Brazil Risk Premia and EM Debt

Brazil debt market has two domestic crises rather than a spillover from the U.S. in the form of inflation and fiscal policy. Very restrictive BCB policy can help produce some disinflation and we forecast 4.1% for 2026, which some allow some rate cuts in H2. Brazil risk premium will likely be reduced latter in the year in the shape of a narrower bond spread versus the U.S. and higher Brazilian Real. However, Brazil crisis over fiscal policy would not be fixed, which is the 2 precondition for a more dramatic narrowing of bond spreads versus the U.S.

The rise in 10yr U.S. Treasury yield has prompted a modest widening of S Africa spread in recent weeks, but the focus is on Brazil where domestic issues have driven a large widening versus U.S. Treasuries.

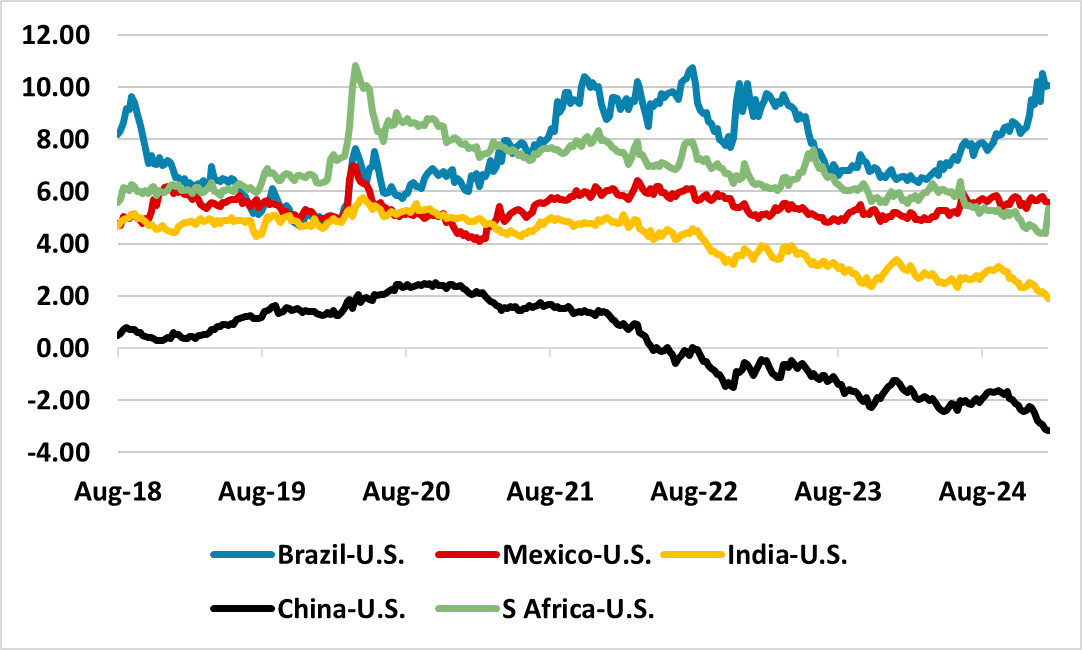

Figure 1: 10yr Government Bond Spreads versus U.S. (%)

Source: Datastream/Continuum Economics

The rise in U.S. 10yr yields is not causing major problem for big EM’s, with India narrowing recently and Mexico maintaining a stable spread. S Africa has seen a widening versus the U.S., but this largely reflects profit-taking after a dramatic narrowing in 2024 on enhanced fiscal credibility from the new coalition government. China has actually gone to more of a discount versus the U.S. (Figure 1) on aggressive disinflation expectations and as China government debt remains dominated by domestic players (here).

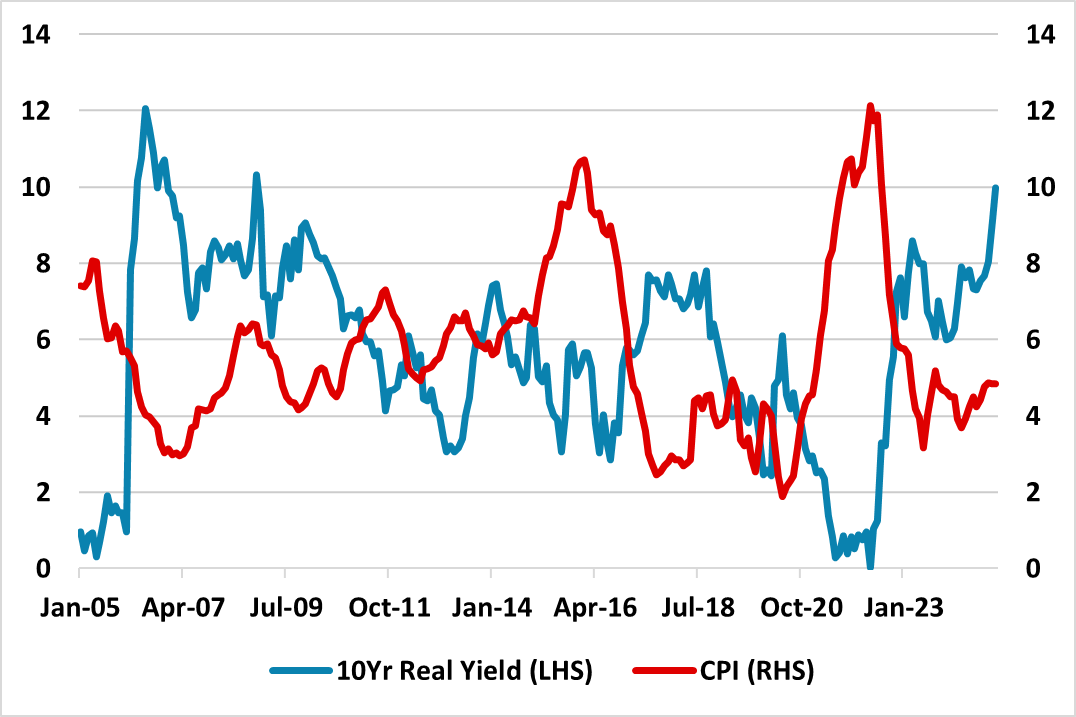

Thus the sharp widening of the 10yr Brazil-U.S. spread stands out. However, this is two domestic crises rather than a spillover from the U.S. – inflation and fiscal policy. Firstly, market participants remain concerned that inflation is not converging to the BCB target and prompting views that the BCB will need to hike the SELIC policy rate to 14-15% to reduce overheating and inflation risks. Secondly, the bond market vigilantes worry that the government are reluctant to tight fiscal policy enough to ensure long-term debt sustainability. At the moment Brazil is in a bad equilibrium, with 10yr real yields of close to 10% using CPI inflation (Figure 2). This very high-risk premia reflect the adverse effects of higher interest rates causing fears of higher coupon payments, plus also the high gross funding/GDP given the relatively short maturity spectrum on Brazilian debt (here).

Figure 2: 10yr Real Brazil Government Bond Yields (%)

Source: Datastream/Continuum Economics

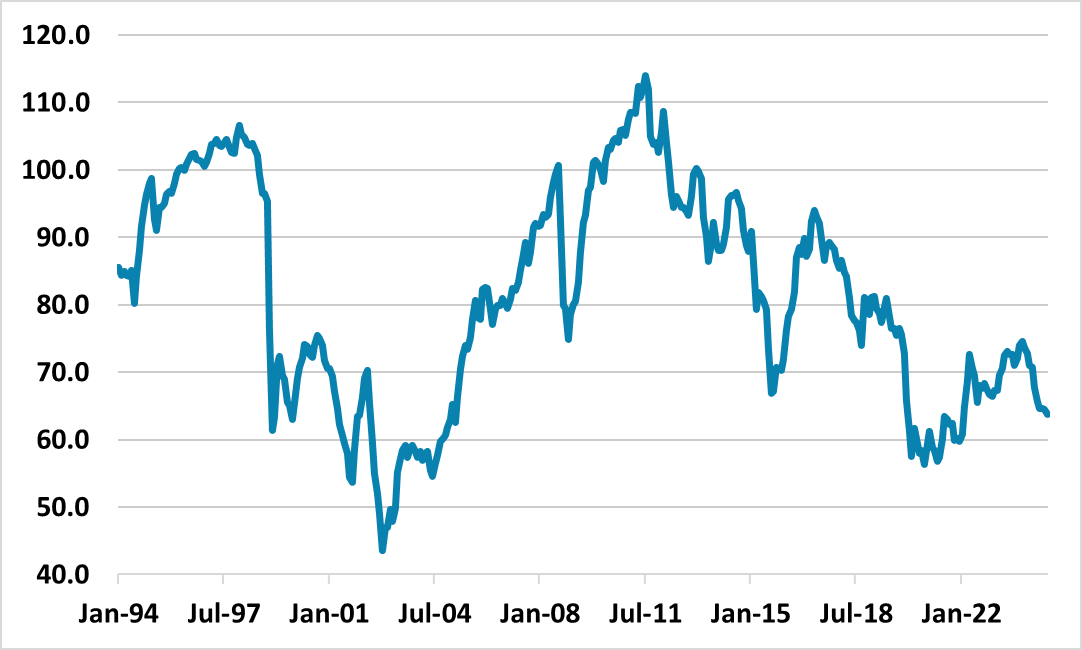

However, the Brazilian Real has also depreciated significantly in the last 9 months, with a sizeable discount of the real effective exchange rate to the 10yr average of 74 (Figure 3). The exchange rate is seeing a 2 risk premium, beyond the high real yields. The combined high-risk premia have prompted some global investors to question whether Brazil markets are discounting too much bad news?

Brazil markets are most likely discounting too much bad news on our latest forecast in the December outlook (here). A super weak exchange rate or very high real yield make sense when a severe upward break in inflation is feared, but this is not the case with the BCB undertaking aggressive tightening. We forecast a sticky 4.7% for 2025 Brazil CPI and then 4.1% in 2026 as the lagged effects of ultra-tight monetary policy feedthrough to restart disinflation. Could be better, but not a disaster.

Figure 3: BRL Real Effective Exchange Rate (2010=100)

Source: Datastream/Continuum Economics

Policy is likely to be so tight by the end of H1, that H2 will likely see some rate cuts to reduce the degree of restrictive policy and avoid an economic hard landing. We see the Selic back down to 13.25% versus a peak of 15% in 2025. If the economy clearly slows down more than our baseline 2025 GDP forecast of 2.3% then then it could prompt the BCB narrative to change still further and produce a downward shift across the curve – the new BCB board has been more focused on overheating than fiscal policy. Lower but still high policy rates and yields could perversely boost the Brazilian real, if it reduces the sense of crisis. Brazil risk premium will likely be reduced latter in the year.

Recent data points to some acceleration in government revenues, mainly extraordinary ones (here), which will allow government to fulfill the 0.25% primary budget deficit target. However, the excessive high interest rates pose risk for debt/GDP stabilization. The key for 2025 is that government controls expenditures growth, allowing a 0% primary deficit in 2025, an event market still doubt. If as 2025 progress it becomes clearer the target will be fulfilled alongside the economy cooling - pointing to inflation decelerating - we could see more of a reversion on inflation expectations towards the target, allowing the BCB to cut rates without raising inflation, and reduce debt costs. This could produce a some further narrowing of bond spreads versus the U.S., but a more noticeable change would only occur if central government produces primary surpluses at a moderate percentage of GDP, which is unlikely. We will remain watchful for future developments.