BCB Review: Switching Back to Hikes

The Brazilian Central Bank (BCB) raised the policy rate to 10.75%, signaling more hikes due to domestic pressures, including stronger economic activity and de-anchored inflation expectations. Despite global uncertainties, the decision reflects concerns about Brazil's positive output gap and fragile credibility, especially with Galipolo's appointment. The BCB aims to restore credibility by showing readiness to tighten further. A moderate adjustment of two more 25 bps hikes is expected, though faster hikes to 50 bps remain possible amid ongoing uncertainties.

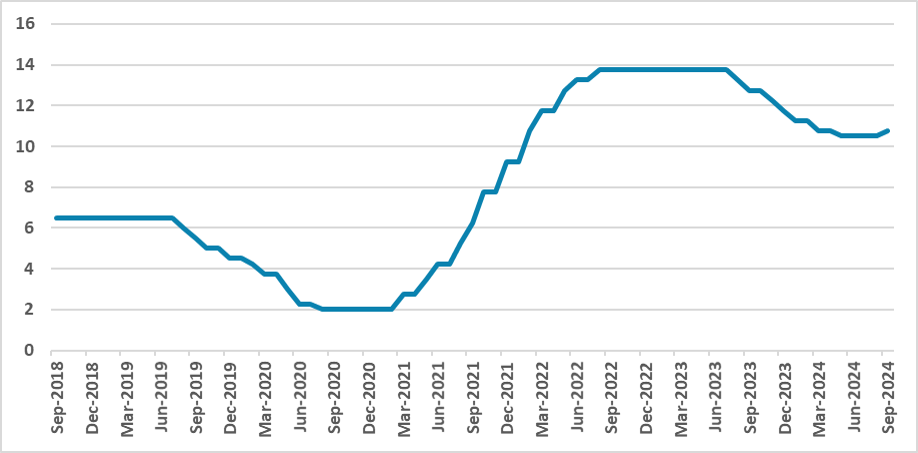

Figure 1: Brazil’s Policy Rate (%)

Source: BCB

The Brazilian Central Bank (BCB) has convened to decide the policy rate (SELIC). In a decision in line with market expectations, the BCB resumed hiking the policy rate after a six-month pause at 10.5%. The chosen adjustment was a 25 bps hike, raising the policy rate to 10.75%. The BCB also signaled that more hikes are likely to come.

Regarding foreign markets, the communiqué highlighted uncertainty around the disinflation process in advanced economies and their easing cycles. However, the decision to hike was driven primarily by domestic factors. The acceleration of economic activity and the tightening labor market have shifted the output gap from negative to positive. Official estimates from the BCB for the output gap will be released next week. Moreover, despite the fall in current inflation, inflation expectations remained de-anchored, with markets expecting 4.4% inflation in 2024 and 4.0% in 2025.

The Committee also stated that there is an upward bias in their balance of risks. On the upside: a prolonged period of de-anchored expectations, stronger resilience in services inflation, and a persistently depreciated exchange rate. On the downside: a stronger-than-expected global economic slowdown and greater-than-anticipated effects of monetary tightening on the disinflation process.

The usual paragraph regarding fiscal policy was maintained, stating that expectations about the sustainability of the public debt trajectory are affecting the valuation of Brazilian assets and likely influencing inflation expectations. Interestingly, the communiqué did not mention the potential increase in electricity prices due to droughts.

The justification for the rate hike can be summed up in two factors: increased pressures from economic activity, and the de-anchoring of inflation expectations. Breaking it down, the economic activity accelerated in the last quarters, and the BCB did not expect it. Additionally, the BCB's credibility has been fragile, especially with the appointment of Galipolo to the board, who is associated with a more heterodox economic approach. Coupled with government criticism of Campos Neto, many market participants feared the BCB might become complacent with inflation, even more after Galipoli was appointed the next BCB President. By raising rates, the BCB aims to boost its credibility, signaling to the market that they will raise rates if the situation demands it.

Now that the BCB has decided to hike, the question is how far they intend to go. We believe a marginal adjustment is the best approach to gain credibility while minimizing damage to economic activity. Therefore, we foresee two more 25 bps hikes followed by a pause, leaving the policy rate at 11.25% by the end of 2024. However, uncertainty remains regarding the strength of economic activity and the true impact of rising electricity prices. Thus, we cannot rule out the possibility of the BCB accelerating the pace of hikes to 50 bps.ce, which in actions could rather more indicate a hike rather than a cut.