, finishing the year at 5.2 USD/BRL. We also see some room for further appreciation in 2025, reaching 5.1 USD/BRL, as the yield spread with the Fed funds rate remains strong.

In Argentina, the government has implemented a strong fiscal adjustment plan. After a significant devaluation of the ARS aimed at unifying the official and black market rates, the rate of depreciation has been somewhat controlled and lower than previously recorded. As inflation slows and macroeconomic imbalances diminish, we anticipate the ARS will depreciate at a more controlled rate. Our forecast for the ARS is to end 2024 at 1100 ARS/USD and 2025 at 1600 ARS/USD.

EMEA

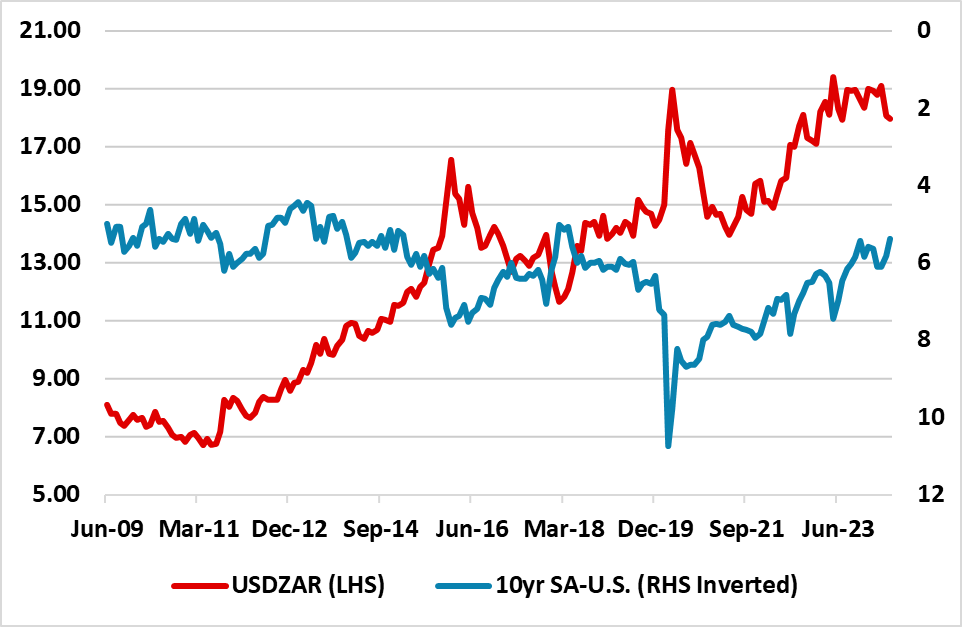

ZAR has edged up against the USD particularly after June 15 after the new coalition government was announced. The ANC-DA led coalition is a relief for the business community since it is expected to follow a more liberal framework, with a strong focus on the private sector based on the labour market to create jobs, inspire entrepreneurship, and get tough on crime. We foresee the coalition government backed by DA would likely push for some fiscal tightening in the budget for the current 2024/5 year, and ZAR to strengthen in H2 as the concerns around South African politics fade and the market starts to price in SARB easing. We feel the first rate cut (likely 25 bps) will take place in Q4 as we think the country could use DM easing as an opportunity, which will help fixed income returns, and supporting the ZAR, but this will depend on the inflation outlook. We foresee the U.S. will start cutting in September helping ZAR to remain well underpinned, finishing 2024 at 18.2 USD/ZAR. In 2025, we see some ZAR appreciation towards 17.8 USD/ZAR, as the bond yield spread with the U.S. will be high, coupled with SARB’s domestic inflation sensitivity, an improving foreign trade balance and a full speed coalition government at work showing determination in solving fiscal and power cut problems.

Turkish lira (TRY) has been one the best-performing carry trades in emerging markets over the in H1, and investors buy TRY forwards taking into account continued tight monetary conditions and higher summer tourism revenues. Despite the pace of TRY decline slowing after April due to favourable interest rate differentials, , we continue to see losses for TRY H2 as foreign capital inflow remains weaker-than-expected, inflation remains strong and Turikye needs to avoid excessive real TRY appreciation. We predict USD/TRY rate at 37.5 by the end of 2024 as exporters and domestic industry continue to push for a more competitive TRY. We see some further depreciation in 2025, USD/TRY reaching 45, as we expect average inflation in 2025 to stay strong at 35.3%.

In Russia, the macroeconomic instability ignited by sanctions continue to dominate as inflation is spiking, the fiscal deficit is widening and the Russian ruble (RUB) is under pressure remaining mostly uninvestable. In addition to the Ukraine-Russia war overheating the economy and the lack of peace deal causing no immediate return by foreign investors, the new set of sanctions by the U.S. Treasury Department targeting the country’s financial system on June 13 prompted the Moscow exchange to halt trading of dollars and euros, caused some Russian banks to raise rates as high as 150/200 USD/RUB. The CBR announced it would set daily dollar and euro exchange rates based on aggregated data from commercial bank purchases and sales, and set the official dollar exchange rate at 85.4 USD/RUB on June 21! As inflation is on the rise, the labour market remains tight and buoyant public sector and consumer demand contribute to pump up imports, we expect USD/RUB to end 2024 at 91.5. We foresee financial and trade sanctions continuing to pressurize RUB in 2025, and likely push USD/RUB to 95.3, particularly if no Ukraine peace deal will be signed in 2025.

Figure 4: USD/ZAR Rate 10yr South Africa-U.S. Bond Yield (%)

Source: DataStream/Continuum Economics