BCB Minutes: Detailing the Deterioration

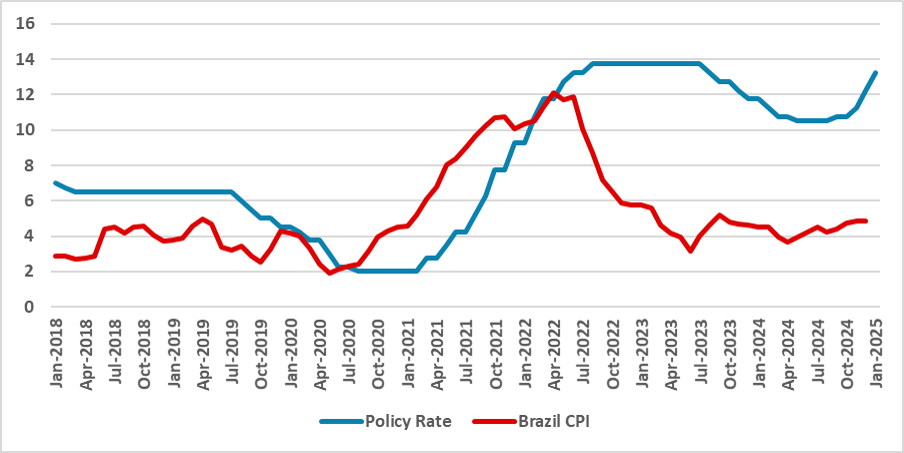

The BCB raised rates by 100bps to 13.25%, signaling another hike in March. External uncertainty remains, but domestic risks worsened, with inflation expectations rising. The BCB stressed fiscal-monetary coordination and warned about policy distortions. Despite markets pricing a 15% rate, we expect stabilization at 14.25%, assuming marginal improvements in economic conditions.

Figure 1: Policy Rate and CPI (%)

Source: IBGE and BCB

The Brazilian Central Bank (BCB) has released the minutes of its last meeting, in which it opted to hike the policy rate by 100 basis points to 13.25%. It was the first meeting presided over by the new BCB President, Gabriel Galípolo, and we observed some tweaks in the minutes' communication, providing more detail on the committee’s reasoning. This could also be attributed to the arrival of new members, indicating some convergence in their views.

Regarding the external market, the minutes highlighted ongoing uncertainty, particularly concerning the pace of inflation convergence in advanced economies and the potential impact of tariffs. However, the BCB made it clear that its central scenario for external markets has not changed significantly, despite increased uncertainty. The committee also emphasized the need to remain attentive to abrupt exchange rate movements.

In the domestic scenario, the BCB acknowledged that conditions have worsened. Some downside risks, such as a sharper economic slowdown leading to a stronger decline in inflation, have eased. However, other upside risks have materialized, such as a significant de-anchoring of inflation expectations, even in the long term. The BCB analyzed that one channel through which inflation expectations exert influence is wages, leading to cost shocks for companies and driving inflation higher. Additionally, the committee remains cautious regarding some deceleration observed in high-frequency indicators, as much of it could be attributed to seasonal effects. Moreover, the BCB sees the output gap as being in clearly positive territory, suggesting a possible overheating of the economy.

Interestingly, the minutes also conveyed messages to government officials. The board emphasized the importance of maintaining the monetary policy transmission mechanism. It highlighted the need for coordination between fiscal and monetary policy, noting that the perception of an unsustainable debt-to-GDP path is affecting asset prices and increasing risk premiums. Furthermore, subsidies and directed credit programs impact the effectiveness of monetary policy by raising the cost of disinflation.

The minutes stated that raising the policy rate by 100 basis points was the right decision in the last meeting, and the committee remains committed to its guidance of another 100-basis-point hike. In this regard, it maintained its forward guidance to raise rates by another 100 basis points in March. Beyond this, no additional forward guidance was provided. We believe that, rather than further deterioration, some marginal improvements will be observed, which would allow the BCB to maintain a 14.25% policy rate. While markets are pricing in a terminal rate of 15%, we maintain our call for a 14.25% peak policy rate.