BCB Preview: A Pause Amid the Risks

The Brazilian Central Bank (BCB) is expected to maintain the SELIC rate at 10.5% amid external sector volatility, stubborn service inflation, and deteriorating inflation expectations. A hawkish majority on the board suggests a pause despite potential for cuts. Risks include rising food prices post-flooding and inflation expectations nearing 4.0% for 2025, above the 3.0% target. Future cuts may resume by late 2024 with improved global stability and easing inflation. Appointment of a non-technical BCB President could alter market expectations towards complacency with higher inflation.

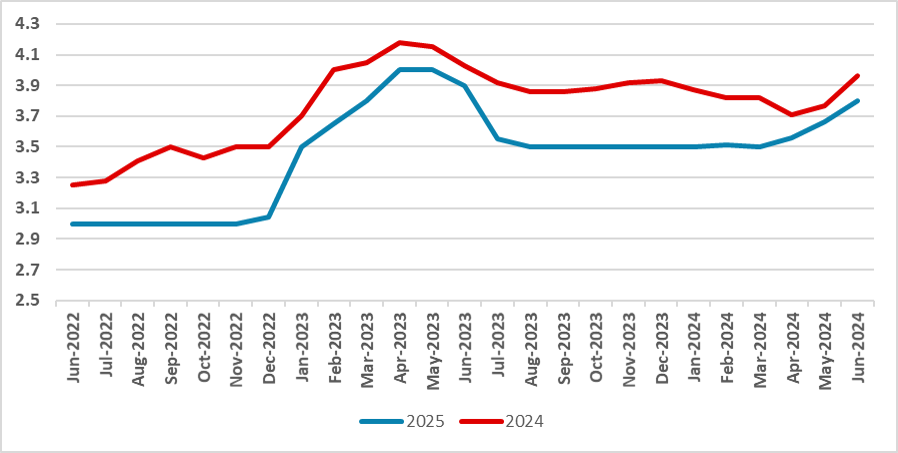

Figure 1: Inflation Expectations (%)

Source: BCB

The Brazilian Central Bank (BCB) board will convene on June 19 to decide the policy rate (SELIC). In their last meeting, the board diverged from its past forward guidance by applying a 25bps pace and stated that the next steps of the monetary policy will be data-dependent. We believe that due to the volatility in the external sectors, the stickiness in service inflation, and mainly the deterioration of inflation expectations, the board will apply a pause, maintaining the SELIC stable at 10.5%.

Although we see some space for continuing with cuts, we believe that the hawkish part of the BCB, which is now in the majority on the board by 5 to 4 in relation to the dovish wing, will join forces to apply a pause. The fiscal situation will be pointed out as one of the risks, but the uncertain situation about when the Fed will cut rates, alongside a heated labor market and de-anchored expectations, will likely be enough for the hawks to apply a pause.

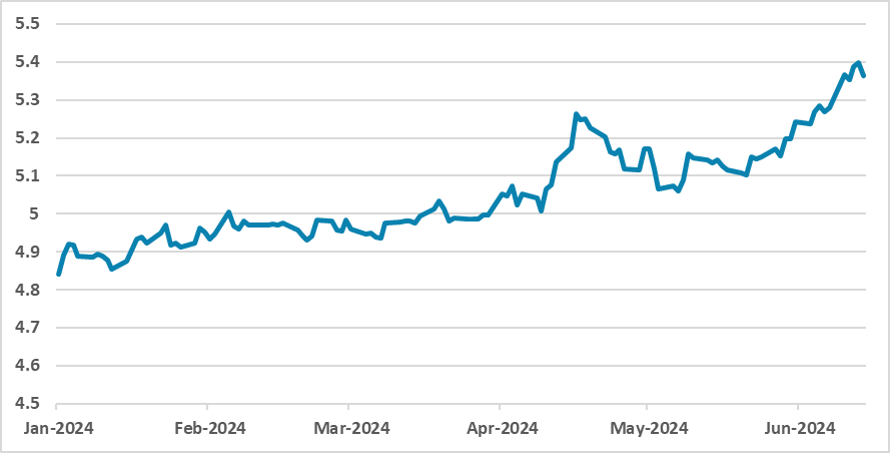

Figure 2: BRL/USD

Source: BCB

A further risk is the Food and Beverages situation, which will likely increase in the next months in response to intense flooding in the southern region of the country. The space for cuts is now going to be restricted by the inflation expectations for 2025, which are approaching the 4.0% mark, far from the 3.0% target. The current situation, in which the exchange rate will be higher than previously thought, will also not help the goods CPI, which also supports the hawkish BCB argument.

By the end of 2024, we believe there will be room to resume cutting, with a possible Fed cut and less volatility in the external market, and inflation easing a bit. Additionally, the BCB will start looking to the 2026 expectations, which tend to be lower than those for 2025, at least initially. This decision will not please government officials, who will likely blame the BCB for any subdued growth. Then, at the end of the year, markets will look to who the next BCB President will be. Appointing a non-technical President could mean a new round of revisions of market expectations, as they will think the BCB would prefer lower rates rather than pursue the inflation targets.