BCB Preview: 50bps Hike and More to Come

The Brazilian Central Bank (BCB) is expected to raise rates by 50bps in November to curb rising inflation, which could exceed the 4.5% upper limit if inflationary shocks persist. Market concerns focus on food prices, a strong labor market, and external exchange rate pressures. The new BCB President, Gabriel Galipoli, likely aims to reassure markets of his commitment to the 3% inflation target. Additional 50bps hikes are anticipated in December and February, with cuts delayed until economic cooling.

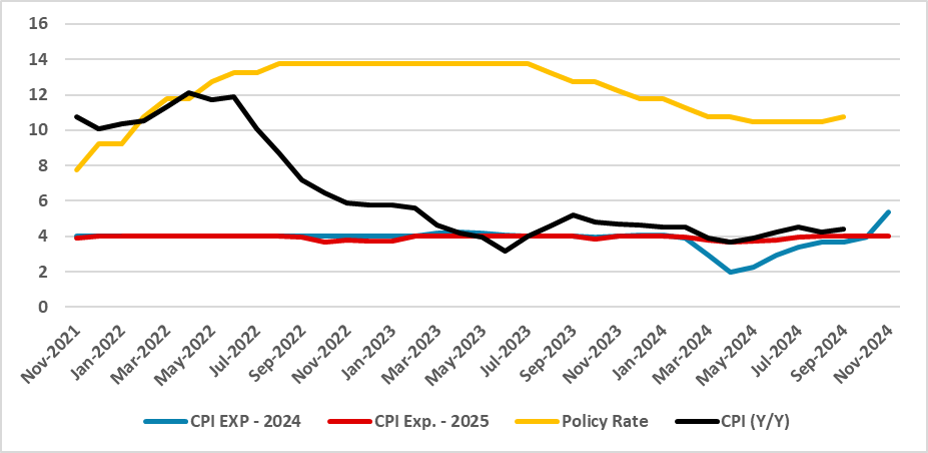

Figure 1: Policy Rate and CPI (%)

Source: IBGE and BCB

Source: IBGE and BCB

The Brazilian Central Bank will convene on Nov. 6 to decide the policy rate. After resuming the hiking cycle with a 25bps increase, we believe the BCB will likely accelerate the hikes towards a 50bps raise, which is now the main assumption of local markets. In the view of Brazilian markets, the situation has worsened, with the risk premium rising and inflation expectations also increasing, still not aligned with the BCB's 3.0% target.

We now expect the inflation rate to touch the upper bound of the target band by December, showing some persistence in the early months of the new year. Our baseline assumption does not account for additional inflationary shocks; however, a scenario in which the inflation rate remains above the upper 4.5% limit for more than six months cannot be ruled out if new inflationary shocks emerge.

The main reason for a deterioration in the outlook is a potential food price shock over the next few months due to severe rains in parts of the country and a robust economy. Labor data continues to show significant strength, with the unemployment rate reaching historical lows and wage inflation outpacing the CPI variation. We believe the recent volatility in the exchange rate is more related to external factors than domestic ones, although some action on fiscal policy will be needed to ensure a sustainable Debt/GDP ratio.

Additionally, the new BCB President, Gabriel Galipoli, has had his appointment approved by the Senate, meaning he will assume the BCB Presidency in January. As he is already a member of the board, markets are closely watching his votes. Coming from a heterodox economic background, markets are still gauging his commitment to inflation control. Therefore, raising the interest rate may also serve as a signal from Galipoli that he will do everything necessary to bring inflation back to the 3% target.

In terms of future hikes, we expect an additional 50bps increase in December and another of the same magnitude in February. Afterward, the BCB will likely wait for the economy to cool down before resuming rate cuts.