BCB Review: A Hawkish Tweak

The Brazilian Central Bank (BCB) kept the policy rate unchanged at 10.5%, with a hawkish tone highlighting risks. Strong domestic growth and employment data persist despite monetary tightening. Inflation expectations for 2024 and 2025 are at 4.1% and 4.0%, respectively, above the 3.0% target. Fiscal challenges remain, but no crisis is imminent. The BCB is cautious, with no rate cuts expected, though some foresee potential hikes due to inflation convergence concerns.

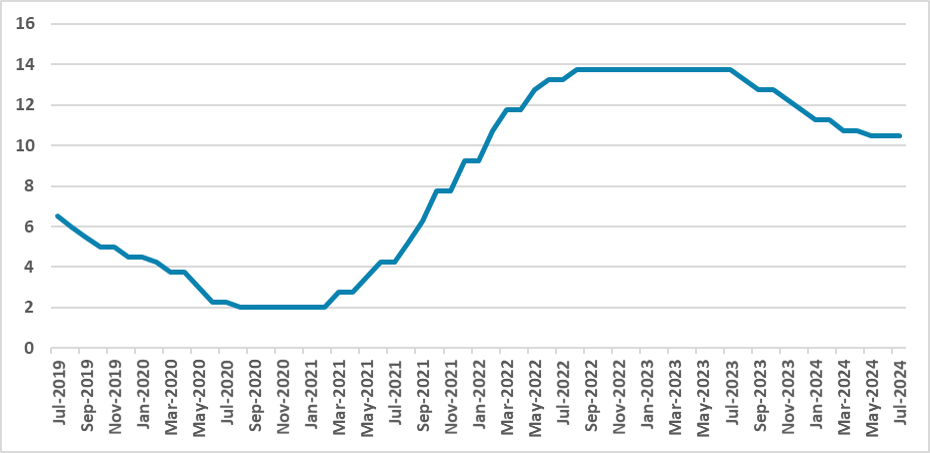

Figure 1: Brazil Policy Rate (%)

Source: BCB

The Brazilian Central Bank (BCB) has decided on the policy rate. Aligned with market expectations, the BCB has unanimously maintained the policy rate unchanged at 10.5%. However, what caught the most attention was the hawkish tone of the communiqué, highlighting the risks. Although most market participants forecast the policy rate to be kept unchanged, it is possible that some will now switch and start to forecast a hike.

Regarding foreign markets, the BCB stressed the lack of synchrony between countries, which demands caution from emerging economies. In domestic markets, the Brazilian economy continues to show higher dynamism than previously thought. In fact, employment numbers remain strong, and recent data points to growth in the second quarter; given the level of monetary tightening, one would expect the economy to decelerate.

Inflation expectations for 2024 and 2025 now stand at 4.1% and 4.0%, respectively. As we approach 2025, inflation expectations for this year have been rising, which, of course, causes concern. Expectations are still somewhat far from the 3.0% target. Additionally, the BCB now expects services inflation to be stickier as they see the output gap narrowing.

The BCB is also monitoring developments on the fiscal front. As we have previously stated (here), the recent changes on the fiscal front suggest that the government may face difficulties complying with the fiscal rule, but the recent budgetary changes indicate that they will at least try. Brazilian markets are somewhat overreacting as we don’t see any sort of fiscal crisis coming. Although the fiscal targets will possibly not be met, the situation is far from catastrophic. Moreover, the recent devaluation of the BRL, along with other LatAm currencies, is not an idiosyncratic feature of Brazil but a factor of risk for the BCB.

All in all, the BCB is closely watching what is happening in the market, and due to the risks, it is prudent to wait and keep the policy rate unchanged. So far, cuts are completely out of the radar, but some market participants could start to interpret that the BCB might hike. We believe the fundamentals do not point to a hike, but we are not the BCB. We will gather more information from the minutes, but the BCB stated that any adjustment in the policy rate will be focused on the process of inflation convergence, which in actions could rather more indicate a hike rather than a cut.